Every month, headlines summarize employment data, inflation numbers and other economic data. Only the most popular economic reports make the news. Other announcements are followed only by economists and investors looking for potentially profitable insights or to avoid disaster such as recession.

Among the little-noticed flood of data every month is the Chicago Fed National Activity Index (CFNAI), one of the most detailed statistical summaries of the economy.

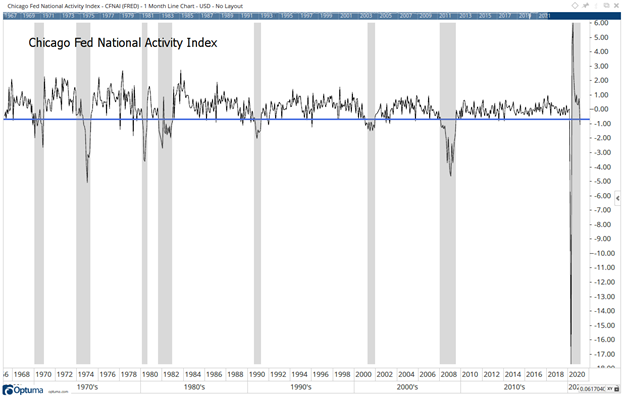

CFNAI is a weighted average of 85 monthly indicators of national economic activity. Researchers created the Index to have an average value of zero and a standard deviation of one. Readings above zero forecast an economic expansion, and readings below zero forecast contraction.

In February, the Index fell to -1.09, down from +0.75 in January. In the past, readings below -0.70 preceded recessions — that value is shown as the solid blue line in the chart below.

CFNAI Warns of Double-Dip Recession

Source: Optuma.

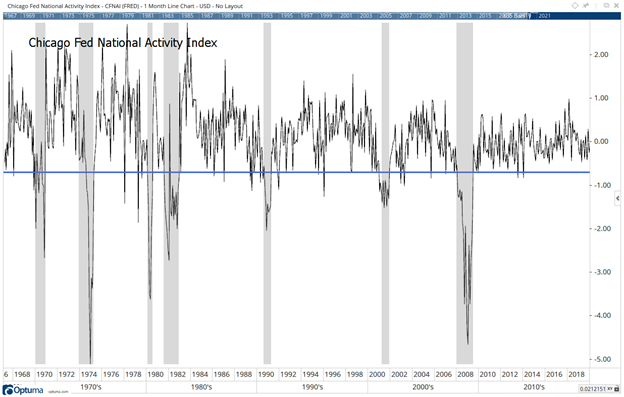

In 2020, unprecedented shutdowns and stimulus packages created large moves in the CFNAI. This makes it difficult to see the longer-term data in context. The next chart, with the key -.70 recession line still in blue, excludes those gyrations.

CFNAI Excluding Stimulus Spikes

Source: Optima.

Investors Must Keep Watch for Double-Dip Recession

That key level of -0.70 has rarely been breached. When it’s been below that level for several months, a recession almost follows. One study found that the Index is 95% accurate in identifying U.S. recessions and expansions.

For now, CFNAI is flashing an early warning of a contraction, with a majority of the 85 indicators in the index were negative, with 60% below zero. Compared to January, 65% of the indicators were in downtrends.

Despite the indications of widespread weakness, it is possible the Index will surge higher when the March data is released in late April, and that this surge can help avoid recession. That’s possible because stimulus checks could drive consumer spending significantly higher.

But consumer spending represents just one part of the Index. CFNAI also measures changes in manufacturing that are less prone to swings from stimulus.

Investors should be watching this Index for details on how strong the economy really is in the next few months.

Is this stupid … or brilliant?

I found a way to trade the markets making the same trade every week.

We do this because any given week, this trade can knock it out of the freaking park.

I recommended 59 of these trades last year. We saw five trades go up 100% or more — each in a week or less.

And a total of 18 went up 50% or more — in an average of two days each.[i]

All told, someone could have doubled every dollar they invested last year trading this way.

I want to give you the same chance.

P.S. I’ve been telling my readers that someone could double their money in a year with this. By the end of 2020, I proved that to be true. My “One Trade” strategy has never had a losing year across 12 years of back testing. And last year’s live results were even better. Click here to see how it all works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.