You and I use it every day.

You’re using it to read this article.

It’s become one of those things that you don’t know what you would do without.

Especially now.

I’m talking, of course, about access to the internet.

That access is only going to grow — and smart investors will be able to profit.

Adam O’Dell’s proprietary stock rating system has identified a company that will deliver solid gains to investors as more folks in the U.S. use the internet.

The Internet: An Essential Service

One thing the coronavirus pandemic has reinforced is that access to the internet is essential.

Shelter-in-place orders, remote work and finding ways to stay sane even as businesses slowly reopen make internet access more a “need” than a “want.”

The Pew Research Center found in a study that 53% of Americans believe the internet has been essential during the coronavirus outbreak. What’s more, 87% at least said connecting to the internet was important.

Pandemic aside, internet traffic will double in the next three years:

Internet Traffic on the Rise

The need for additional internet infrastructure will increase during that time. Companies that need to beef up their networks will look to internet equipment manufacturers to continue building that infrastructure.

Don’t Forget About the 5G Revolution

It may not seem connected, but the internet boom and the 5G revolution are linked.

The telecom companies that are building out their infrastructure for increased internet traffic are doing the same to accommodate 5G installation.

To save on costs, telecom businesses will look to partners who can provide software and equipment for both the internet and 5G.

And we’ve found one.

This Value Internet Stock Serves Both Masters

Now, you could invest directly in telecom companies building internet and 5G capabilities.

But a stronger investment is in those companies working in the background to make that build-out possible.

Adam’s system has found a company that does just that.

Aviat Networks Inc. (Nasdaq: AVNW) manufactures and sells wireless networking products, including those that support new network expansion.

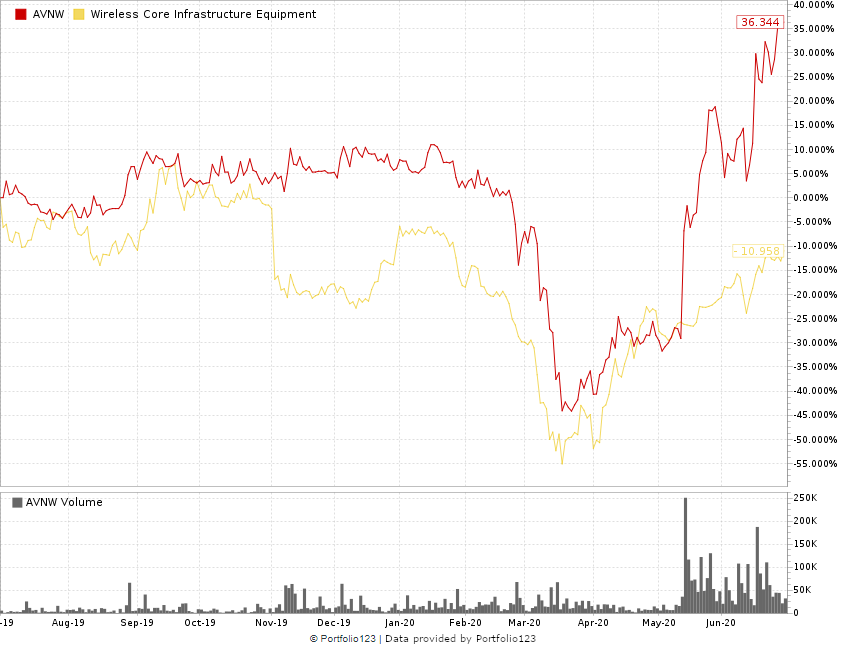

AVNW Outpaces the Competition

Adam’s Take on This Internet Stock

M&M Chief Investment Strategist Adam O’Dell

Aviat scored 99.3 overall on Adam’s rating system. That makes it one of the highest rated of all stocks.

Its momentum and quality ratings are all close to 90 while its growth, value and volatility are all better than 80% of all the stocks Adam rates.

The stock’s upward trend is better than 83% of all rated stocks. So the price of the stock should continue to move up.

What’s more is that AVNW gives investors strong returns with mild volatility. The company’s risk-adjusted returns are rated 83 out of 100.

While its quality is solid, Aviat’s stock presents investors with value. Its price-to-sales ratio is rated at 97. Only 3% of all other rated stocks are better.

In terms of growth, Aviat’s earnings per share and net income are better than 90% of all the companies Adam rated.

The Takeaway

Access to the internet is getting wider. And with 5G on the horizon, the need for equipment to make connectivity seamless is pivotal.

Investors who jump into companies manufacturing that equipment will see strong gains.

We see Aviat Networks as the perfect internet stock to do it.