Buying a house has always been touted as a solid investment, but what happens when the trend gets flipped on its head by what some may call an unlikely generation?

I’m talking about the rise of older baby boomers renting properties instead of owning in retirement.

It sounds like a fairly economic decision — especially if you are short on retirement funds — because you can sell your larger-than-needed house to grow your nest egg while also throwing out the worry of expensive renovations.

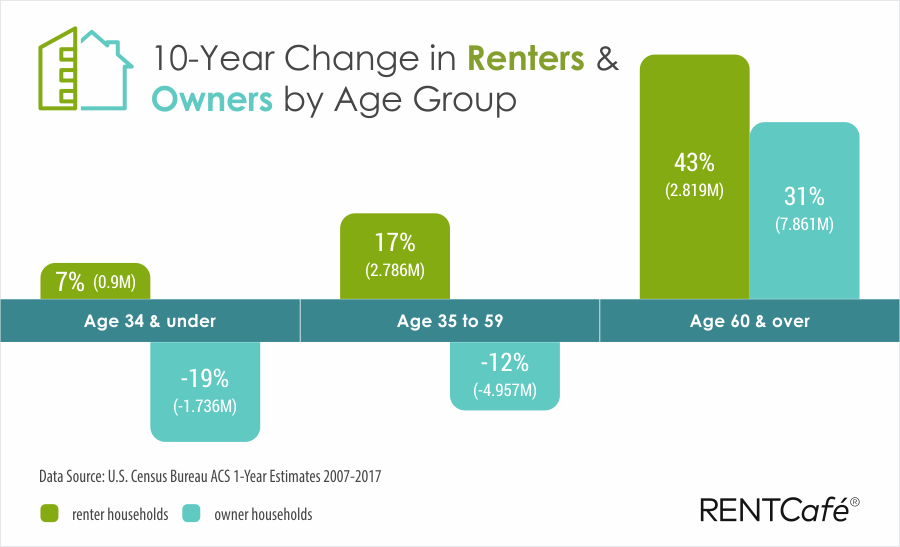

A RentCafé study found from 2007 to 2017, the estimated number of renters age 60 and up grew 43%.

And that number isn’t slowing down, either. The same study projects that by 2035, renters age 60 and up will control 31% of the rental market share, which will be the highest among all age groups. The number of baby boomers renting is projected to almost double from 9.4 to 18.6 million.

There are many reasons for this shift. For one, empty nesters don’t want to continue upkeep on a home that is much too large after the kids have flown the coop. Who needs five bedrooms when two or three would suit someone’s needs just fine?

Home repairs also aren’t getting any cheaper. Home maintenance is a retirement expense that can get out of hand quickly if your home is older and in need of big ticket repairs like a new roof. If your nest egg isn’t too large, spending a good chunk of it on repairs or accessibility renovations isn’t going to feel good.

Economist Harry Dent notes that while these rental surges are hitting popular areas like Arizona, Nevada, Florida and Texas because of warmer climates and affordability, it’s something to watch for everywhere.

“They have always been the biggest force at any age that their massive wave has moved into,” Dent wrote in a 2019 article.

So how can an investor capitalize on this wave of baby boomers renting?

1 REIT to Consider Based on Baby Boomers Renting

Real estate investment trusts (REITs) are a great way to invest in real estate while not having the headache of actually owning a property. Money & Markets staff writer Matthew Clark gives a great explanation here:

In simple terms, a REIT is a company that owns, operates or finances income-generating real estate. The company pools the capital of many different investors, similar to that of a mutual fund.

Investors earn dividends from real estate investments without actually owning, managing or financing property themselves.

If you are looking for an apartment REIT that has established itself where baby boomers are renting, look no further than Mid-America Apartment Communities Inc. (NYSE: MAA).

The company has a market cap over $13 billion and manages over 100,000 properties across 16 states in the Southeast, Southwest and Mid-Atlantic.

While MAA’s price-to-earnings ratio is a little high around 43, it is still trading about 21% lower than its 52-week high of $148.88, which was was hit back in February before the coronavirus crash.

The company did miss earnings per share estimates by a wide margin in its May 6 quarterly report. It reported $0.55 earnings per share, well below consensus estimates of $1.60. But revenue was up 4.2% compared to a year ago.

MAA’s 3.36% dividend yield lags some other REITs, but its annual dividend is $3.29 per share and it has risen steadily over the last decade.

MAA specializes in luxury rentals, which may attract a contingent of wealthier boomers that want to relocate to warmer areas.

As the number of baby boomers renting continues to climb, real estate REITs may be the perfect opportunity to capitalize on the wave of older renters entering the market.