Managing risk is important to banks. They want to avoid losses.

There are many tools for doing that. One of the most important risk management tools is the ability to reject loan applications.

For example: If a consumer is unemployed, the bank might reject a credit card application.

Interest rates might be the most important risk management tool. High-risk consumers pay higher interest rates than low-risk consumers.

At the right rate, banks profit even if default rates are high. An interest rate of 18% could help a bank make money even if 26% of borrowers default.

Bankers understand this.

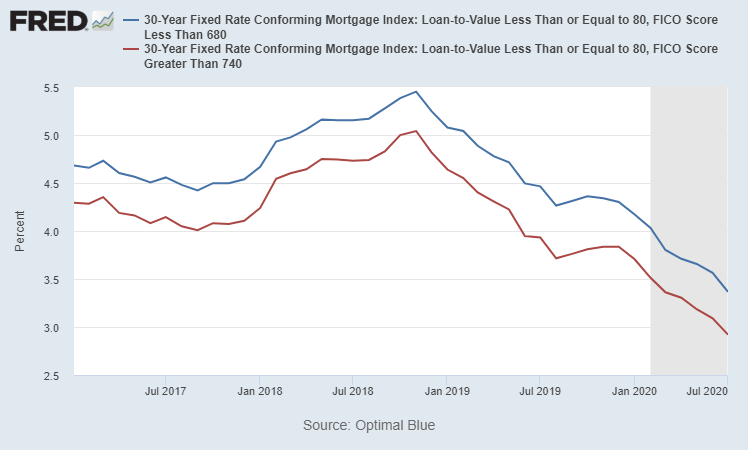

The chart below shows that rates are higher on mortgages for borrowers with lower credit scores.

- The blue line shows borrowers with credit scores below 680. They pay an average of 3.4%.

- Borrowers with credit scores above 740 (the red line) pay just 2.9%.

Better Rates for Lower-Risk Borrowers

Source: Federal Reserve

Rates have been falling because of Federal Reserve policy. But banks became more risk averse in the past few weeks.

You can see that in the next chart. it shows the difference between the two rates.

Caution Grows Within Banks

Source: Federal Reserve

Banks worried about an economic slowdown in the second half of 2019. So, the difference between rates rose. That shows that borrowers with low scores were paying a larger-than-average risk premium.

Banks Aren’t Worried Enough

The recent bounce in the risk premium indicates that banks are worried again. Other data indicates banks aren’t worried enough.

The last financial crisis was due, at least in part, to mortgage defaults. Banks made too many risky loans. A larger-than-expected number of defaults threatened the entire financial system.

To avoid a repeat, the Securities and Exchange Commission studied mortgage-backed securities. Researchers found: “mortgage borrowers with a FICO score of 690 or lower were six times more likely to default as borrowers with FICO scores above 740.”

Borrowers with low credit scores present a serious risk to the financial system. And that risk isn’t adequately reflected in the price of mortgages.

Stocks with exposure to mortgages are high-risk right now. Financials aren’t pricing risk appropriately. And neither are investors in their stocks.

P.S. To find out how you can use my “Strike Zone” Indicator to see gains of 364% in 12 days, 323% in 18 days, 496% in 4 days and more, sign up for this FREE broadcast.

- Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter, Technically Speaking.

- Follow him on Twitter @MichaelCarrGuru.