Hype is all around us.

In the investing world, hype — created by financial headlines, Reddit or other social media platforms — leads to FOMO (fear of missing out).

This was particularly evident in 2021, when Reddit users banded together to push the price of certain stocks higher, forcing a short squeeze against institutional investors who would lose millions on their bets.

It worked.

Once the news spread and FOMO set in, social media users pushed the price of GameStop Corp. (NYSE: GME) from a paltry $8 a share to $81 in weeks.

But eventually, hype gives way to reality.

Today, I’m going to share with you another stock that got caught up in hype, but spiraled back to reality.

More importantly, I’ll show you that our proprietary Green Zone Power Ratings system told you to avoid the stock … well before it cratered back to earth.

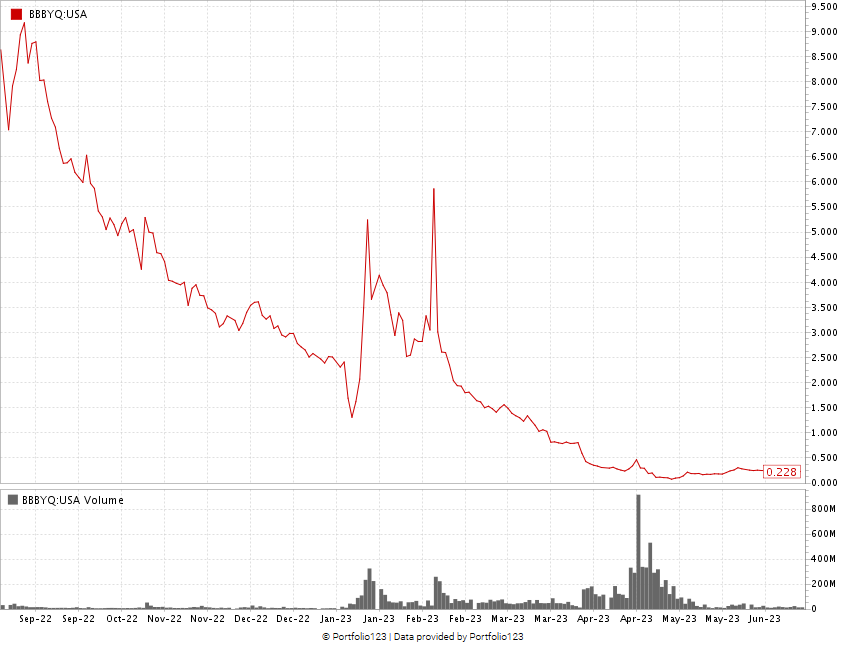

BBBY’s 390% Pump … and Dump

In August 2022, Bed Bath & Beyond Inc. (Nasdaq: BBBY) surged 120% in just seven days.

BBBY was one of the most shorted stocks on the market. Big Money investors were betting against it.

FOMO led retail investors to pour cash into the stock, pushing the price up.

Its price soared, which forced those institutional investors to repurchase their shares … driving the price even higher.

Bed Bath & Beyond stock went from $4.68 at the end of July to $23.08 in August — a 393.4% jump in a matter of weeks.

Then reality set in.

By April 2023, the company filed for bankruptcy and its market capitalization plummeted to around $160 million. Its stock, which now trades over the counter with the ticker BBBYQ after being delisted from the Nasdaq exchange, crashed to around $0.22 today.

Not to Say We Told You So

As the stock was grabbing headlines, I decided to look at our Green Zone Power Ratings system to see what the real story was.

In early September 2022, the stock scored a “High-Risk” 8 out of 100, meaning we expected it to underperform the broader market over the next 12 months.

So I wrote about it as a stock to avoid in Stock Power Daily.

Boy, I’m glad I did.

BBBY’s Epic Crash

Since I wrote that essay, Bed Bath & Beyond stock has fallen more than 97%!

What’s even more telling is its journey on the Green Zone Power Ratings system:

Dating back to June 2021, the stock was never rated above 50.

That meant that, even at its peak, BBBY was never considered a buy based on our proprietary system.

Bottom line: This reinforces a couple of things:

- Don’t buy into the hype. If the price of a stock is being pushed up by FOMO or hype, it’s likely the fundamentals of that stock aren’t good enough to support that upward movement for very long.

- Verify. A journalism professor once told me: “If your mom tells you she loves you, verify it.” That’s extreme, but the idea holds true for stocks as well. If the price is shooting up, verify that the momentum is legitimate. In the case of Bed Bath & Beyond, it wasn’t.

It’s why Adam O’Dell created the Green Zone Power Ratings system. It is meant to find both stocks to invest in … and ones to steer clear of.

In the case of Bed Bath & Beyond, the system clearly said this was a stock to stay far away from.

And Adam has identified almost 2,000 other tickers that rate “Bearish” or “High-Risk” within his system. Click here to see how to access this list.

Along with Adam’s stock “Blacklist,” you’ll also gain access to his highest-conviction Green Zone Fortunes recommendations. These are the stocks that are expected to crush the market from here.

If you want to reduce risk in your own investing, Adam is ready to show you how. Just click here to find out more.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Market