Europe is in a natural gas crisis thanks to Russia.

Before it invaded Ukraine, Russia was the largest exporter of natural gas.

However, countries have stopped importing from Russia.

Countries are scrambling to find resources to replace Russian gas ahead of winter, when Europe uses natural gas the most:

The chart above shows the monthly cost of natural gas in the European Union versus the U.S.

Since Russia’s invasion of Ukraine earlier this year, gas prices in Europe have skyrocketed. They are now 602% higher in Europe than in the U.S.

To combat the supply issue gripping Europe, nations are looking toward an innovative way to provide natural gas outside of Russian-controlled land pipelines.

Today’s Power Stock specializes in this alternative delivery method: Höegh LNG Partners LP (NYSE: HMLP).

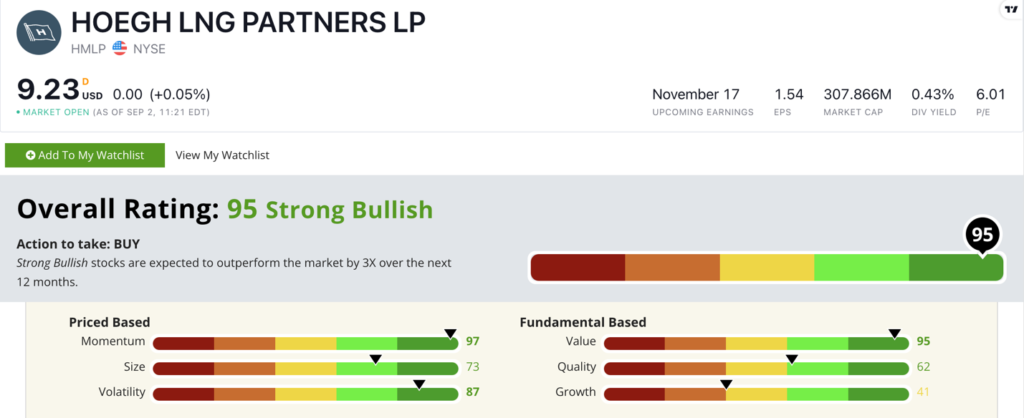

HMLP Stock Power Ratings in September 2022.

Bermuda-based Höegh owns and operates floating storage and re-gasification units (FSRUs).

FSRUs are boats that store natural gas and act as floating gas terminals, piping essential natural gas to utility companies.

It’s Europe’s way of getting natural gas without tapping into Russian pipelines.

Of note: The German government recently announced it was using four FSRUs so it can import more natural gas from countries including the U.S.

HMLP stock scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

HMLP Stock: Top Momentum + Excellent Value

Höegh just reported a strong second quarter.

Highlights include:

- Quarterly net income of $13 million: 400% higher than the same quarter last year!

- For the first six months of the year, total revenue increased 4% over the same period a year ago.

HMLP is a terrific value stock, scoring a 95 on that metric in our Stock Power Ratings system.

Its price-to-earnings ratio of 6 is three times lower than its industry average. This means HMLP is a bargain compared to its peers.

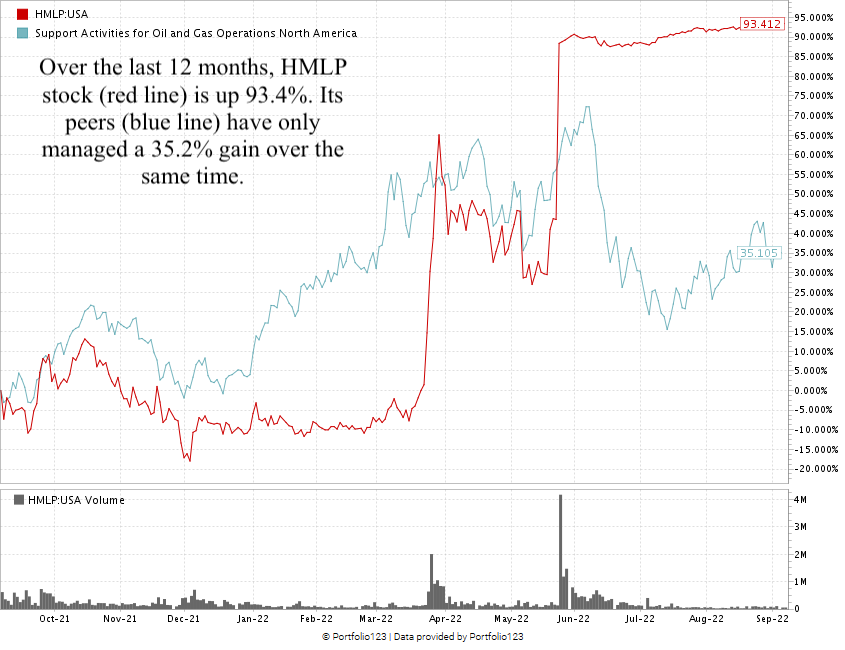

Over the last 12 months, HMLP stock has risen 93.4%, while its peers are up 35.1%.

You can see HMLP’s 52.4% price spike since mid-May in the chart above.

Höegh LNG stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Europe is pivoting away from Russian gas.

HMLP is giving countries a quick, inexpensive way to import the natural gas they need before the long winter months.

I’m confident you’ll agree that HMLP is a strong contender for your portfolio.

Stay Tuned: “Strong Bullish” Management Consultant

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a consulting company that helps businesses prosper.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.