Learning how stuff works is a passion of mine.

When I was a kid and our VCR broke, I spent hours taking it apart and learning how it turned a plastic cassette reel into a movie on our TV screen.

One of the first things I noticed was the hundreds of little transistors and components inside.

And we need these pieces to make everything from our smartphones to airplanes function.

As you can see in the chart above, Precedence Research expects global demand for electronic components to increase 117% by 2030 compared to 2021.

To meet demand, companies are expanding production for these essential parts.

Today’s Power Stock distributes electronic components worldwide: Bel Fuse Inc. (Nasdaq: BELFB).

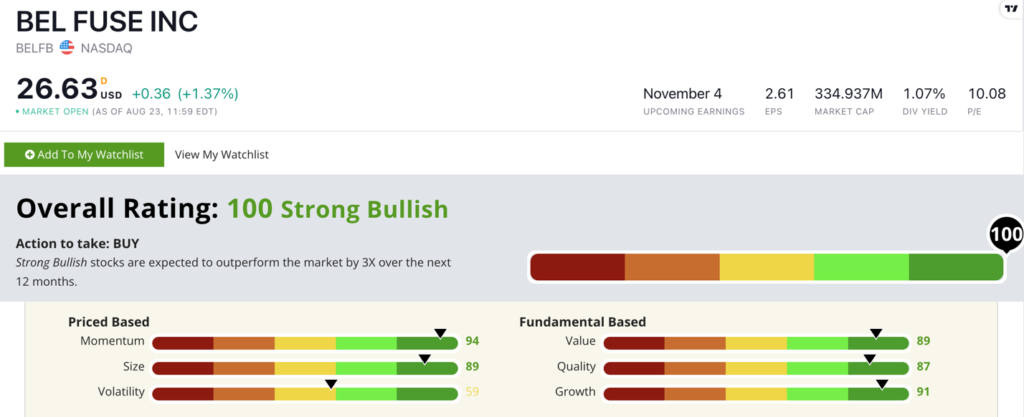

BELFB Stock Power Ratings in August 2022.

Bel Fuse produces components used in telecom, military, aerospace and other sectors around the world.

BELFB stock scores a perfect 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

BELFB Stock: Strong Momentum + Fundamentals

Here are two highlights from BELFB’s outstanding second quarter:

- Net sales came in at $170.6 million — an increase of 23% over the same quarter a year ago … and its best quarter for net sales since 2018!

- It was the sixth consecutive quarter of year-over-year sales growth.

BELFB stands out as a strong momentum stock, rating a 94 on the metric. (Find out more about that below.)

And it scores in the green on all three of our fundamental factors: value, quality and growth.

BELFB’s strong price-to-earnings ratio of 10 is more than double the electronic components industry average.

Its price-to-sales ratio, on the other hand, is a reasonable 0.7. The industry average is 2.4, so BELFB is a bargain.

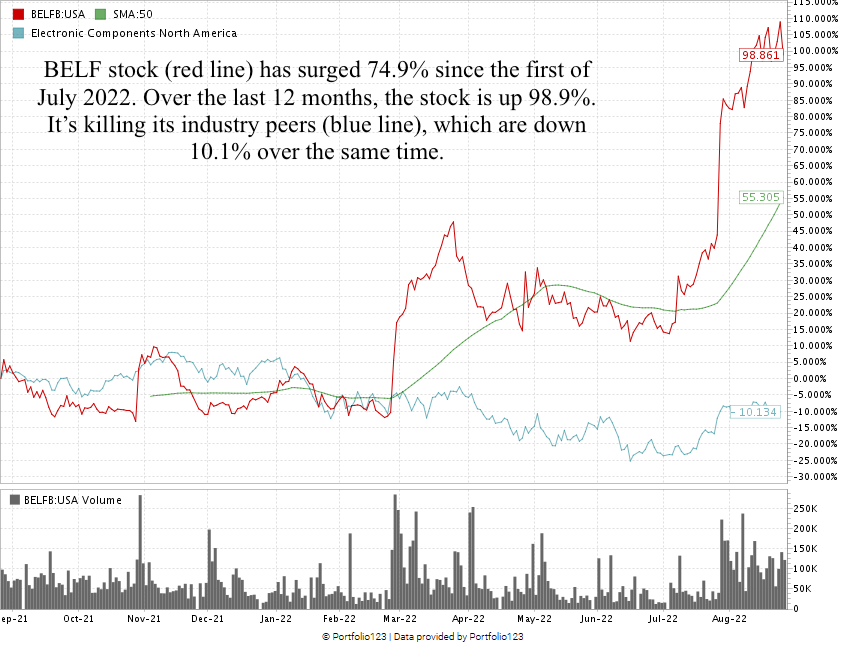

As you can see in the stock chart above, BELFB stock has rocketed up 75% since the first trading day in July.

That’s the “maximum momentum” we love to see in stocks.

Over the last 12 months, the stock is up 99%. It’s blasting past the rest of the electronic components industry, which is averaging a loss of 10% over the same time.

Bel Fuse Inc. stock scores a perfect 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Outstanding growth in a fast-growing market coupled with market-beating momentum make BELFB a strong contender for your portfolio.

Bonus: The company’s 1.1% forward dividend yield means shareholders earn $0.28 per share, per year in dividends!

Stay Tuned: Powerboat Stock to Buy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a “Strong Bullish” boating Power Stock.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.