Remember watching videos of early assembly lines at Ford Motor Company?

A small team of people would rush around a car as they worked to carefully lower the engine block into the chassis of a car.

Now, one person uses a keypad to tell a robot to do the exact same task with laser precision.

Go to any major auto manufacturer and that is exactly what you’ll see.

Factories of all sizes are adopting automation at a rapid pace — despite the global economy teetering on recession.

And the industrial automation market is expanding at a solid clip around the world:

Global investment bank Harris Williams forecasts the size of the industrial automation market will hit $265 billion by 2025. That’s a 51.5% jump in just five years!

Today’s Power Stock helps large manufacturers capture the power of industrial automation: Benchmark Electronics Inc. (NYSE: BHE).

BHE is a $1 billion company that develops software and hardware used to automate manufacturing processes.

Its products include:

- Industrial automation equipment.

- Automation inspection software.

- Automated test systems.

- High-speed packaging automation.

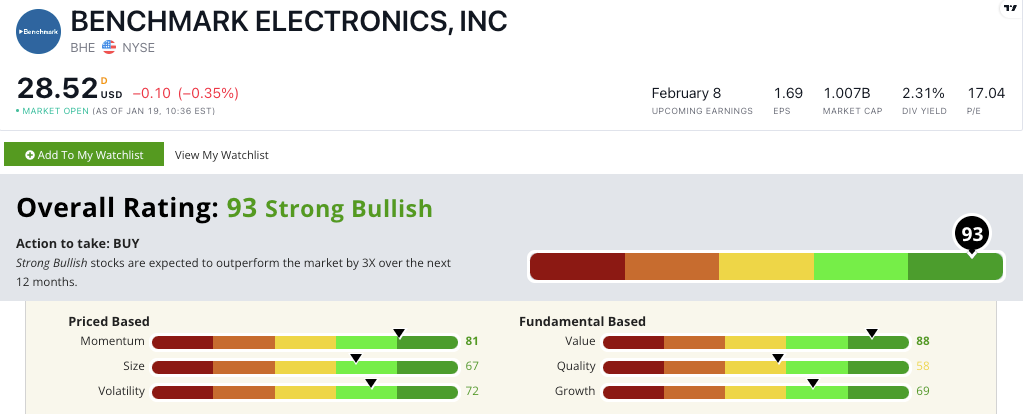

BHE stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Benchmark Electronics Stock: Great Value + Strong Momentum

BHE had an outstanding third quarter of fiscal 2022 and is lining up for another solid year:

- Quarterly revenue was $772 million — a 35% jump from the same quarter a year ago.

- Revenue from its industrial division rose 44% from last year!

While that shows fantastic growth (it scores a 69 on that factor), BHE is also a solid value stock.

Its price-to-sales ratio is nearly half the industry average of 0.54.

The company’s price-to-book value ratio is 1 compared to the manufacturing equipment sector average of 1.82.

This tells us Benchmark Electronics stock is a bargain compared to its peers.

It earns an 88 on our value factor.

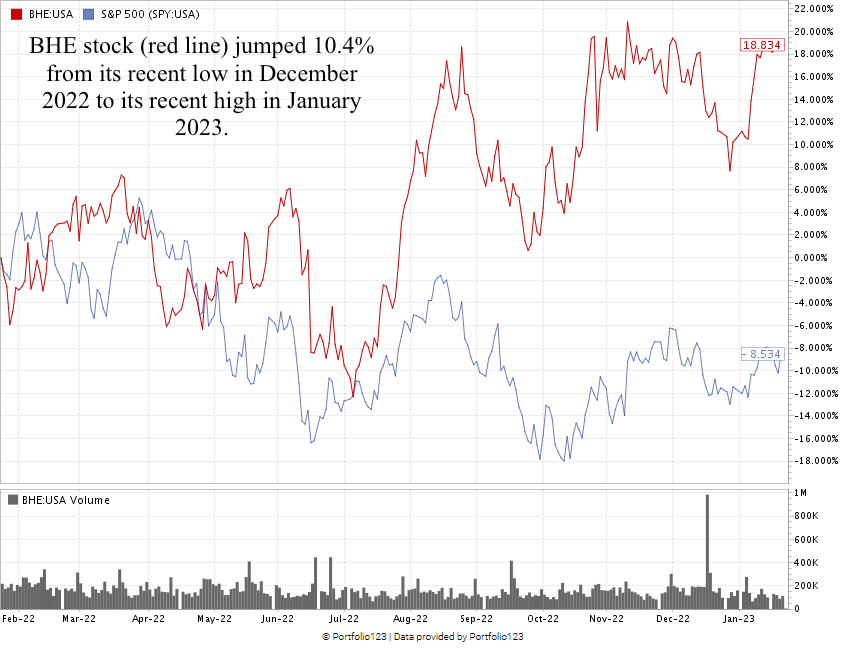

Over the last 12 months, BHE has risen 18.8%. The S&P 500 is down 8.5% over the same time.

Its recent performance is what stands out to me. Check out the chart below:

Created in January 2023.

From its recent low in December 2022 to its recent high in January 2023, the stock has increased 10.4%.

That’s fantastic short-term momentum, and with a factor score of 81, I expect BHE to climb higher from here.

BHE stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Manufacturers are using revolutionary tech to automate their processes. It’s as simple as that.

BHE is becoming a leader that provides outstanding products to speed up this transformation.

You can see why BHE is a smart addition to your portfolio.

Stay Tuned: Strong Bullish Construction Play

Stay tuned for the next issue, where I’ll share all the details on a company that plays a key role within industrial construction.

And it’s working within another booming industry as new skyscrapers dot skylines in cities around the world.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets