It’s easy for investors to get caught up in the week-long stock rally, but beware as a double bottom is coming.

The coronavirus continues to spread, businesses are furloughing employees by the thousands and millions of Americans are forced to stay inside — crippling retail, travel and entertainment.

So, what’s the stock market doing? Going up.

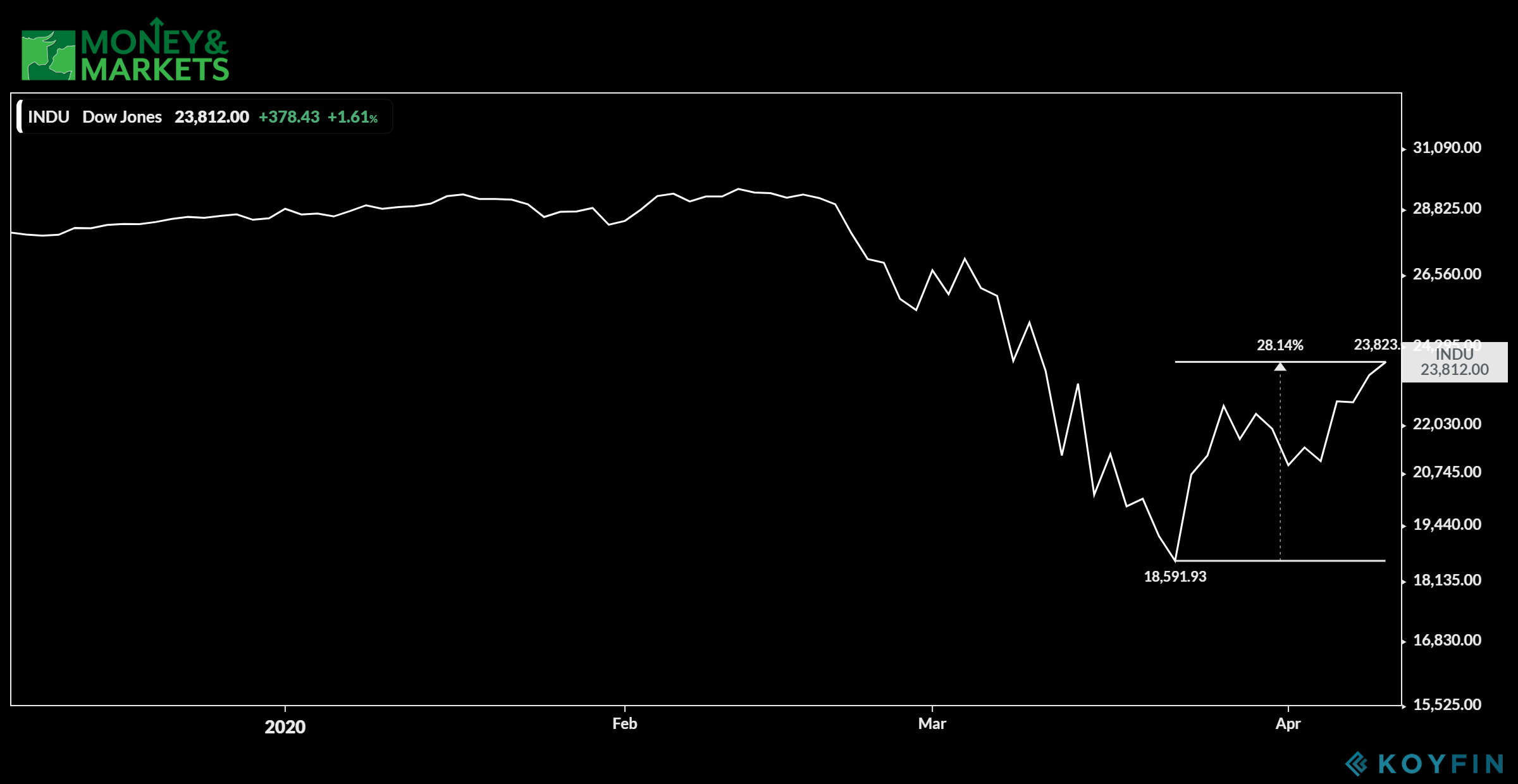

After plummeting more than 36% in just over a month, the Dow Jones Industrial Average has risen 28% — despite the bad news that would otherwise push markets down further.

It’s the same for the Nasdaq Composite — down 30% in late February to early March and up 18% since. — and the S&P 500 — up 23% after hitting a low on March 20.

The market movements have left big investors and analysts like billionaire hedge fund manager David Tepper and CNBC market analyst Jim Cramer scratching their heads.

“I spoke to Dave Tepper yesterday and we were both kind of marveling, ‘Jeez it’s been bullish. Why?’” Cramer said on “Squawk on the Street.”

David Tepper the greatest hedge fund manager of our time said he doesn’t understand this rally bc every company he talks to is going broke, the credit markets are a mess and unemployment is headed to 20%.

— Will Meade (@realwillmeade) April 8, 2020

Banyan Hill Publishing economist and economic historian Ted Bauman said that while the rally may tempt investors, beware because a double bottom is coming.

“It’s not sustainable. It’s not broad enough,” Bauman, editor of The Bauman Letter, said.

Why is it Not Sustainable?

Bauman said, in order for a rally to sustain, there have to be two things.

The first in a consistent rise in market volume.

“Volume has been fairly constant, and selling days have bigger volumes than buying days,” Bauman said.

“Market breadth” is something else to look for. That’s when all stock sectors benefit from the rally.

“We’re not seeing that. Instead, we’re seeing a lot of buying activity in sectors that are really beaten down, like housing, as investors look for value and position themselves for gains after the crisis,” he said.

Another Important Factor Pointing to a Double Bottom

One more important thing that hasn’t been seen yet is complete economic data from the period of the coronavirus crisis.

We haven’t seen GDP or manufacturing index figures yet. When those come out, they’re going to be shocking, and people are going to panic again,” Bauman said.

“That’ll lead to a double bottom.”

What we have seen is Federal Reserve monetary policy changes — including a new, $2.3 trillion program benefiting business and governments — along with a $2.2 trillion stimulus package from the federal government to help stem the tide of the coronavirus.

On Thursday, the Fed unveiled a plan to offer loans to companies with up to 10,000 employees and less than $2.5 billion in revenues, along with up to $500 billion in lending to states and municipalities.

One Twitter user, @FinancialHe has an idea why the rally remains ongoing — basically because the Federal Reserve is pumping new money into just about every sector, it seems.

Has Mr. Tepper seen this? pic.twitter.com/SaOuNweDeu

— financialhe (@FinancialHe) April 8, 2020

The message here is buyer beware. While it may be tempting to get into the market now as equities rise, the strong potential of a double bottom will mean increased losses — so resist FOMO (fear of missing out).

“There is a ‘happy days are here again’ Wall Street impression versus what I hear … people saying: ‘Can I get a mask? How do I get a mask? Do I want an N95?’” Cramer said. “I don’t want to risk it. I think America doesn’t want to risk it.”