Reacting to news rather than crafting a strategic plan, President Biden is selling oil. On Tuesday, with great fanfare, the White House announced a plan to lower the price of oil:

Today, the President is announcing that the Department of Energy will make available releases of 50 million barrels of oil from the Strategic Petroleum Reserve (SPR) to lower prices for Americans and address the mismatch between demand exiting the pandemic and supply.

The underlined text is from the original message. Presidential proclamations generally use tricks like underlining text when they are trying to distract from an important point. In this case, the White House hopes that no one looks at the history of these releases.

The SPR Won’t Solve the Oil Crisis

This isn’t the first time that presidents have released oil from the reserves. Since 1996, there have been 12 previous releases. Most releases intended to raise money for the government and were spaced over two months.

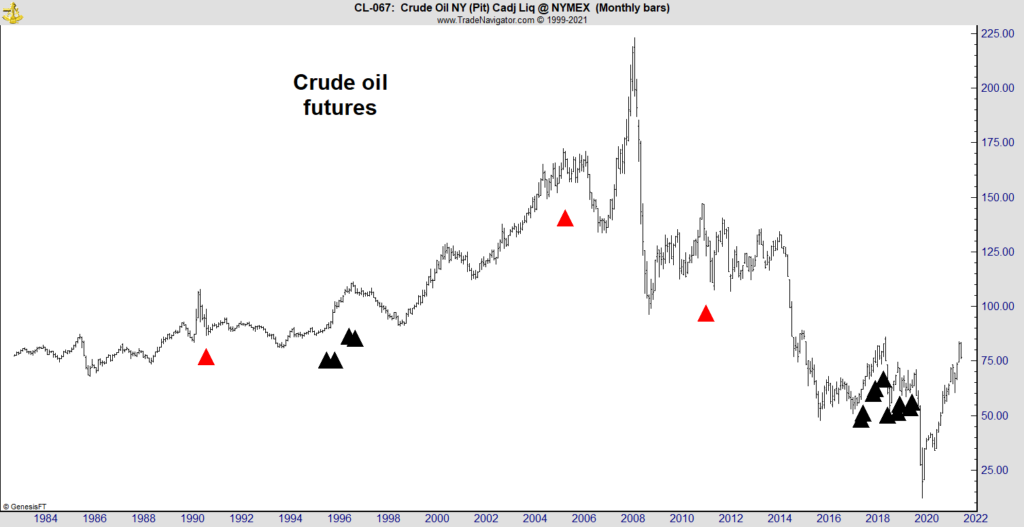

The chart below shows those sales. Black arrows indicate fundraising sales, while red arrows indicate responses to emergencies like the current case. They rarely, if ever, had a substantial impact on prices.

Source: TradeNavigator.

The Strategic Petroleum Reserve (SPR) is the world’s largest supply of emergency crude oil. It was created in 1975, after the Organization of Arab Petroleum Exporting Countries (OAPEC) imposed an oil embargo in 1973 that triggered an energy and economic crisis. Under normal conditions, the SPR holds a little more than a months’ worth of reserves.

Although well-meaning, the release of oil from the SPR is unlikely to have a significant impact on oil prices.

The U.S. uses about 20 million barrels of oil per day. This release will provide less than three days of supply, and then the reserve will need to be replenished.

The release simply shifts demand into the future rather than creating a new supply of oil.

While Biden generated headlines, history shows he won’t solve the oil problem.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.