Inflation fears dominate the news. It’s about time the mainstream media caught up with consumers. Higher prices impact many consumers and families. Even families that are able to cope with current inflation are rightfully worried about future inflation.

As problems mount, a search for the cause of inflation is underway. Many blame the Federal Reserve, which has been printing money for years. Other blame Congress, which stepped up to help families when the government shut down the economy in the pandemic but continues throwing trillions of dollars into new programs.

That’s an important debate. But as investors we want to look for the next problem that the media will cover. For now, it looks like a return to slow growth for the economy.

The Federal Reserve Can Learn From Japan

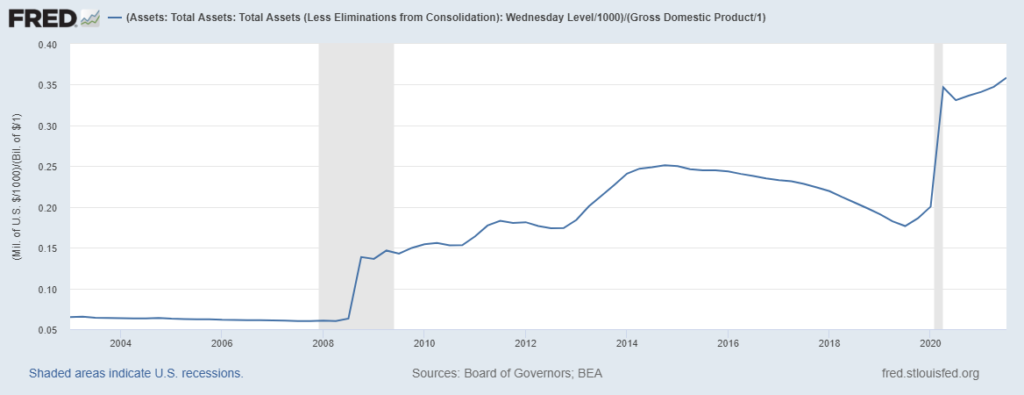

Congress financed its spending with debt and the Fed bought a significant amount of that debt. The Fed now holds assets equivalent to 35% of gross domestic product (GDP) on its balance sheet.

Total Assets of the Federal Reserve

Source: Federal Reserve.

This level of central bank involvement in the debt markets isn’t unprecedented. Japan is another country where the central bank owns more than 35% of the government’s debt.

The Bank of Japan has long been a buyer of debt. It breached that threshold in 2013. It might be a coincidence, but Japan’s economy hasn’t grown since then.

It’s probably not a coincidence. The central bank is buying so much debt because there aren’t enough other interested parties to accommodate the government’s desire for spending money. The high level of debt on the balance sheet indicates that government drives the economy rather than businesses with a profit motive. That leads to inefficient and wasteful spending.

The U.S. is now likely to join Japan as a large and slow economy unless the Fed reduces the size of its balance sheet.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.