Interest rates for loans generally increase as the length of the loan increases. At a car dealership, for example, the finance manager might offer you a loan at 4% for 48 months or 5% for 60 months.

The reason for that is simple: There are more risks associated with longer terms, and the higher interest rate compensates the lender for that risk.

When shorter-term interest rates exceed longer-term rates, the lender sends a message. At the car dealership, it might be a promotional offer, which is good news for consumers. In the Treasury market, if short-term rates are higher than longer-term rates, it’s bad news for consumers.

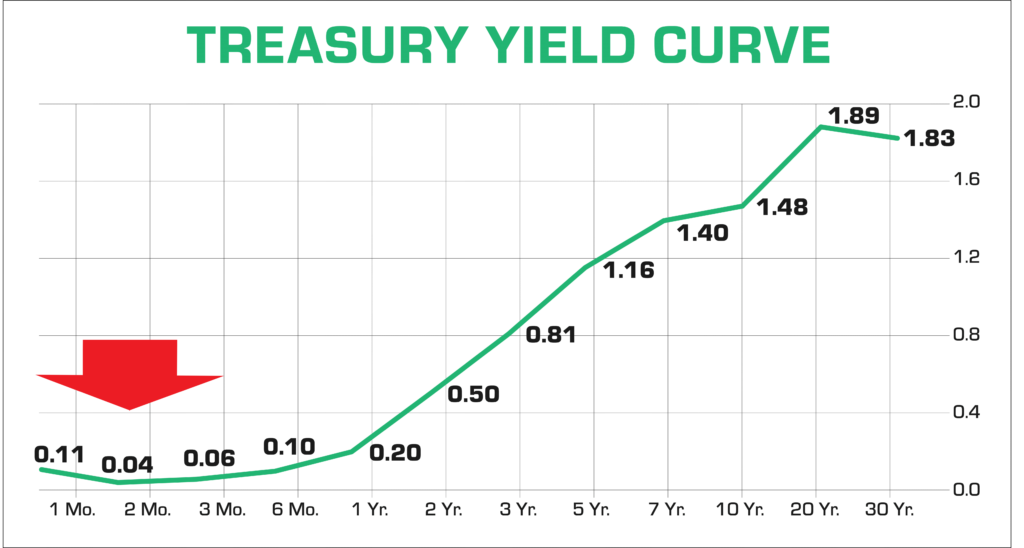

Right now, the Treasury market is delivering bad news. Rates on one-month Treasury bills are higher than the rates on two- or three-month bills. You can see it on the left side of the chart below.

Source: U.S. Treasury.

Yellen Could Lower Debt Ceiling Via Infrastructure Funding

Traders are pricing in the risk of a default that Treasury Secretary Janet Yellen warned about. In a letter to Congress, Yellen wrote that “she has ‘a high degree of confidence’ in the Treasury’s ability to keep the U.S. current on debt payments until midway through next month.”

But she added that the Treasury could run out of cash shortly after December 15. That’s the deadline Congress set for the department to transfer $118 billion to the Highway Trust Fund for the infrastructure bill.

The problem is that the Treasury will hit the debt ceiling within days after making that payment unless Congress acts quickly.

Representatives and Senators who support that spending may not have understood that such a short deadline for infrastructure funding could trigger a problem for the government. It’s also likely they didn’t realize this could create a crisis in the financial markets.

Money market funds own trillions of dollars’ worth of short-term Treasury bills. A default could trigger losses in these funds, the same scenario that contributed to panic in 2008.

Interest rates show us that problems should be resolved fairly quickly if they occur. But the rate curve above shows Congress may not fully understand the implications of the laws they pass.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.