In the latest episode of The Bull & The Bear podcast, I want to show you why Silicon Motion Technology Corp. (Nasdaq: SIMO) is a big data stock to buy today.

By now, you all know that I am big on data.

Data is hard facts, and the already massive pool of available data is constantly growing larger.

Think about a doctor’s office. If 50 individuals have appointments in a day, that’s 50 medical records that need to be updated. Those records aren’t shrinking; they are growing larger with every appointment. And that requires huge amounts of digital data storage.

Whether it’s big data centers or something as small as your smartphone, the need to store the increasing amount of data is constantly growing.

And I see a lot of potential in companies that specialize in data storage solutions.

Well, I used Chief Investment Strategist Adam O’Dell’s six-factor Green Zone Ratings system to find a stock at the forefront of data storage.

I’ll tell you about it in this episode of The Bull & The Bear.

Let’s look at why this company is positioned to outperform the broader market by three times in the next 12 months.

Big Data Is Big Business

Data and information are a cornerstone for how business is done.

And that’s translated to big gains for companies dealing with anything related to data … including data storage.

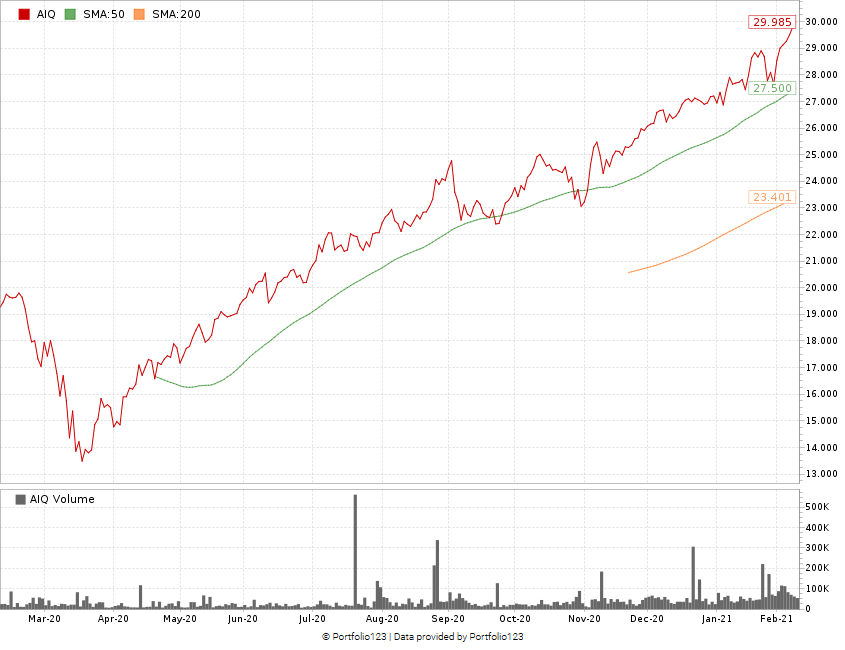

The Global X Artificial Intelligence & Technology ETF (Nasdaq: AIQ) has seen remarkable growth coming off its March 2020 lows.

AIQ Jumps 122% Since its March Bottom

The exchange-traded fund invests in growth and value stocks across the artificial intelligence and big data sectors.

And I’ve found a stock dealing with big data that will beat the broader market by three times over the next 12 months.

Big Data Stock SIMO Has Reached New Highs … and Is Still Growing

Silicon Motion Technology Corp. (Nasdaq: SIMO) has gained 122% in its share price since March 2020.

And it’s jumped more than 31% since January 27.

I think it still has a lot of room to run.

In this episode of The Bull & The Bear, I tell you why SIMO is worth a spot in your portfolio for 2021.

SIMO landed on our Money & Markets hotlist this week. If you don’t know about the hotlist, it’s a weekly basket of 10 stocks that are topping our Green Zone Ratings metrics. Go here to gain access to this list each week, free of charge!

And if you want to access Adam and Charles Sizemore’s highest-conviction monthly stock picks, along with research and guidance on the best time to buy or sell, check out Adam’s Millionaire Master Class here.

Remember, knowing the data and the details about a specific stock or sector of the market helps you determine whether it is worth investing in.

That’s why we do the work for you and give you our analysis every week.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.