“This train had already left the station … The global COVID-19 crisis is only accelerating it.”

Markets rallied in a big way Monday on the back of biotech stocks following a positive breakthrough on the COVID-19 vaccine front, but that begs the question: What’s the best way to invest in a potential coronavirus treatment?

You should absolutely look into companies that are racing to find a treatment for the novel coronavirus that has ground the global economy to a halt, triggering the fastest 30% drop for the S&P 500 in its history — but that’s not the only play in biotech stocks.

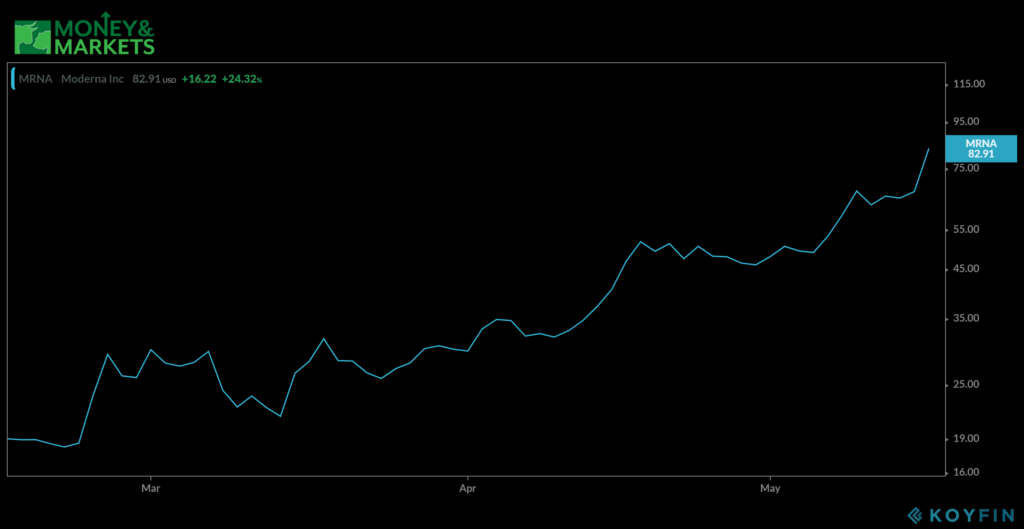

A company that’s all the rage today is Moderna Inc. (NASDAQ: MRNA), the latest to see a massive price spike after reporting its early stage human trial for a coronavirus vaccine successfully created COVID-19 antibodies in 100% of its test participants. Shares of the biotech company were up over 24% by 2 p.m. EDT.

It’s not the only company that has benefited from positive breakthroughs concerning the virus, either. Gilead Sciences Inc.’s (NASDAQ: GILD) stock price has risen 15% since its February lows while developing its own virus treatment, remdesivir. Europe may conditionally approve the treatment later this week.

Money & Markets Chief Investment Strategist Adam O’Dell also is bullish on the health care sector’s future, and it’s not just driven by the coronavirus vaccine.

“I’ve been recommending a strategic, long-term overweighting to the health care sector since last year — well before COVID-19,” O’Dell wrote via email. “The baby boomer generation is driving demand for major breakthroughs in the health care and biotech spaces. And given the speed at which technology in the field of genomics is advancing, I really think baby boomers will see new, groundbreaking therapeutics in their lifetime.

“This train had already left the station — and the global COVID-19 crisis is only accelerating it.”

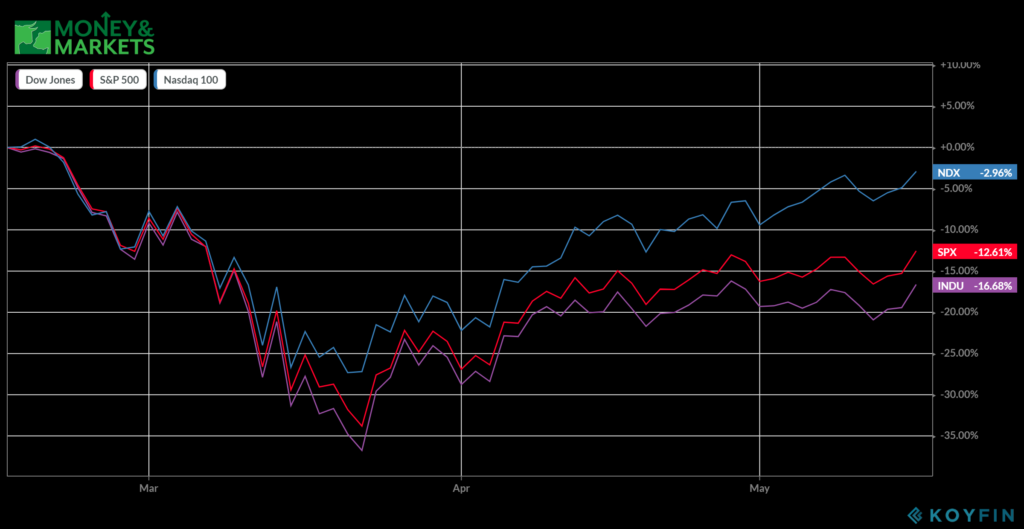

The coronavirus has had a major impact on market sentiment overall. The Moderna news Monday juiced all three major U.S. indexes, sending the Dow Jones Industrial Average and S&P 500 more than 3% higher in afternoon trading. The Nasdaq Composite was also up over 2.6%.

While the indexes have been climbing back out of the coronavirus crash, it hasn’t been a smooth ride. Big, volatile swings have been commonplace as investors buy or sell on any news concerning the pandemic and its impact on the global economy.

This market environment can be a bit scary, but opportunity within the health care sector and biotech is there.

How to Maximize Investing in Biotech Stocks

While many companies are racing to develop a coronavirus treatment, causing investors to flock to whichever one has the latest, greatest breakthrough, O’Dell has crafted a different approach to investing in biotech stocks for his Cycle 9 Alert readers.

“I’m identifying companies that are fundamental to the genomics biotech revolution — with or without the COVID crisis,” O’Dell said. “It helps to see my shortlist of companies respond quickly to the crisis, but I also need to know they’ll continue to grow the market once the worst of the crisis has passed. There are a small handful of companies that are absolutely essential to genomics research and future breakthroughs, and not all of them are the headline-grabbing drugmakers you’re hearing about now.”

In fact, if you want to play it simple and cover all your bases, an exchange-traded fund, or ETF, is probably the best way to go.

“An option for those who want diversified exposure to this growing market is a simple ETF,” O’Dell suggested. “I’ve written on the ARK Genomic Revolution ETF (BATS: ARKG) before. I actually recommended the fund during an investment conference presentation I gave last October, and it’s up around 65% since.”

O’Dell’s Cycle 9 Alert, a premium Money & Markets trading service, focuses on tactical trades like this that maximize gains while minimizing risk, including lucrative option plays. O’Dell’s current Cycle 9 portfolio has six ongoing trades and the average gain among them is a staggering 89.2%. One trade in particular that was initiated in February is up 396.1% through Friday’s market close, and two of them have gained more than 100%.

The coronavirus response is fueling biotech stocks in a big way and while the big names grab headlines, it’s worth looking elsewhere — such as an ETF like ARKG — to grab diversified profits.