As technology becomes more prevalent in every aspect of our lives, some investors may be wondering what China’s digital currency could mean for Bitcoin and other cryptocurrencies.

Digital payments have become more the norm in China rather than the exception as consumers would rather pay with a simple click on a phone app instead of having to carry around a wad of yuan notes, which is pushing the government to figure out new ways to get into the digital world.

China’s digital currency, basically a digital yuan, has been rolled out in a pilot program in four cities: Shenzhen, Suzhou, Chengdu and Xiong’an, according to Bloomberg. An even larger stress test of the digital yuan, which acts exactly like a physical note without the “physicality,” will likely occur during the 2022 Winter Olympics in Beijing.

So what does that mean for cryptocurrencies like Bitcoin?

China’s Digital Currency vs. Bitcoin

Banyan Hill’s Ian King

Banyan Hill Publishing’s Ian King, a crypto expert, thinks this could be a great development on multiple fronts for Bitcoin.

“The fact that central banks are looking into digital currencies is bullish for Bitcoin,” said King, Editor of

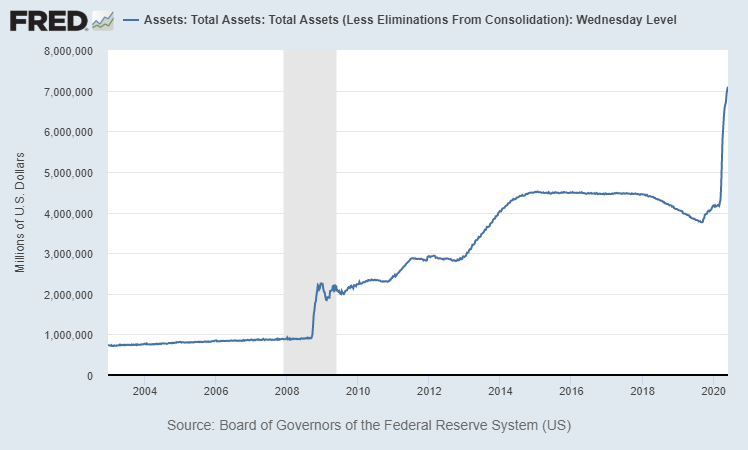

The Federal Reserve and other central banks around the world have pledged to do whatever it takes to help the economy out of the slump caused by the coronavirus outbreak and subsequent lockdown. The Fed’s balance sheet has ballooned over $7 trillion as a result of the rampant “money printing” (or quantitative easing).

If China’s digital currency gains traction and becomes the new norm in the world’s second-largest economy, it could offer the Chinese government newfound control over the way people move and spend money.

“Digital cash gives central planners more control over the economy,” King said. “Like cash, they’re backed by China’s central bank, but also provide the government insight into private financial transactions.”

Digital transactions are much more prevalent in China, where purchases through mobile apps from big tech companies like Alibaba Group Holding Ltd. (NYSE: BABA) and Tencent Holdings Ltd. (OTCMKTS: TCEHY) account for 16% of the country’s gross domestic product.

That number is less that 1% in the U.S., and some worry it’s giving too much power to big tech.

“Those big tech companies bring to us a lot of challenges and financial risks,” People’s Bank of China Governor Yi Gang said last year. “You see: In this game, winners take all, so monopolies are a challenge.”

Forced liquidity by central banks alongside government oversight of financial history may have some investors worried, and King thinks Bitcoin is a great hedge.

“If you don’t want a government-controlled currency, you can buy Bitcoin, a peer-to-peer cryptocurrency with a fixed money supply,” King said. “With the amount of money that’s currently being printed globally to fight financial slumps, Bitcoin offers an alternative.”

And China’s digital currency, or the implementation of something similar in other parts of the world, would only make it easier for investors to hop on the Bitcoin train, King argues.

“A digital currency reduces the friction into Bitcoin,” he wrote via email. “If people are already holding digital dollars, they can easily exchange them for cryptocurrency. Square’s Cash App already offers this for the U.S. dollar. You can trade in and out of bitcoin with the extra cash in your Cash App account.”

Trends like a shift into more digital transactions are exactly what King seeks for his Automatic Fortunes subscribers. He finds “tipping-point trends” that will change life as we know it, and uses an exclusive four-step system to achieve profits.

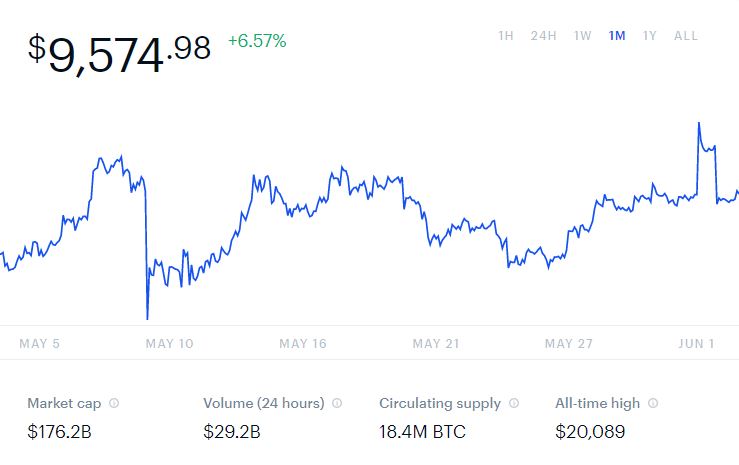

Bitcoin experienced a reasonable amount of volatility through May while also being backed by billionaire hedge fund manager Paul Tudor Jones.

The crypto went through a halving on May 11, which cuts the rewards for mining new bitcoin in half, making it more and more expensive to mine because of how much electricity the mining process consumes.

“By throttling the creation of new Bitcoin, the system avoids inflation,” Money & Markets contributor Charles Sizemore wrote here in a recent piece about the halving.

Tim Enneking, managing director for Digital Capital management, thinks the halving will eventually lead to another big spike soon.

“The halving has never had much of an effect right on the halving date,” Enneking said in a Forbes interview. “The big move from that is almost certainly still coming.”

The currency spiked over $10,000 a few times over the last month.

Source: Coinbase

And while China’s digital currency is likely years away, it is another factor to keep an eye on, especially if you are investing in cryptocurrencies like Bitcoin. A move toward more digital cash could be a boon for the sector — and its investors.