Bitcoin dropped more than 47% from its mid-April high. Bulls said that’s normal. Bitcoin is a volatile asset, and steep sell-offs have occurred in the past.

The bulls do have a point. This was the sixth time bitcoin dropped at least 40% since 2015. In a bear market that began in 2017, bitcoin dropped more than 80%. In the bear market that began two years later in 2019, the decline topped 70%.

This time, the decline could be in line with those bear markets.

In 2017, bitcoin was a novelty, largely unknown and difficult for the average investor to own. At the peak in 2019, bitcoin was still a relatively difficult to own asset. Now, bitcoin and other cryptocurrencies are simple for anyone to own or trade.

Increased access fueled a bull market in risk assets beginning last year. The beginning of this recent bull market can be precisely traced to the first stimulus checks, which hit bank accounts last spring.

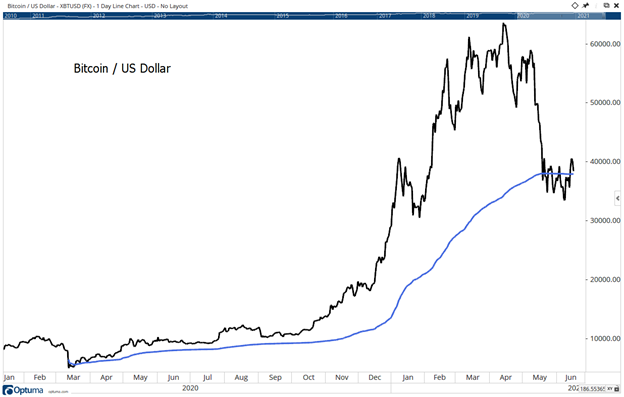

The chart below shows bitcoin and an indicator showing the average price paid by investors since the bottom in March 2020. That indicator reveals the average investor is near breakeven, a perilous state for the market.

Bitcoin Investment Is Now Breakeven

Source: Optuma.

Investors’ Losses Could Indicate Bitcoin Bear Market

This indicator is the volume-weighted average price. Volume defines the level of trading activity at any price. By incorporating this factor, the indicator allows us to learn about the average price investors paid for their bitcoins over time.

At the end of last week, investors who bought during the bull market paid an average of $37,885 for their positions.

At the highs in April, the average investor had a gain of more than 70%. Now, those gains are gone. As positions turn to losses, there will be sellers. As selling pushes prices down even more, losses will grow, and the selling is likely to accelerate.

Bargain hunters might be attracted to bitcoin. But the market is vulnerable to another crash, possibly pushing prices more than 70% below their highs, which would make this a bitcoin bear market.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.