Gold is surging.

In the futures market on Friday, it blasted through the $1,400-per-ounce barrier like a sharp knife through soft butter.

Then it kept right on going to $1,415.50, before consolidating a bit this weekend.

No surprise to our readers — we’ve been warning about this breakout for a long time.

And it’s just the beginning. So, early investors stand to make a heck of a lot of money.

What most people don’t realize is that two other markets we’ve been following have the potential to make them even more money.

Cannabis Stocks Poised for Another Giant Leap Forward

The first sector that could leave gold in the dust is cannabis stocks; and the correction we’ve seen there could end at any moment.

That’s why at 2 p.m. Eastern THIS afternoon, I’m holding an urgent Q&A session, devoted exclusively to the huge cannabis opportunity in front of us.

It couldn’t be more timely.

So, if you want to join me online, be sure to go here a few minutes before the hour.

Look! There’s big money sloshing around the cannabis industry, and it’s only making the massive marijuana megatrend gain more and more strength.

Silver Likely to Outperform Gold

The second market that could lead precious metals into the stratosphere is silver.

On that point, consider what Bob Archer, the CEO of Newrange Gold, has to say.

His company is a gold explorer getting busy in Nevada.

But if you’ve been following me for a while, you may remember Bob as the CEO of Great Panther Mining (NYSE: GPL). That’s a silver miner that made my subscribers a heck of a lot of money back in the day.

So when Bob has something to say about gold — and silver — you’d be wise to listen.

In the following video, Bob laid out his four reasons why gold is going higher. And he also explained his view why silver will lead the way in a precious metals bull market. You can watch that video here …

Bob and I reference some price action in gold, as well as the gold-silver ratio. So I wanted to share charts of each.

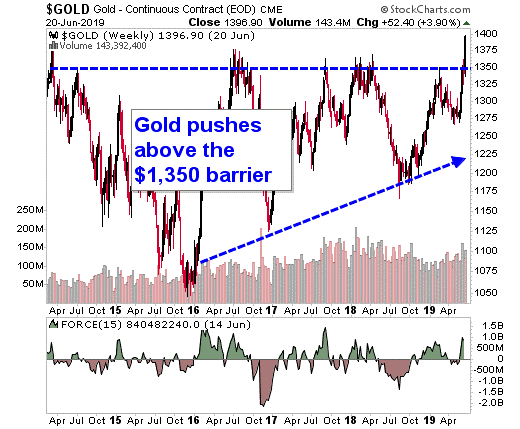

First, here’s a chart showing how gold rammed through the $1,350 price resistance that held it in check for five long years.

You can see that gold has trended higher for years — but every time it tests that overhead resistance, it gets slammed down. But not this week. This week, gold roared on through that barrier. Gold is now trading at six-year highs.

On the bottom of the chart is a momentum indicator that I trust a lot, called “The Force Index.” The Force is now bullish on gold.

And here’s something else that Bob referenced in the video — a chart of the gold-silver ratio.

This chart shows the price of gold divided by the price of silver. It is at extreme levels — just over 90! That means it takes 90 ounces of silver to buy one ounce of gold.

Previous peaks in this ratio have signaled the start of bull markets. And precious metals are overdue for a bull run.

Just some things to think about this weekend. If you aren’t investing in gold and silver miners yet, it’s not too late to start. Heck, after talking to Bob, I just bought Newrange Gold (OTCQB: NRGOF) for my own portfolio. And I expect I’ll buy more companies — explorers, developers, miners — leveraged to gold and silver. I’ll buy them on any pullback.

Just remember, before you buy anything, do your due diligence.

All the best,

Sean