My wife and I went to Miami last weekend, and one thing stood out.

There is construction everywhere.

Cranes dot the South Florida skyline.

The chart above shows the S&P 500 Construction and Engineering Industry Index against the S&P 500.

Since February 1, the index is up 24.6%, compared to a 20% decline for the broader market.

Today’s Power Stock distributes building and industrial products in the U.S.: BlueLinx Holdings Inc. (NYSE: BXC).

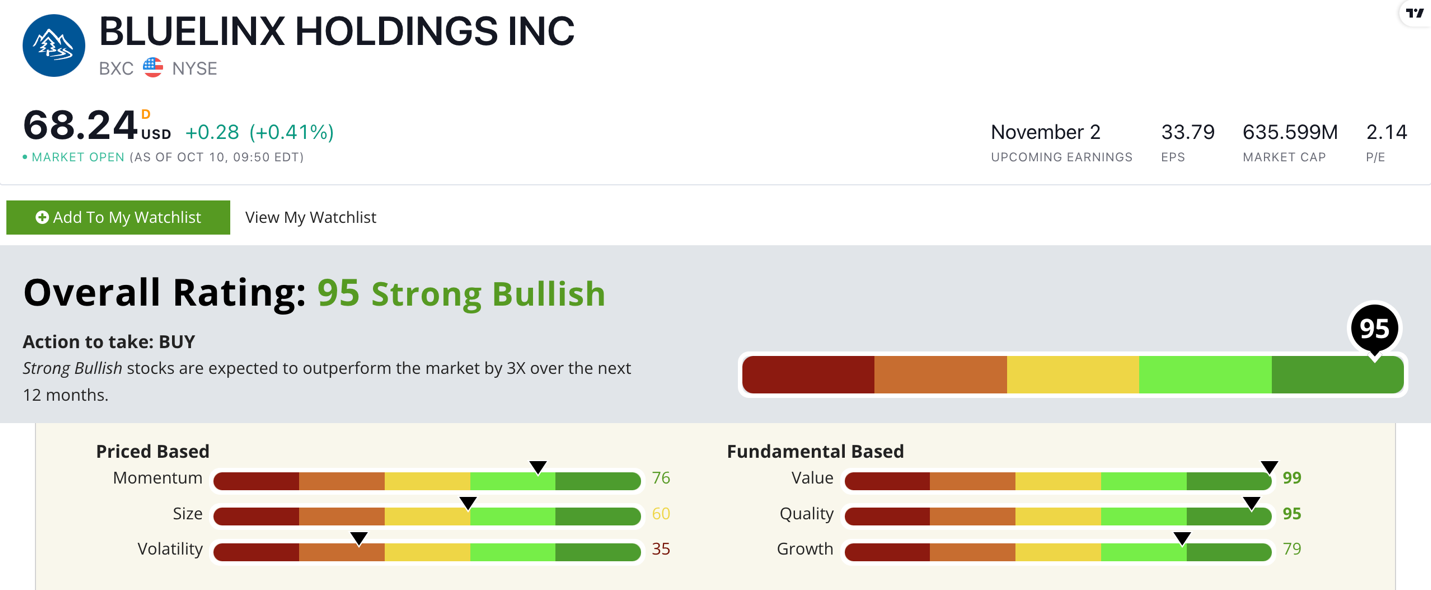

BXC’s Stock Power Ratings in October 2022.

BlueLinx’s products include:

- Plywood.

- Rebar.

- Lumber.

- Metal.

- And siding.

The company markets its products for many projects (from houses to big office buildings).

BXC stock scores a “Strong Bullish” 95 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

BXC Stock: Great Value + Quality

BXC reported a solid quarter with some significant high points:

- Its specialty product sales were $788 million — an increase of 17% from the same quarter a year ago!

- The company’s net income for the first six months of 2022 was $204.7 million — an increase of 16% over the same period last year.

While BXC has strong growth potential, it is also a solid value and quality stock to boot.

Its price-to-earnings ratio is nearly six times lower than the diversified industrials distribution sector’s.

The company’s price-to-cash flow ratio is more than five times lower than the industry average.

This all tells me BXC is a much better value stock than most of its peers.

BXC’s returns on assets, equity and investment are also all higher than its peers’ averages.

This means its management is great at making money.

Created October 2022.

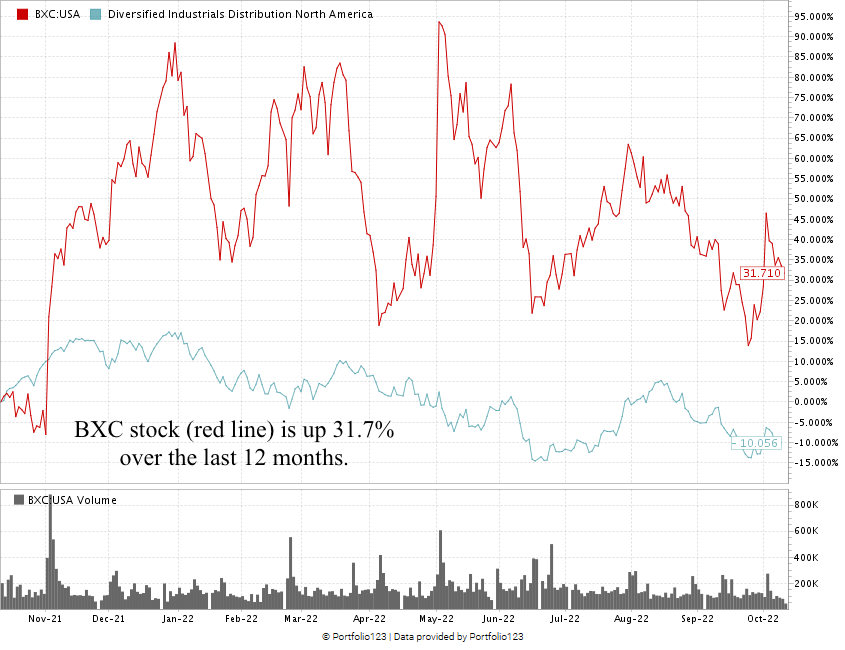

Over the last 12 months, BXC stock is up 31.7%.

Its peers (the blue line in the chart above) are averaging a 9.6% decline!

That shows BXC is outperforming the industry by a wide margin.

BlueLinx stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Home prices are coming down, but the construction industry is beating the broader market.

With building on the rise, you can see why BXC is a strong contender for your portfolio.

Stay Tuned: “Strong Bullish” Coal Miner Leads Industry

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a Power Stock that mines coal used for heat, power and steel production.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.