Sometimes, it’s good to be wrong.

A year ago, 72% of economists polled by the National Association of Business Economics expected the U.S. economy to be in a recession by now.

But now, major players are walking their pessimism back after the Federal Reserve cooled inflation from a massive 8.5% in July 2022 to 3% in June 2023:

- Bank of America economists just reversed their recession prediction as optimism grows — the first major bank to do so.

- And CEOs are using the buzzy Fed phrase “soft landing” 97% more this earnings season compared to last. That tells me they expect a steady decline and not an epic economic crash.

Who’s to thank? You and me, of course!

At least that’s part of the argument…

Consumer sentiment improved another 11% in July from June’s numbers. Long-term business conditions within the survey jumped 18% higher over that time.

This sets up well for consumer discretionary stocks. So I want to use two resources — Adam O’Dell’s Green Zone Power Ratings system and his “Blacklist” — to find one consumer stock with the potential to beat the broader market … and one to avoid as we flash our cash.

Copy My Process

An easy “one-click” investment to follow improved consumer sentiment is the Consumer Discretionary Select Sector SPDR Fund (NYSE: XLY).

But as Adam has noted before, exchange-traded funds (ETFs) like XLY expose you to the broad spectrum of whatever basket of stocks it’s holding — good and bad.

That’s why I’m using Adam’s system and his “Blacklist” to single out one stock on each side.

And it’s as simple as finding a list of the ETF’s holdings and plugging them into Green Zone Power Ratings at www.MoneyandMarkets.com. Just look for the big button below, or use the search bar to do the same:

Let’s start off with the good….

Everyone Loves Free Bread

Want to know how the economy is doing? Drive by your local Olive Garden or LongHorn Steakhouse at dinnertime and check out the parking lot.

The Olive Garden by me is always jampacked. Neighboring businesses have to fend off would-be diners looking for a space.

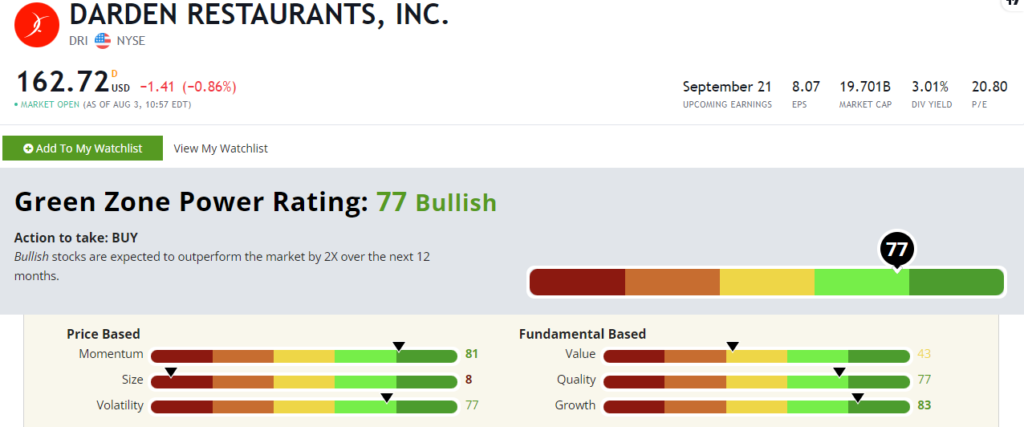

That’s a great sign for its parent company, Darden Restaurants Inc. (NYSE: DRI). And Green Zone Power Ratings agrees:

DRI rates a “Bullish” 77 out of 100, which means it’s expected to beat the broader market by 2X over the next 12 months.

Darden beat expectations on earnings per share in its June quarterly report ($2.58 versus $2.53). It also reported $2.7 billion in revenue, a 6.3% increase year over year.

Those are two metrics that reflect its 83 rating on Adam’s Growth factor.

Looking at its strong Momentum (81) and Volatility (77) ratings, DRI stock has climbed more than 28% over the last year, without many big price swings. That’s almost 3X the S&P 500’s 8.4% gain!

And optimistic consumers should only help DRI’s bottom line from here.

Of course, not all consumer discretionary stocks are equal…

We Don’t Need More Rubbermaid

I’ve mentioned Adam’s “Blacklist” a couple of times already, and that’s how I found this stock to avoid.

Adam updates this list every week. It shows every stock that rates “Bearish” or “High-Risk” in Green Zone Power Ratings for those seven days. It’s a one-stop shop of everything to avoid. To learn how to gain access, click here.

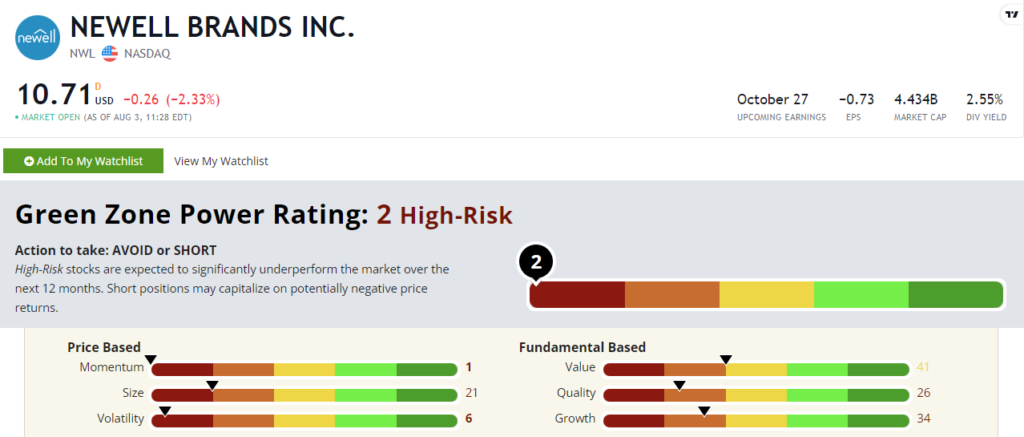

An added bonus is that you can sort the list by factor ratings, and Newell Brands Inc. (Nasdaq: NWL) showed up in the worst of the bunch on Momentum with a 1 rating.

That helps explain NWL’s “High-Risk” 2 out of 100 overall. Stocks in this category are set to significantly underperform from here.

NWL’s Green Zone Power Ratings in August 2023.

Over the last 12 months, NWL’s stock price has lost around 46% of its value, which explains the abysmal Momentum rating.

It also reported a 13% decline in year-over-year revenue in its latest earnings call. Add to that a 0.8% net profit margin (89% lower than the second quarter a year ago), and you can see why NWL’s Growth rating is at 34.

When given a choice, we’re opting to spend our hard-earned cash on salad and breadsticks, not Sharpies and Rubbermaid…

And that’s why Green Zone Power Ratings says Newell Brands stock is one to avoid.

Until next time,

Chad Stone

Managing Editor, Money & Markets