Age divides America. Boomers and millennials hold different views. They live different lifestyles. And they are investing in stocks right now with completely different attitudes.

Millennial investors and young traders are in the news lately. Many are on Twitter talking about stocks like Hertz Global Holdings Inc. (NYSE: HTZ) and Chesapeake Energy Corporation (NYSE: CHK). Both companies are in bankruptcy. Bond prices indicate the stocks are headed to zero. Yet they are popular among newer millennial investors who don’t seem to be doing much research on their stocks.

Millennial investors also started buying options. Volume in these markets is at record levels. And most of the volume is in calls, indicating traders expect more gains in stocks.

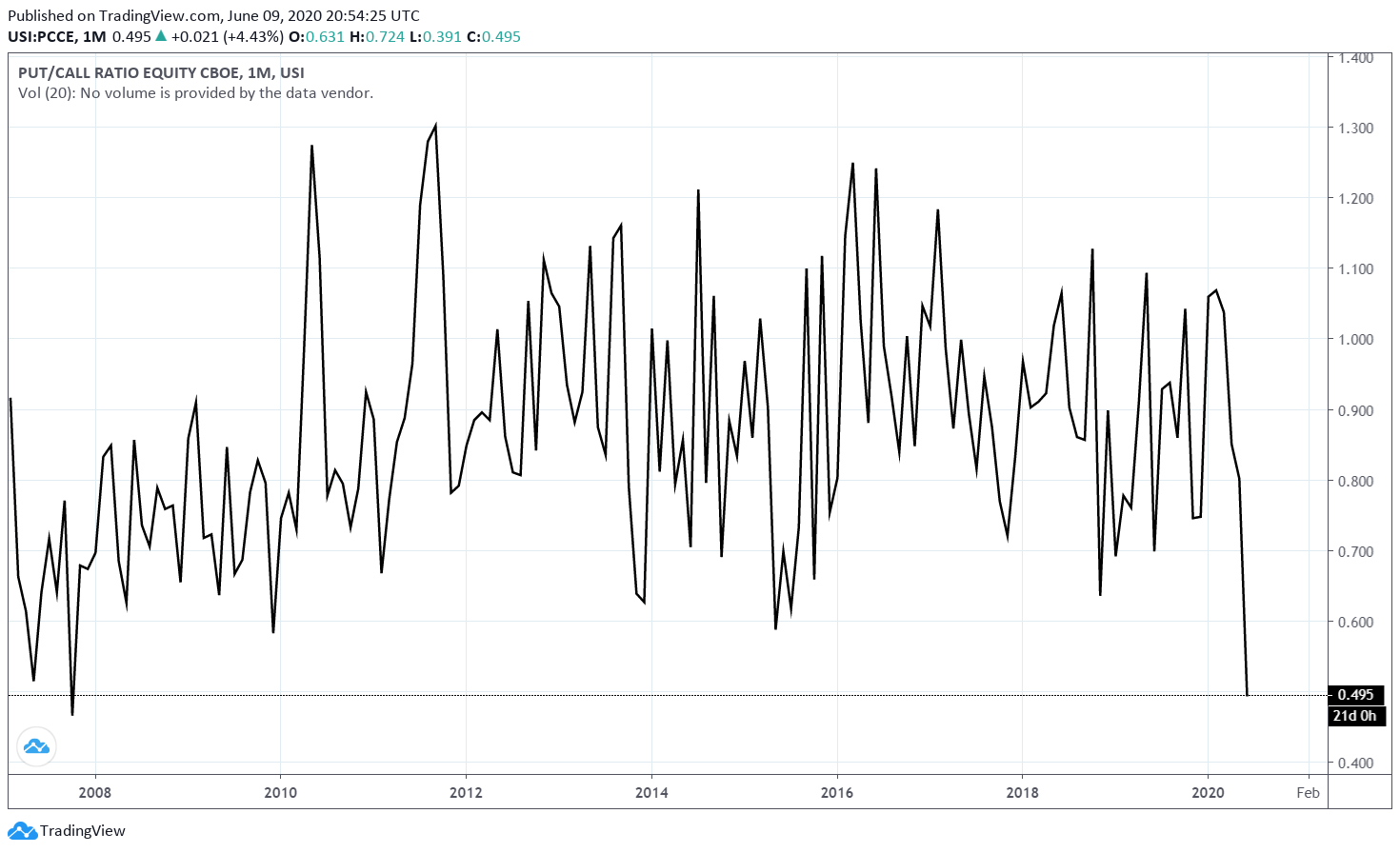

The chart below shows the put/call ratio. It measures how many puts are traded for each call. In the long run, the average reading of this indicator is 0.9. That means trading is usually relatively balanced but there is a small bias towards calls.

Right now, traders are loading up on calls and the reading is 0.495.

Source: TradingView.com

This tells us traders are much more bullish than average. That’s the most extreme bullish reading since October 2007.

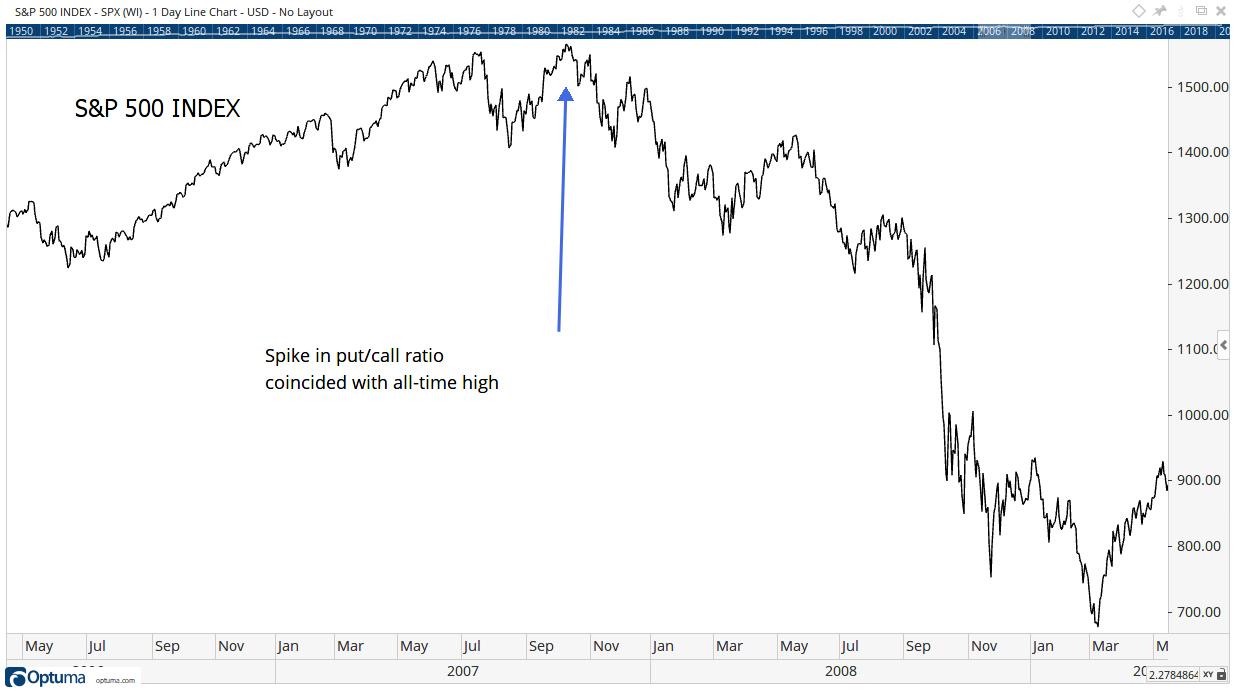

The next chart shows the S&P 500 at that time.

Source: Optuma

Millennial Investors Appear Bullish, Older Traders Bearish

It seems safe to say new and millennial investors buying calls today don’t know what happened in 2009. They’ve never seen a bear market.

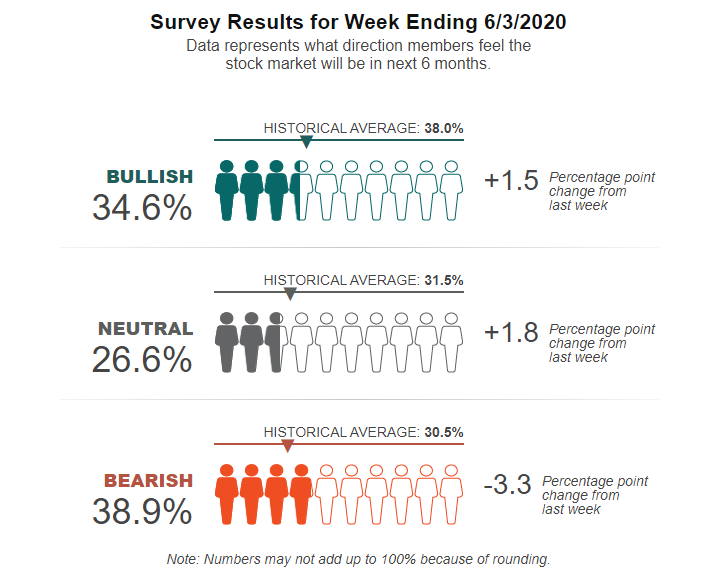

Another group of individuals are the members of the American Association of Individual Investors, or AAII. This organization completes a weekly survey asking members if they are bullish or bearish. Results show members are bearish right now.

AAII members tend to be older, often retired. They’re baby boomers. They have seen multiple bear markets and they understand investing is difficult.

It’s interesting that inexperienced investors are wildly bullish while experienced investors are cautious. One group is clearly wrong.

I’ve seen a number of bear markets over more than 30 years and I’m cautious. I’ve mentioned several times that bear markets always offer a second chance to get out near the all-time high.

I believe the market is giving us a second chance to avoid the worst of the bear market. Many investors won’t take advantage of this opportunity. They’re confident that they know all they need to know about stocks. After all, as many have said on Twitter, they are better at picking stocks than Warren Buffett.

It really is sounding a lot like 1999 again when day traders expected to make 1,000% a year. It’s also looking a lot like 2007 when stocks were beginning the worst bear market since the Great Depression.

Editor’s note: Money & Markets contributor and Apex Profit Alert Editor John Ross also wrote today about so-called “dumb money” driving the rally while the “smart money” is sitting back. Click here to read John’s take.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.