Money & Markets Week Ahead for the week of February 7, 2021: Bumble’s IPO debuts alongside earnings from two American stalwarts: Coca-Cola Co. (NYSE: KO) and PepsiCo Inc. (Nasdaq: PEP).

Last week was tame on Wall Street, compared to the “short sell” the week before.

Earnings season is winding down, but there is another big initial public offering on the books.

Here’s what to look for in the week ahead on Wall Street:

On the IPO Front: Bumble Inc.

There are a few initial public offerings (IPO) to watch.

Bumble Inc., which expects to price its IPO on Wednesday or Thursday, may be the biggest launch to watch.

What is it? Bumble Inc. is a popular dating app that says it’s “changing the dynamics of dating.

The app differs from other dating apps, where either men or women initiate contact.

Users fill out a profile and list it. If a woman is interested in either dating or connecting as friends, they make the first move.

The app is open to those who are looking to date, find friendships or even business connections.

The company’s CEO, Whitney Wolfe Herd, founded the group in 2014 following her departure from rival Tinder.

According to the company’s S-1 filing with the Securities and Exchange Commission (SEC), it had 2.4 million users for the nine months ending September 30, 2020.

Those users generated 36.1 billion messages on the app.

Bumble reported an earnings loss of $116.7 million on $376.6 million for the nine months ending September 30, 2020.

That’s compared to an earnings gain of $68.6 million for the same period the year before.

The offering. Bumble will trade on the Nasdaq Global Select Market under the ticker BMBL.

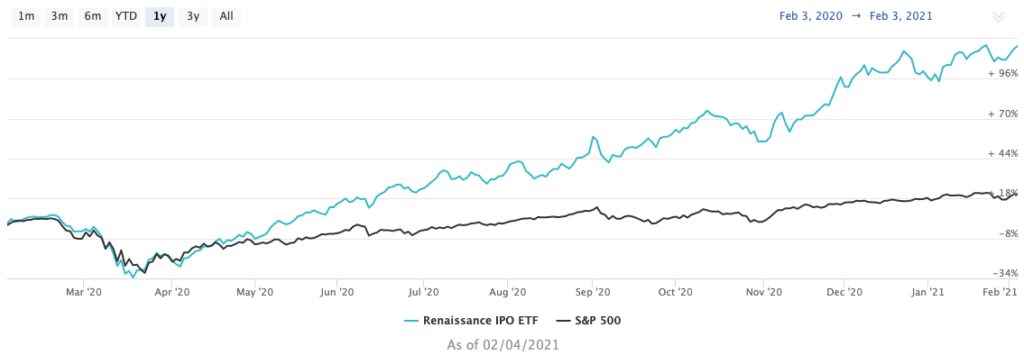

The Renaissance Capital IPO ETF (NYSE: IPO), the exchange-traded fund which tracks the performance of IPOs across the market, is up 117% over the last 12 months compared to an increase of just 21% for the S&P 500.

Renaissance IPO ETF Up Triple Digits Since February 2020

Bumble plans to sell 34.5 million shares in the IPO with a price range between $28 and $30 per share.

It’s looking to raise as much as $1.04 billion from the IPO.

At the top end of the price range, Bumble could reach a market value of $6.46 billion, including debt, after the listing.

The company said it will use proceeds from the IPO to purchase common shares of Buzz Holdings LP — the parent company of Bumble Inc. That will make Bumble Inc. the sole general partner in Buzz Holdings LP. Buzz will then use those proceeds to pay down more than $300 million in debt.

The remaining proceeds will buy equivalent common shares from its pre-IPO owners.

According to The Street, Wolfe-Herd will own approximately 14% of the company following the IPO with Blackstone Group (NYSE: BX) holding another 83%.

Lead underwriters for Bumble’s IPO are Goldman Sachs, Citigroup, Morgan Stanley and JPMorgan Chase.

Deeper Dive: The Cola Wars

The quarterly earnings season has already started to wind down, as several large companies have already reported.

In our deeper dive into earnings, I want to focus on the cola wars.

For decades there has been a long-standing battle between Coca-Cola Co. (NYSE: KO) and PepsiCo Inc. (Nasdaq: PEP) to control market share in the beverage industry.

Both companies report their quarterly earnings this week, with Coca-Cola reporting on Wednesday and PepsiCo reporting on Thursday.

Last time out … In their last quarterly earnings reports, both Coke and Pepsi beat revenue and earnings projections.

Coca-Cola reported earnings of $0.55 per share on revenue of $8.7 billion for the quarter.

That bested Wall Street projections, which were $0.46 per share on $8.36 billion in revenue.

Coca-Cola Beat Wall Street Earnings in Q3 2020

The quarter also marked the first revenue increase for the company in three quarters.

Earnings per share have been up and down all year, ranging from $0.55 to $0.42 per share.

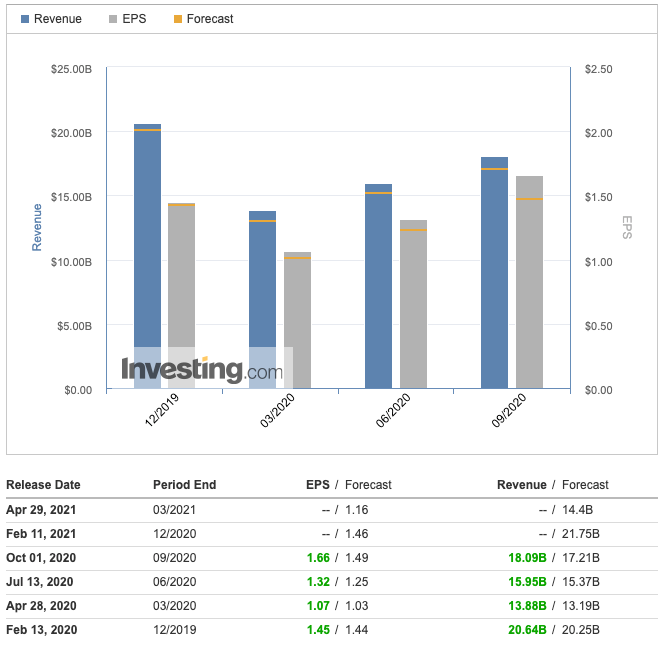

PepsiCo, like Coca-Cola, also beat Wall Street projections by reporting $1.66 per share in earnings on $18.09 billion in revenue last quarter.

It was the third consecutive quarter where the company not only beat expectations but bested the previous quarter.

PepsiCo Has Beat Projections in the Last 4 Quarters

Wall Street analysts are expecting an increase in revenue for both companies from the fourth quarter.

The forecast for Coca-Cola is for earnings per share of $0.41 on revenue of $8.61 billion.

PepsiCo is forecast to have earnings of $1.46 per share on $21.75 billion.

Money & Markets Week Ahead: Data Dump

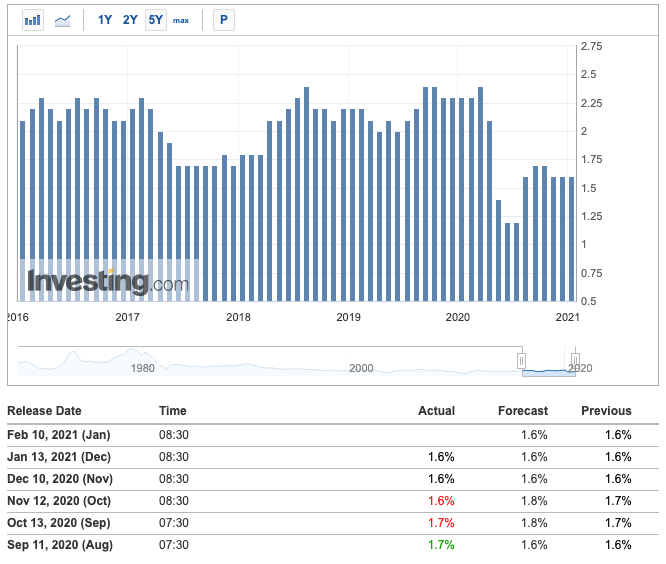

This week’s data dump starts on Wednesday when the U.S. Bureau of Labor Statistics will report year-over-year changes in its Core Consumer Price Index (CPI).

The CPI measures the changes in the price of goods and services, taking out food and energy.

It is a key component to look at purchasing trends and inflation.

Core CPI Unchanged In Last 3 Months

The CPI has remained unchanged, marking 1.6% increases over the last three months — down slightly from the 1.7% reported for August and September.

Expectations are for the index to maintain a level reading.

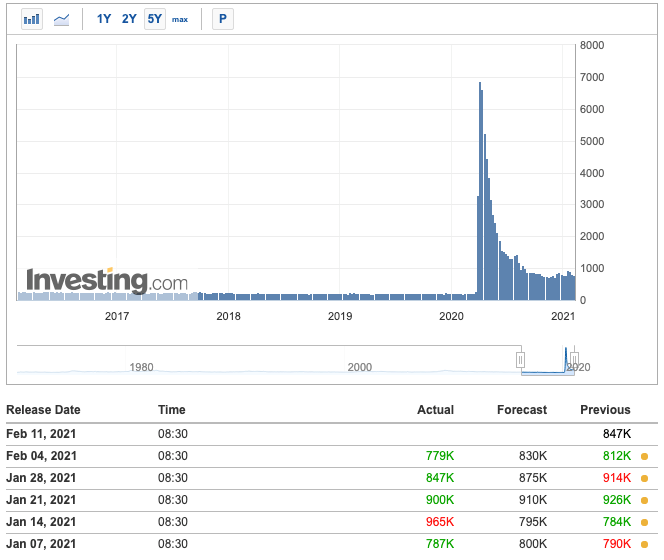

On Thursday, the Labor Department will release its initial jobless claims figures for the week.

The figures reflect the number of Americans who filed for unemployment insurance for the first time.

Last week, the department noted that 779,000 had filed for unemployment, better than the 830,000 forecasted.

Initial Jobless Claims Still Over 700,000

It was the lowest number reported since the beginning of January and indicates a slight economic uptick.

The forecast for this week is for around 847,000 new applications for unemployment.

If the figure comes in lower than that, it would further signify the U.S. economy could slowly start picking up.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

Simon Property Group Inc. (NYSE: SPG)

Hasbro Inc. (Nasdaq: HAS)

Tuesday

Cisco Systems Inc. (Nasdaq: CSCO)

Twitter Inc. (NYSE: TWTR)

Canopy Growth Corp. (NYSE: CGC)

Lyft Inc. (Nasdaq: LYFT)

Wednesday

Coca-Cola Co. (NYSE: KO)

Uber Technologies Inc. (NYSE: UBER)

General Motors Co. (NYSE: GM)

Zillow Group Inc. (Nasdaq: Z)

Thursday

Walt Disney Co. (NYSE: DIS)

PepsiCo Inc. (Nasdaq: PEP)

Duke Energy Corp. (NYSE: DUK)

AstraZeneca PLC (Nasdaq: AZN)

Friday

Dominion Energy Inc. (NYSE: D)

Newell Brands Inc. (Nasdaq: NWL)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.