Editor’s Note: Adam O’Dell’s Perfect Trading Window live event is just hours away. If you haven’t signed up — click here right now to sign up while there’s still time. Today, at 4 p.m. Eastern time, Adam will show you how it’s possible to target stocks that are about to shoot up like a rocket, with top gains as high as 430% in only 63 days!

The country’s crumbling infrastructure has been a political issue all year, but some new developments are promising. Instead of one massive bill, we now have two — one built around social spending and the other focused exclusively on infrastructure.

This presents some interesting investment opportunities. In today’s Investing With Charles, research analyst Matt Clark and I discuss infrastructure plays that may lead to major gains with the passing of the new bill.

Here are some highlights from my conversation with Matt:

Infrastructure Bill Moves Through Congress

Matt: Today, we’re talking about infrastructure. It’s not the sexiest of topics to get into, but it is one that is starting to materialize. The infrastructure deal is slowly slogging its way around the Potomac in Washington and could become reality at some point, maybe in the next 30 days.

Charles: I feel like we’ve been talking about this for a year now. Fingers crossed.

Matt: We have two bills here. We’ve got a $1.5 trillion social spending bill, and we have a $1.75 trillion infrastructure bill. They were once together in a single bill. Now, they’re separate, but they are moving through Congress together. The House hopes to vote on both of these by the end of this week. Then it will move over to the Senate, where it faces a whole myriad of issues that we won’t get into today.

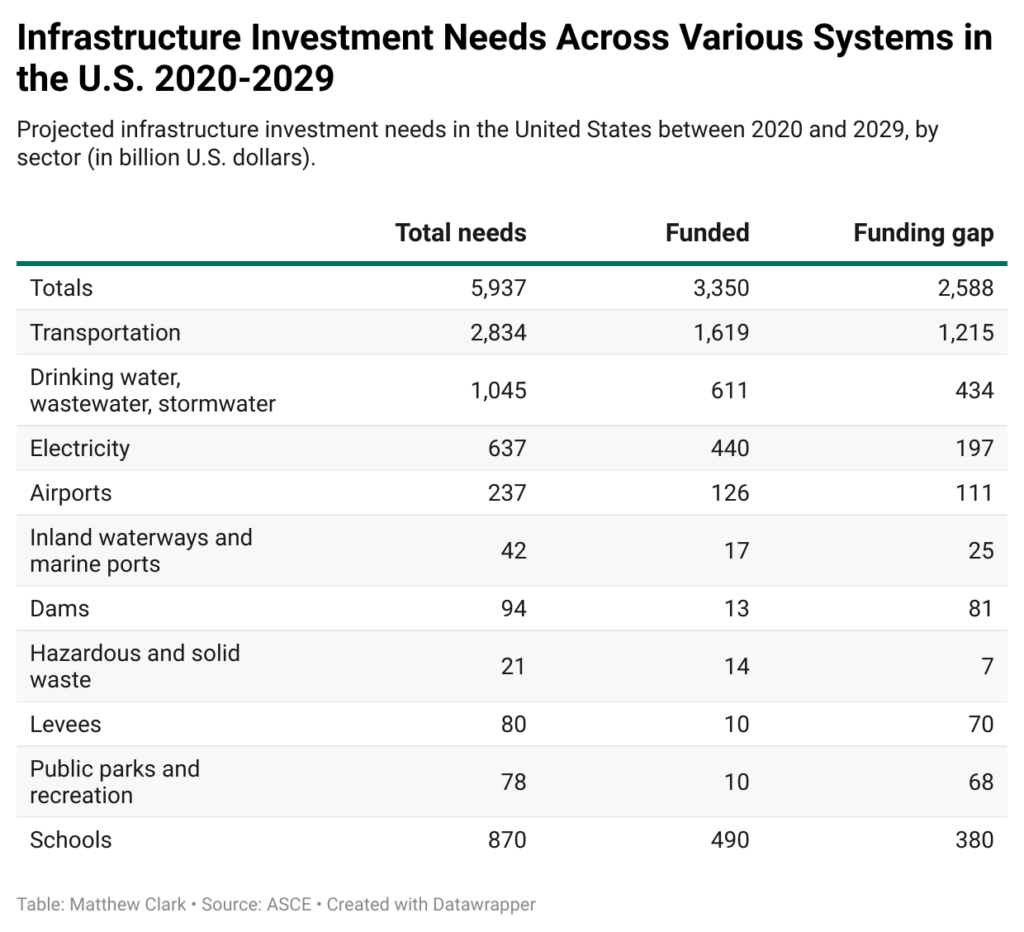

We see some shortfalls with a lot of infrastructure spending. There is a $2.5 trillion funding gap between what we have funded already and what the needs are by 2029.

But how can investors play the potential passage of this massive spending bill to improve roads, waterways, bridges, dams, Internet infrastructure, all sorts of things? What are you looking at here as a way to play this and provide investors with profit?

An Infrastructure Stock With an Edge

Charles: Pure plays here are few and far between, so you have to define companies that have a mixture of products that don’t “get it” in your way, so to speak.

I’ll give an example. Caterpillar Inc. (NYSE: CAT) is an obvious infrastructure stock. It’s been around forever. You can’t really build a large highway project without Caterpillar equipment. The only problem is that it’s also dependent on the mining sector. So buying Caterpillar stock, you’re implicitly betting that the mining sector does well. Maybe that’s not your thesis. Maybe that’s not what you want to do.

So a stock that I like right now — I’ve been following it for months and it’s one that I’m very bullish on right now — is Oshkosh Corporation (NYSE: OSK).

Oshkosh is not a “pure play” of infrastructure. It does a lot: It makes cement mixers, cherry pickers and specialty trucks that very few other companies make. But its other businesses are not particularly cyclical: fire trucks, mail trucks, and military trucks and equipment. All that tends to be fairly stable. Demand just doesn’t change that much from year to year.

Why Oshkosh? Why is it special? Why buy it instead of the heavy-duty equipment maker down the street?

Well, part of it is that Oshkosh has gone big on “electrifying” its products. That’s a big priority of the current administration. They’re really big on green energy, battery-powered vehicles, et cetera.

Now, not all of Oshkosh’s vehicles are battery-powered, not even close, but that is a high-profile thing it’s doing. It is making a lot of noise about having electric versions of its heavy-duty trucks. So that puts Oshkosh in the government’s favor right now.

As an example, it recently won the contract to replace the USPS mail truck fleet. While not all of the mail trucks are electric — that’s not how it panned out — a decent percentage of them are. So that’s one of those very nice, high-profile headlines that really gets this stock on the radar of people it may not have normally been on the radar of.

Infrastructure Stock: Oshkosh’s Future Is Bright

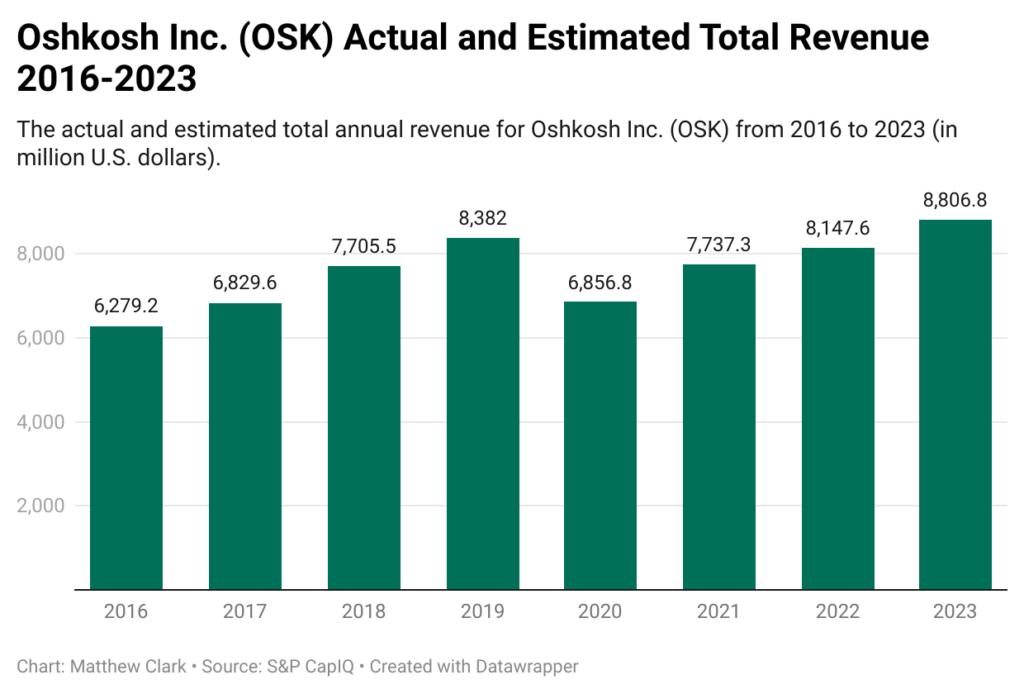

Matt: Now, looking at actual and estimated total annual revenues for Oshkosh, 2020 was a down year. It went from $8.3 billion in revenue in 2019 to $6.8 billion in total revenue in 2020. This can be explained away. You had the COVID-19 pandemic, work wasn’t being done, businesses were very skittish on buying new products and spending capital.

Looking at projections into 2023, obviously, we’re going to see nice tick-ups of total revenue for Oshkosh in 2021, 2022 and 2023. By 2023, we can expect $8.8 billion in total revenue. That would beat the pre-COVID high that this company had. So you can see a nice earning trajectory in terms of how much money this company is projected to bring in.

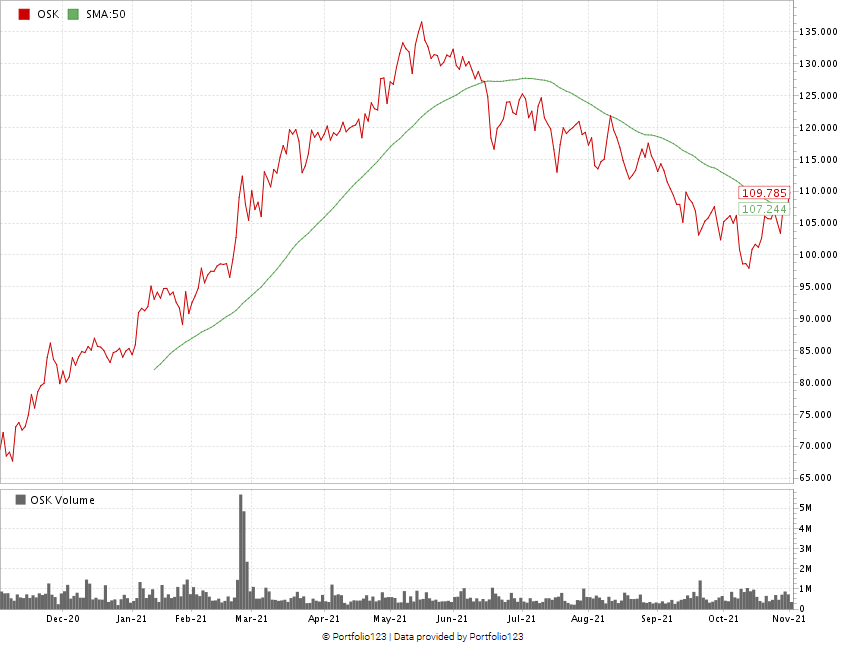

Stock wise, we had a nice run-up along with other infrastructure stocks into May. Those have pared back. Talks stalled, so the excitement wore off on these infrastructure plays.

Oshkosh’s Stock Price Recovered in Late 2021

Oshkosh was right along there with them. It dropped to a low of about $90 … I want to say $98, $97 per share. But it appears to have bounced back a bit and is now trading above the $100 mark. OSK is closer to $110 at this point. So it is moving forward. It is about two or three dollars above its 50-day simple moving average, which is a nice bullish signal that the stock still has some more room to run.

Watch the rest of my conversation with Matt about infrastructure here. We get into the nitty-gritty of Oshkosh’s Green Zone Rating and why you can expect big things from this infrastructure stock soon.

Where to Find Us

Coming up this week, Matt will have more on The Bull & The Bear podcast, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where chief investment strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss Matt’s weekly insights.

Remember, you can email my team and me at Feedback@MoneyandMarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.