In the latest Marijuana Market Update, I address a viewer question about a cannabis exchange-traded fund I discussed in a previous video: the AdvisorShares Pure U.S. Cannabis ETF (NYSE: MSOS).

Question: MSOS ETF

Kim commented on YouTube:

Can you please advise on MSOS? Is it going down more? Can I keep it for the long term, or should I sell it now?

Kim, thanks for your question.

Now, I can’t give specific advice on an individual portfolio.

However, I can analyze where the stock has been, where it is now and where I think it’s going.

MSOS is an ETF that invests in companies whose revenue comes from the marijuana and hemp business sectors.

AdvisorShares Trust created MSOS on September 1, 2020.

Its top five holdings, as of September 31, 2021, are:

- Ayr Wellness Inc. (OTC: AYRWF) — 36.7% of equity.

- Innovative Industrial Properties Inc. (NYSE: IIPR) — 34.9% of equity.

- GrowGeneration Corp. (Nasdaq: GRWG) — 11.4% of equity.

- Power REIT (NYSE: PW) — 5.6% of equity.

- Hydrofarm Holdings Group Inc. (Nasdaq: HYFM) — 5.3% of equity.

Now, this ETF only has positions in nine companies.

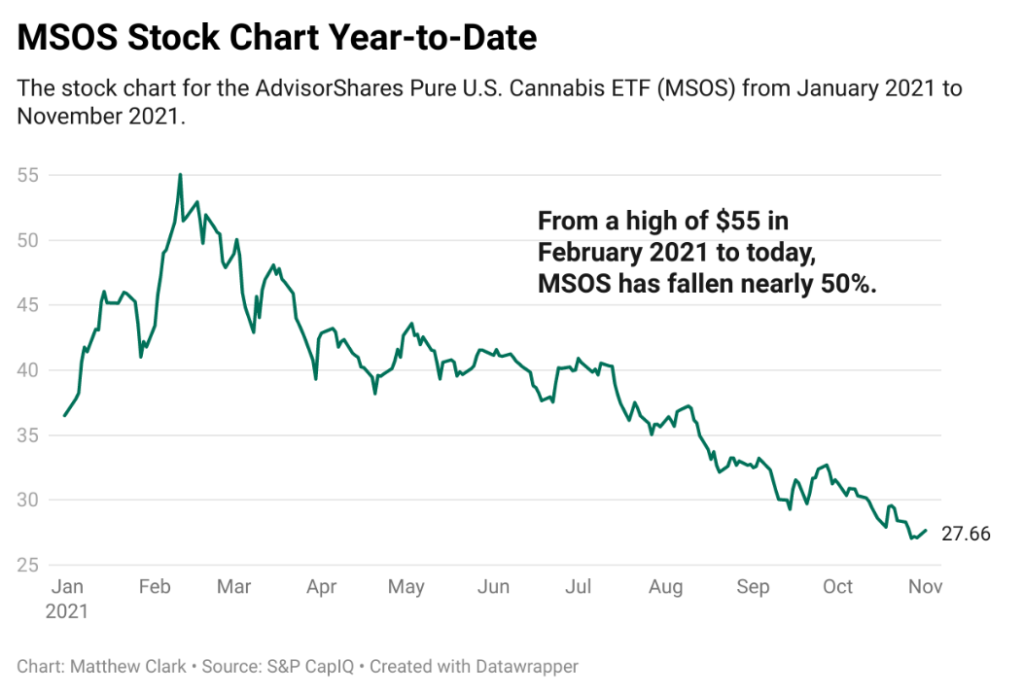

You can see in the chart above that the stock rose to a high of around $55 per share in February.

All cannabis stocks rose at that time, as talk of federal legalization took shape in Congress.

However, like most other cannabis stocks, MSOS then started a downward spiral. Legalization talks fizzled to where they are today — nowhere.

Since its February high, MSOS has dropped almost 50% of its value. It now trades around $27.66 per share.

But this isn’t unique to MSOS. Most other cannabis stocks — with the exception of REITs, which I discussed last week and two of which this ETF holds — have fallen hard since the February run-up.

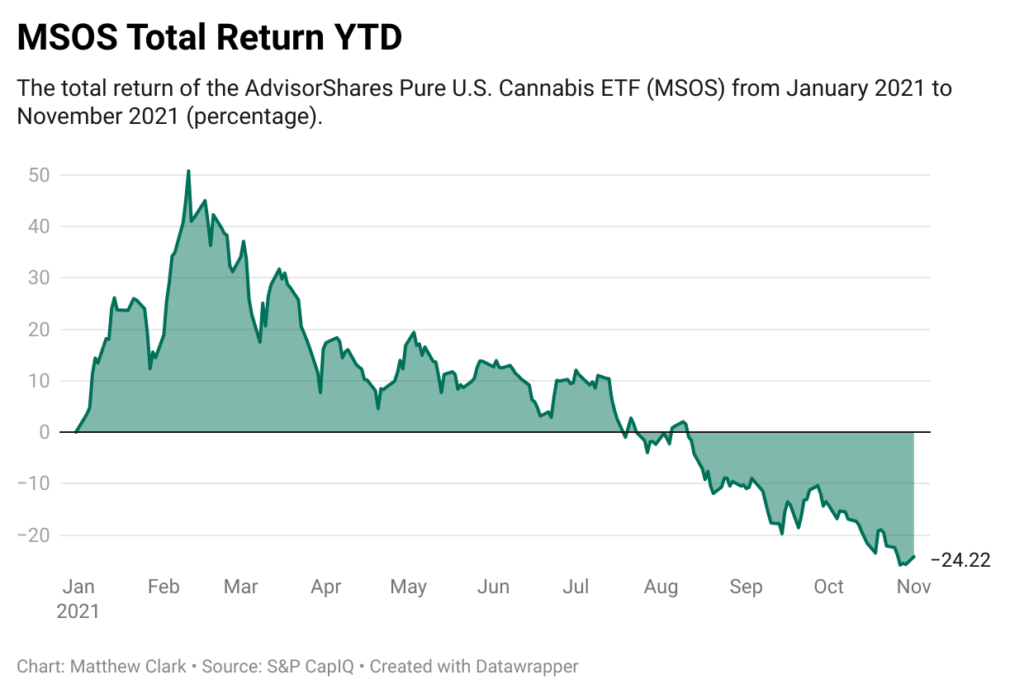

The total returns of MSOS in the chart above tell a similar story.

It notched returns of more than 50% during its February run but fell fast.

Year to date, the ETF has a return of minus-24.22%.

So, holding the stock has been painful for investors, especially if they bought right before or right after the run at the first of the year.

MSOS Short Interest

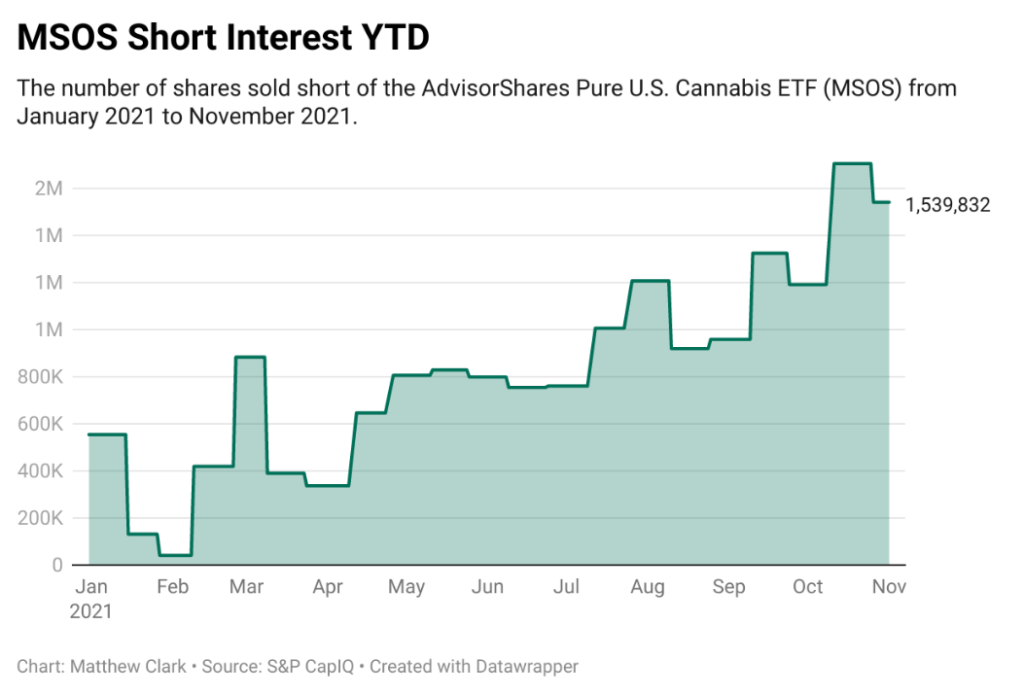

We can see in the chart below that MSOS is drawing a good amount of short interest from institutional investors.

In February, there was virtually no short interest in MSOS.

Remember, short interest in a stock is the number of shares sold short — the idea here is that traders borrow shares, hope for a downturn and sell the shares back at the lower price.

The difference in the price paid and the price sold is profit to the trader.

The bet is that the stock will go down, creating a larger profit for the short seller.

Shorts can also indicate where a stock is heading.

An increase in short positions is often a bearish indicator for a stock.

In this instance, we see that the short position of the cannabis ETF went from nearly zero in February to more than 1.5 million shares today. The high was just last month, at 1.7 million shares short.

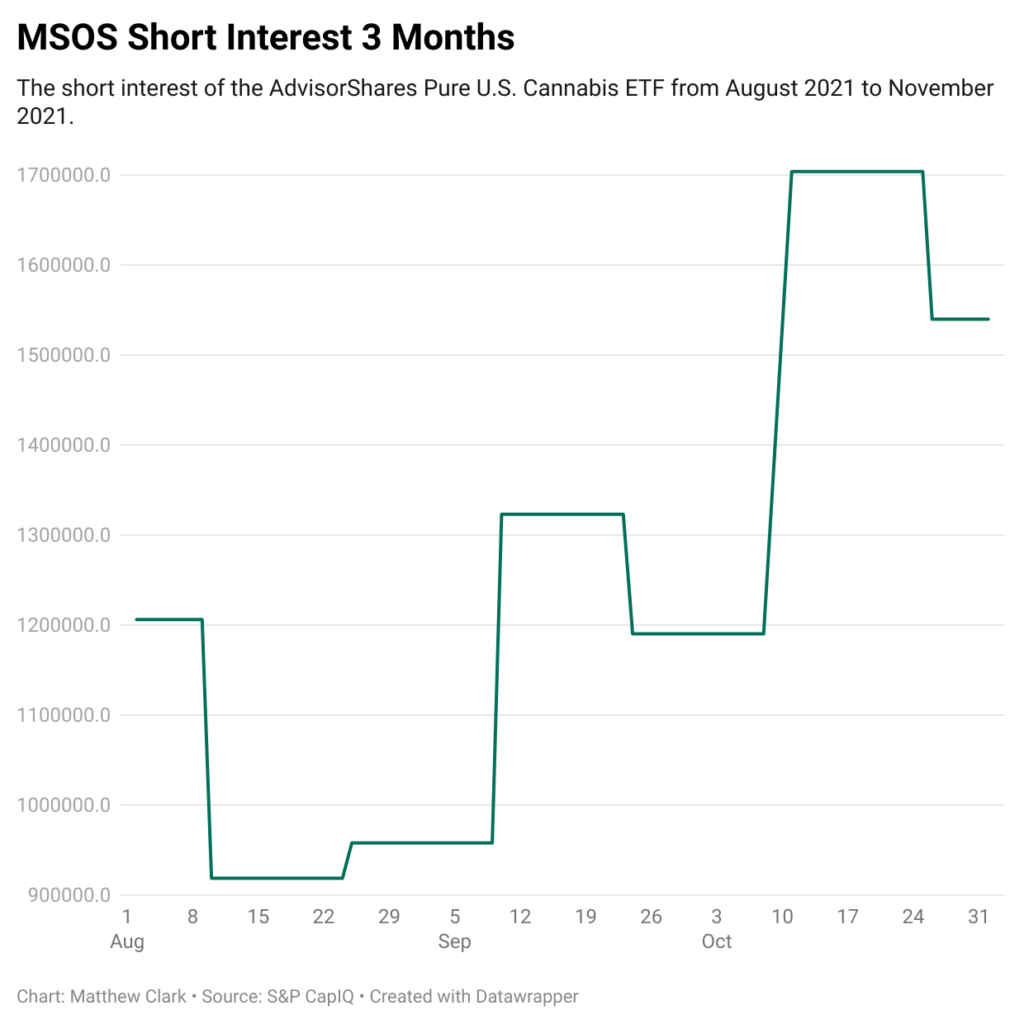

Zooming into the last three months, you can see the increase in short positions of MSOS took off around October 10.

There isn’t much to trigger the move from 1.2 million shares short to 1.7 million in that short time aside from the continued sell-off in the cannabis market.

MSOS: Buy, Sell or Hold?

So, to Kim’s question of whether MSOS will keep falling: I think the answer is yes.

The bigger question is: by how much?

I don’t see this cannabis ETF falling much more than it already has unless some news event drastically changes the landscape.

You have a few options:

- Sell your position.

- Sell half your position, and keep the remaining half in hopes of a recovery.

- Hold and don’t do anything.

- Buy more on the dip, and hope for profits when the stock recovers.

That’s a broad look at your options.

Takeaway: As I said, I think a bottom is near, but there are no guarantees. Selling all or part of your holdings could help stem those losses.

Buying more asserts a bullish position on the stock, as does holding.

Only you know your end goal. Once you assess that, you should have a clearer road map.

I hope that answers your question, Kim. Our team is working on sending you Money & Markets gear.

If you have a question about a cannabis stock or the market, just email me at Feedback@MoneyandMarkets.com. Send us a question, we use it … and you’ll get free Money & Markets gear, like T-shirts, hats and sweatshirts.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

And check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, as well as our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.