A ton of ink has been spilled on the 2020 breakout success of Cathie Wood, founder, CEO and CIO of ARK Investment Management LLC.

Her flagship ARK Innovation ETF (NYSE: ARKK) has attracted inflows of $17.5 billion in the past five years … though that timeframe is misleading, as 90% of that investor capital was poured in over the past twelve months.

Her second-largest fund by assets under management (AUM) is one you should recognize: the ARK Genomic Revolution ETF (NYSE: ARKG).

I wrote about ARKG recently. And before that, I wrote about it in September 2020. And before that, I wrote about ARKG in May, February and January 2020.

I even gave a presentation — in October 2019 — where I made a buy recommendation on ARKG and pitched the idea that “DNA is the future of health care.”

At that time, Wood’s genomics revolution fund had attracted less than $500 million. Today, AUM sits at $8.5 billion. Like ARKK, 90% of the inflows have come in over the last 12 months.

Now, the question on everyone’s mind is …

Is This the Beginning or the End?

Cathie’s ARK funds are getting a ton of press in 2021 for two reasons.

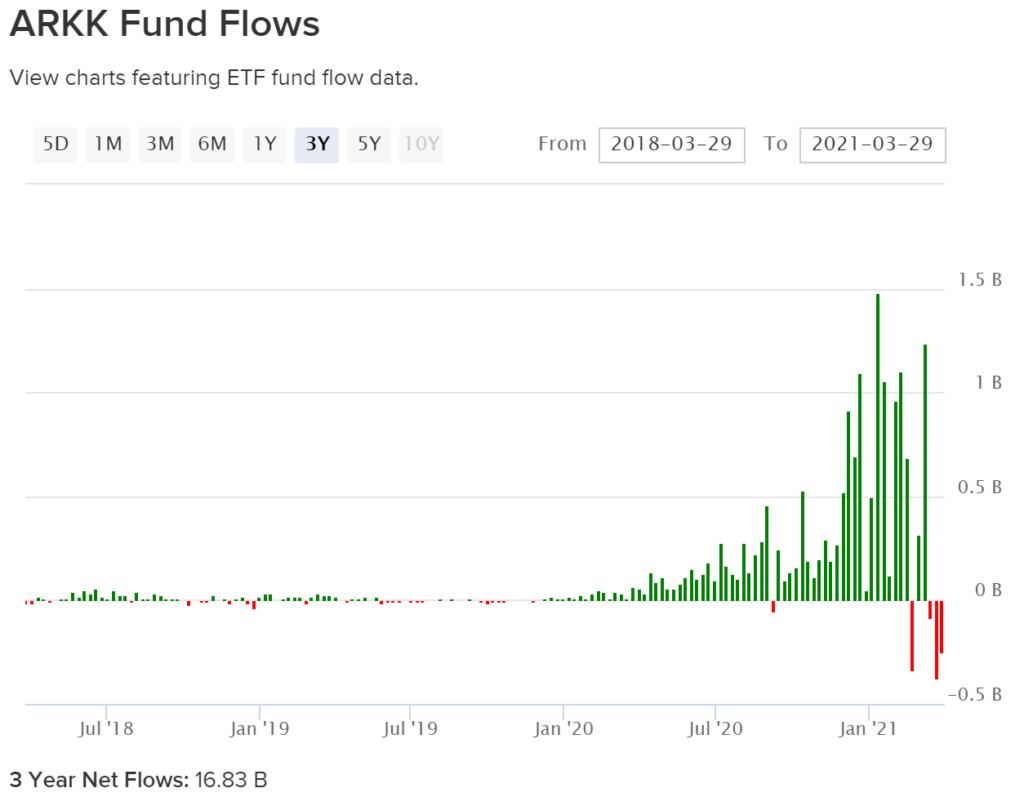

First, the tremendous ramp-up in inflows (new investors pouring money into the ETF) have recently dried up … and turned into outflows (investors pulling money out of the fund).

For instance, ARKK has seen weekly outflows in four of the last six weeks. As you can see in the chart below, the outflows pale in comparison to the size of inflows the ETF attracted around the turn of the year — reaching over $1 billion per week on five occasions.

Nonetheless, it’s only natural the media would pick up on this “inflows turn to outflows” story.

Secondly, the share price of both ARKK and ARKG have suffered steep pullbacks in recent weeks.

At its low in early March, ARKK had fallen 34% from its all-time intraday high, made in mid-February.

Likewise, shares of ARKG pulled back 32% high to low.

So, between the funds’ outflows and price pullbacks, it’s no surprise to me that many are calling for the “end” of the rise of Cathie Wood and her disruptive technology-centric funds.

But to me, this is a dip worth buying, particularly in ARKG.

If I were you …

I’d Back Up the Truck on ARKG

I don’t have a problem with ARKK.

But the genomics revolution that ARKG invests in will have a far greater impact on humanity and financial markets. And I think investments in DNA-focused companies will turn out to be massive wealth-generators … on the orders of magnitude like we haven’t seen since the Cisco’s and Intel’s of the late-90s internet boom.

In fact, I’m so convinced of this I just released a special presentation on this opportunity.

Once you watch it, I bet you’ll have as much conviction in this once-in-a-lifetime opportunity as I do.

Plus, you have the chance to get all the details on my Top 4 DNA buy recommendations.

I hope you’ll act quickly. I had no way of knowing we’d be fortunate enough to have an opportunity to buy the dip when I began preparing this presentation for the public.

We just released the presentation Tuesday … so the timing couldn’t be more perfect!

Folks who followed my October 2019 advice to buy shares of ARKG have since tripled their money!

And even though this “still under the radar” revolution is attracting more and more media attention, I’m confident my Top 4 DNA buy recommendations have the potential to hand today’s investors many multiples of that return.

Again, here’s a link to my special presentation on this revolutionary technology I’m calling “Imperium.”

I’ll see you there!

To good profits,

Adam O’Dell

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.