Despite the Federal Reserve stepping in Sunday with a new round of quantitative easing and a cut of its benchmark interest rate to zero, markets have not responded well today, leaving investors to ponder when it’s safe to buy the dip.

Soon after the Fed announcement, Dow Jones Industrial Average futures fell 1,000 points and the S&P 500 hit a “limit down” when it fell 5%. Soon after the opening bell Monday, the S&P 500’s “circuit breaker” was tripped after a 7% decline, halting trading for 15 minutes.

Banyan Hill Publishing CMT Michael Carr

All of that came after a massive rally Friday as investors bought the dip and markets posted their biggest one-day gains as a percentage since October 2008.

This morning’s retreat signaled a clear indication that Friday’s surge was indeed a dead cat bounce, and it may be a while before the markets present a good time for investors to jump back in and buy stocks.

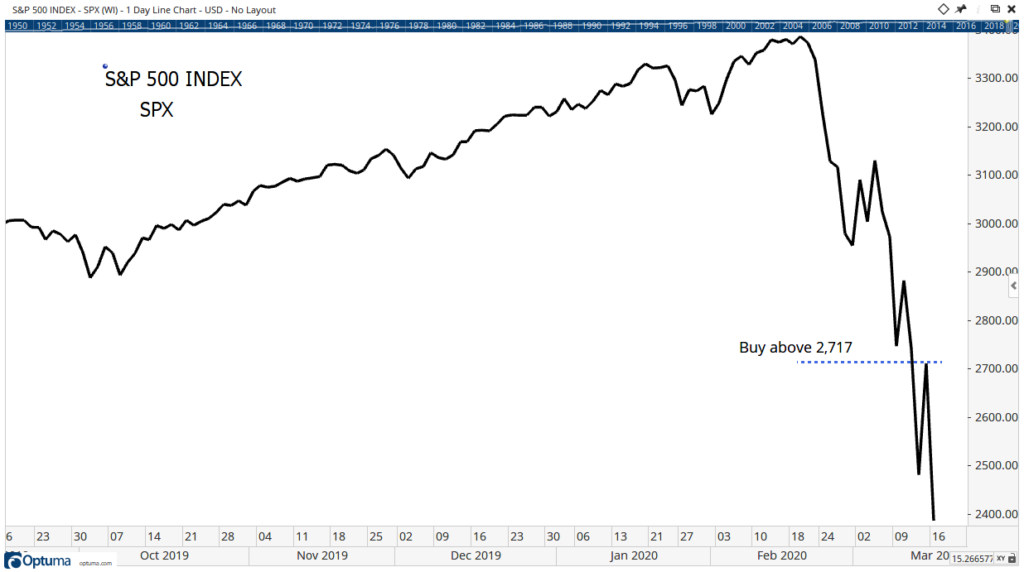

In fact, Banyan Hill Publishing Chartered Market Technician and Precision Profits Editor Michael Carr said the S&P 500 would have to rally more than 15% from its current bear market to show selling pressure has eased.

The time it will take for that to happen is unknown, but it may not be anytime soon.

“Buying the dip now probably won’t work,” Carr said. “Losses are pretty steep and many investors haven’t reacted to the losses yet.”

Problems With Buying the Dip

Carr said buying the dip in current market conditions will not likely produce the gains many individual investors think they will get.

The most recent dip buying is likely to cause additional selling pressure in the markets when prices tick up even just a little.

“Many individual investors like to buy the dip so they were buying a week ago,” Carr said. “Now they have big losses and are likely to be deep in prayer, asking for a chance to get back to breakeven.”

Carr added that there is no need for panic about reaching the bottom with regards to the S&P 500.

“The stock market is reflecting changes in the economy and the decline in the economy has been rapid,” Carr said. “The recovery will be slow since it will take time to undo the damage being done.”

Jeremy Siegel: ‘Buying Opportunities of a Lifetime’

While Carr has a bearish approach to investing amid current conditions, Wharton School finance professor Jeremy Siegel thinks this could be the buying opportunity of a lifetime in the ongoing chaos, but it will take time for things to materialize.

“Fear might drive it down, but then you’re going to have one of the buying opportunities of a lifetime, or certainly of the decade to say the least,” he said. “As much chaos as there may be this year — and yes, there might be a recession … a number of experts say it’s 50-50 — earnings could be off 20%, 30%, but if they bounce back in 2021, we should see a great recovery. We should not see any more significant declines.”

Investors Should Be Patient

If anything, the recent volatility suggests investors should have one thing at top of mind: patience.

The recent speed of the market drop followed by its equally fast rise indicates that stocks can jump just as fast and big as they can fall.

Massive losses are evident by the Fed’s latest move to inject money into the economy and buy $700 billion worth of Treasurys and mortgage-backed securities.

That means it may be some time before investors should buy the dip. He added that unemployment will likely climb, calling it “the price of a panic.”

“The Fed’s saying this is a crisis, and they are trying to stop the bleeding,” Carr said. “Now is the time for the bravest investors to jump in, but the first guy over the top of the trench often gets shot.

“Since it will take months for the economy to recover from this catastrophe, it will take time for stocks to recover. It’s okay to look at the market once a week. You’ll still get in close to the bottom and you might feel better day-to-day if you don’t follow the hysteria on Wall Street.”