I cook a lot for my family at home.

One of the staples I use most is eggs.

From breakfast to dessert, I crack a dozen per week.

In 2021, Americans consumed an average of 284 eggs per person.

That will go up to 288 this year, according to the U.S. Department of Agriculture.

The chart above shows annual worldwide revenue from eggs.

From 2020 to 2027, the revenue for the egg industry will increase 58.1%.

Our appetite for eggs is growing, and I found a way for you to profit from this trend.

Today’s Power Stock is Cal-Maine Foods Inc. (Nasdaq: CALM), a $2.5 billion Mississippi-based egg producer.

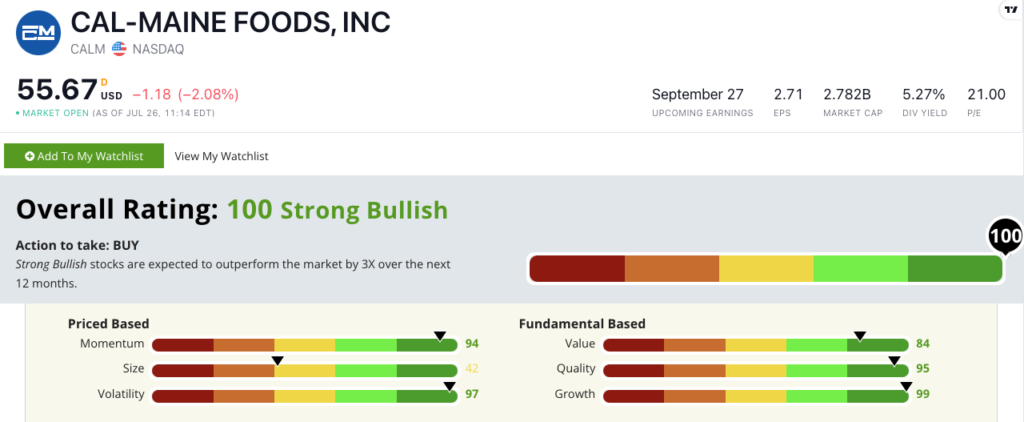

CALM Stock Power Ratings in August 2022.

Cal-Maine produces and sells all kinds of eggs to grocery stores, wholesale clubs (Costco, for instance) and food service companies.

CALM stock scores a perfect 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

CALM Stock: “Strong Bullish” Fundamentals + Momentum

Cal-Maine just closed out a monster year.

Highlights include:

- Revenue of $1.7 billion — a 30% increase over last year.

- In the last quarter of its fiscal year, CALM set a record with $593 million in sales.

CALM is an outstanding growth stock — in the top 1% of all the stocks we rate on the metric.

Its one-year annual sales growth rate is a solid 31.7%. Its earnings-per-share growth rate is over 1,000% — that’s excellent!

On quality, CALM’s gross margin is almost double the average of the agriculture industry.

The company’s value is outstanding as well: Its price-to-sales ratio is just 1.6. That’s less than half the industry’s inflated average of 3.7.

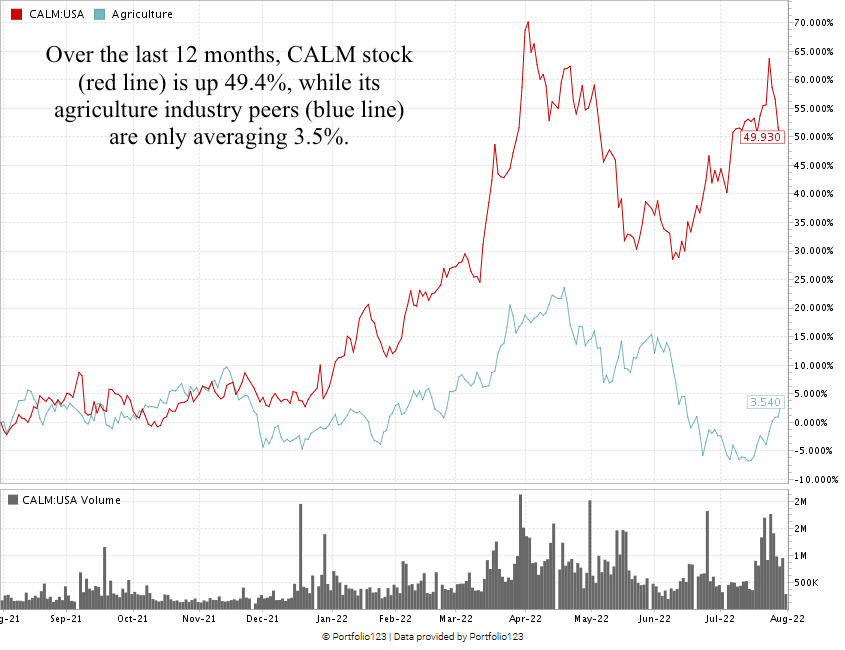

Over the last 12 months, CALM is up 49.4%. It’s crushing its agriculture peers.

CALM is on a fresh tear, as you can see in the stock chart above. It skyrocketed 27.3% from mid-June to the end of July.

Cal-Maine Foods Inc. stock scores a 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Demand for eggs will reach an all-time high in the coming years.

As a leader in the production of eggs in the U.S., CALM is a strong contender for your portfolio.

Bonus: Cal-Maine’s 5.3% forward dividend yield pays shareholders $3 per share, per year.

Stay Tuned: Excellent Real Estate Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a super high-growth public homebuilder and land developer.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.