The Federal Reserve just raised interest rates for the second time this year to help curb 9.1% inflation.

But even with higher interest rates, homes are selling fast.

Redfin chief economist Daryl Fairweather put the housing market in simple terms:

Homes are selling just as quickly as ever. Fifty percent of homes are still going under contract within two weeks.

The U.S. housing market isn’t slowing down:

The chart above shows that revenue from the real estate industry will rise 24.1% by 2025.

Today’s Power Stock is residential land developer and homebuilder Green Brick Partners Inc. (NYSE: GRBK).

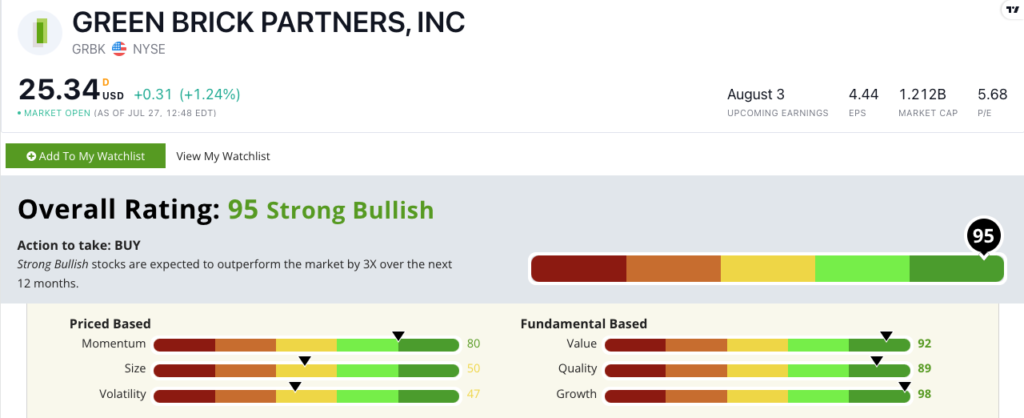

GRBK Stock Power Ratings in August 2022.

Green Brick builds homes in Texas, Florida and Georgia. It develops land for building across the U.S.

GRBK stock scores a “Strong Bullish” 95 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

GRBK Stock: Excellent Growth and Value

Two items stood out after my deep dive into Green Brick stock:

- For the first quarter of 2022, GRBK recorded $393.6 million in total revenue — a 68% increase from the same quarter a year ago.

- In July, the S&P added the company to its SmallCap 600 Index — a benchmark that tracks small-cap stocks.

The Stock Power Ratings above show that GRBK’s fundamentals are terrific. It rates highest on growth and value.

GRBK’s trailing 12-month earnings-per-share growth rate is 81.3%. Its sales growth rate is 56.6% — earning it a 98 on growth!

The stock's price-to (earnings, sales, cash flow and book value) ratios are right in line with the homebuilders and manufactured buildings industry average.

Its price-to-earnings ratio is 5.7, while the industry average is 5.9.

GBRK is showing the “maximum momentum” we look for in stocks.

It hit a 52-week low in June, as you can see in the stock chart above.

Green Brick stock has since rocketed up 44.5% and is trading about $3 over its 50-day moving average — a bullish indicator.

Green Brick Partners’ stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Rising interest rates aren’t deterring millions of Americans from buying homes.

With a supply-demand imbalance, buyers are turning to new construction in developed subdivisions to live, work and raise a family.

Green Brick Partners develops and builds, which makes it a perfect real estate play for your portfolio.

Stay Tuned: Top Workforce Housing Specialist

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a company that serves oil, mining and engineering employees.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.