Looking around the restaurant one day last week while out to lunch with my wife, I noticed that everyone was on their phone almost the entire meal.

It got me thinking about how much data we use on our phones.

What I found out led me to today’s Power Stock:

The chart above shows the amount of mobile data each device uses per month.

In 2021, in North America, the average amount of data used by one mobile phone per month was seven gigabytes (the equivalent of streaming 30 minutes of video per day).

By 2027, the average will grow to 52 gigabytes (52 hours of standard-definition streaming on Netflix) — a 642.9% increase!

And that’s just in North America. Those increases are similar in every region of the world.

To access that much data, we need a reliable mobile network…

One like today’s Power Stock, which has mobile network operations in 50 countries, including the U.S.: Deutsche Telekom AG (OTC: DTEGY).

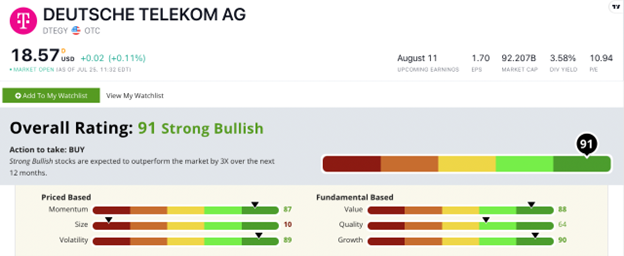

DTEGY Stock Power Ratings in August 2022.

DTEGY started as a classic phone company in Germany and blossomed into a global powerhouse providing broadband and mobile communications.

Deutsche Telekom stock scores a “Strong Bullish” 91 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

DTEGY Stock: Top Growth + Value

DTEGY had an outstanding 2021 and is lining up for another solid year:

- Annual sales totaled $128.6 billion — a 12% jump from 2020’s sales figure.

- Sales in the first quarter of 2022 were $31.4 billion, which is right in line with last year.

- It grew its earnings per share by 274.8% from the same quarter a year ago.

I covered growth, but Deutsche Telekom stock is also a terrific value.

Its price-to-sales ratio is a solid 0.7 — well under the telecommunications industry’s bloated average of 2.9.

Its price-to-cash flow ratio is impressive too: more than three times lower than its industry peers.

On quality, Deutsche Telekom’s operating margin of 12.4% crushes the industry average of negative 7.6%.

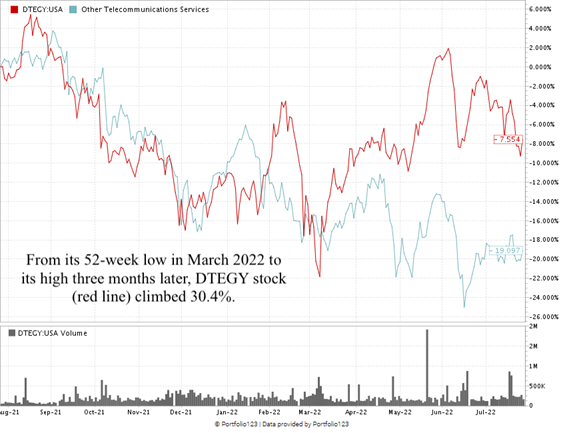

DTEGY dropped to a 52-week low in March 2022. Three months later, it jumped 30.4% to hit its 52-week high.

Over the last 12 months, Deutsche Telekom is down 7.5%. However, it’s still beating its industry peers, which are down 19.1% over the same time.

Deutsche Telekom stock scores a 91 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

This company has spread from Germany to more than 50 countries and established itself as a global telecommunications leader.

That’s just one reason DTEGY is a smart addition to your portfolio.

Stay Tuned: American Egg Producer

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a company that makes about a quarter of the eggs Americans eat.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.