Since stock prices bottomed in March, one index more than doubled in value — the NYSE FANG+ Index.

Now is the time to lighten up on aggressive stocks and move into conservative names.

The index offers exposure to the most popular stocks in the world. It includes the five core FANG stocks, Facebook (Nasdaq: FB), Apple (Nasdaq: AAPL), Amazon (Nasdaq: AMZN), Netflix (Nasdaq: NFLX) and Alphabet’s Google (Nasdaq: GOOGL), plus an additional five tech stocks, Alibaba (NYSE: BABA), Baidu (Nasdaq: BIDU), NVIDIA (Nasdaq: NVDA), Tesla (Nasdaq: TSLA) and Twitter (NYSE: TWTR).

These stocks are volatile and the index reflects that. FANG+ lost 37% in four weeks while the broad market crashed. It rallied 102% over the next four months.

Fang+ Stocks vs. the Dow Jones Industrial Average

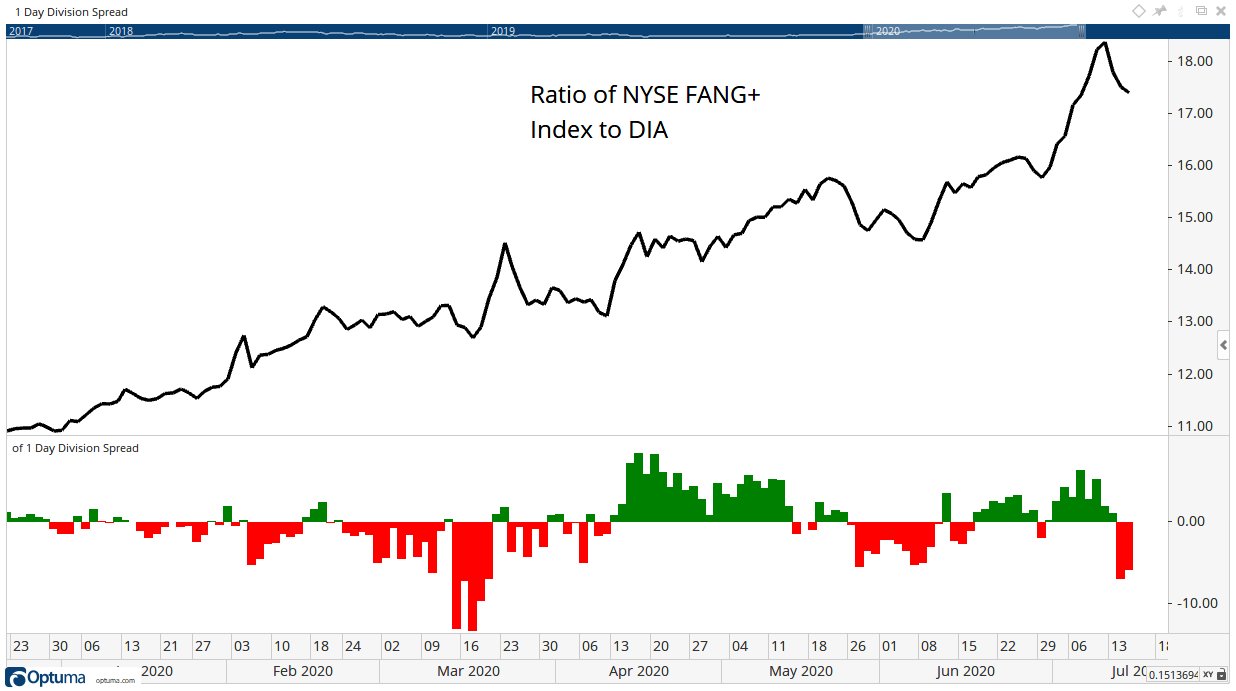

Comparing FANG+ to the Dow Jones Industrial Average shows how aggressive investors are. The chart below shows that calculation. It also includes a momentum indicator of the ratio at the bottom of the chart.

Source: Optuma

When the ratio is rising, it’s best to be aggressive. When the line is falling, the Dow is outperforming the Fang+ stocks. This is especially true when momentum turns negative, as it did on July 14.

This indicator provides reliable signals.

Momentum was negative throughout February and March as major indexes dropped more than 30% in the wake of the novel coronavirus pandemic. Momentum was also negative in May as the market’s advance stalled.

This ratio and its momentum don’t necessarily say it’s time to sell your Fang+ stocks. This chart is simply telling us the Dow is likely to outperform them in the next few weeks.

FANG+ stocks were led higher by Tesla, which gained more than 410% in in four months. That gain came as analysts raised their Tesla earnings estimate for 2021 by 7.5%.

Rationally, it’s difficult to believe that a 7.5% boost in earnings merits a price increase of 412%. Traders became irrationally exuberant about Tesla. The same is true for other stocks in the Fang+ index.

Now, we’re likely to see some profit taking in those names. As traders sell, they will have cash to reinvest. That money should rotate into other stocks, like the undervalued industrials in the Dow.

Now is the time to lighten up on aggressive stocks and move into conservative names.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.