Gold has long been a popular inflation hedge. The relationship between gold and inflation isn’t precise on a day-to-day basis. But it works well over the long run.

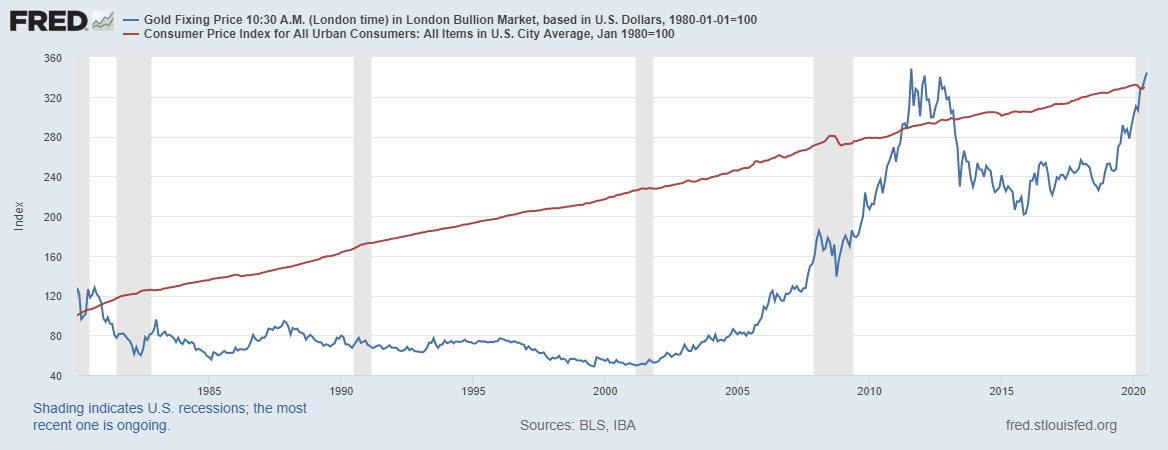

The chart below tracks the relationship between gold and inflation since 1980. The 20-plus years after 1980 were an especially challenging time for investors in gold.

Source: Federal Reserve

Gold was in a bubble in 1980. In the crash that followed the peak, prices fell more than 66%. Gold’s bear market lasted over 21 years.

Now, gold, the blue line in the chart above, is at the exact same level as the consumer price index, the red line.

Gold’s Return as a Top Inflation Hedge

Gold failed to keep up with inflation from 1980 to 2010. That might be the exception that proves the rule, and can be explained by investor psychology.

Private ownership of gold was declared illegal in 1933. Franklin Delano Roosevelt’s Executive Order 6102 prohibiting personal holdings of gold was reversed in 1974. Buyers rushed into the market and created a massive bubble.

After a bubble, investors tend to overreact. They avoid buying the investment that caused them large losses. This explains gold’s weak 30-year trading range as investors instead sought opportunities in stocks as they worked to replace the dollars they lost in gold.

But 40 years later, many investors who remember that bubble are no longer active in the market. This means gold is trading on its fundamentals and is once again an inflation hedge.

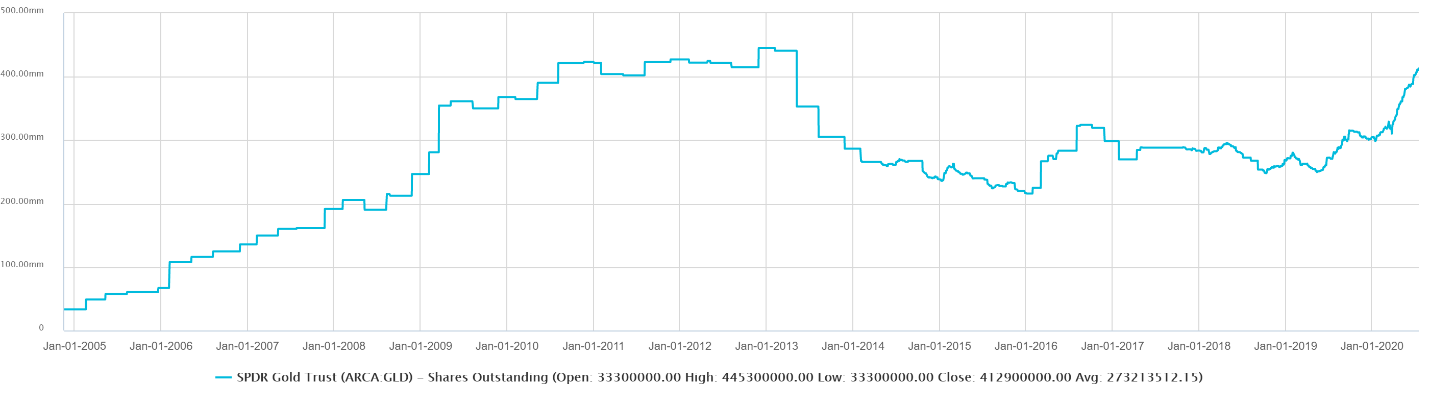

We can see the shift in investor psychology in the next chart. It shows the number of shares outstanding in SPDR Gold Trust (NYSE: GLD).

Source: Standard & Poor’s

GLD is an easy way for investors to own gold. It’s a popular way for long-term investors to add the metal to their portfolios.

The number of shares outstanding is near a record high. It’s likely to remain at record highs for years, providing support to the price of gold.

This is yet another reason to own gold, adding to the argument we’ve made in recent weeks.

This includes my note on the position of the smart money in the market and Chad Stone’s bullish argument.

Money & Markets Chief Investment Strategist Adam O’Dell argues gold will soar from its current price around $1,800 to $10,000 an ounce, and he has developed a strategy to capitalize on its rise.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.