In a globalized economy, everyone is in competition. Companies are forced to compete on cost. Countries compete on regulations and taxes.

This has been recognized since at least 1776 — when Adam Smith published The Wealth of Nations and introduced the idea of “absolute advantage.”

Smith explained that countries should produce goods only where they had an absolute advantage in production, compared to other nations, rather than importation. In his model, this would maximize global economic output.

Smith’s theory withstood the test of time. Clothes were made in England, as Smith wrote. Soon, cheap labor in the U.S. made English clothing a high-priced luxury item. Eventually, cheap labor in other countries forced U.S. clothing manufacturers out of business.

This cycle repeats in other industries. Eventually, each country finds its absolute advantage, and investment flows into that country.

Of course, labor is just one factor that creates an advantage. Low tax rates or looser regulations that allow for rapid construction are also possible advantages.

Companies seek the highest return on capital, so money flows to the countries with the best investment opportunities.

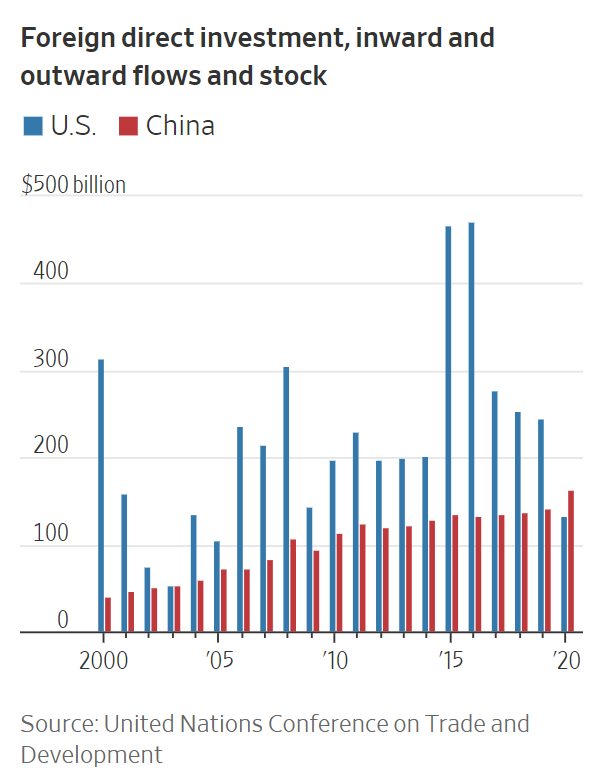

This makes foreign direct investment a measure of how companies view the competitive position of different countries. The chart below shows investors favored China over the U.S. in 2020 for the first time.

China Attracts More Foreign Investment Than the U.S.

Source: The Wall Street Journal.

China’s Stability Attracts Investors

Some will argue 2020 was a special situation. COVID-19 disrupted every aspect of life, so we can’t ignore that argument completely.

But the trend is unmistakable. China has received ever-growing investment over the past 20 years, and for the past five years, flows into the U.S. have declined.

This trend is unlikely to reverse. Once valued for political stability, the U.S. has become prone to policy reversals. Debate and compromise have given way to executive orders.

That instability diminishes the United States’ absolute advantage, and China is likely to continue benefitting from stable policies, even if the policies are authoritarian and contrary to Western values. For some companies, the return on investment is more important than the values of the country that offers high returns.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.