Chipotle Mexican Grill has become a bit of darling among the restaurant sector, and with it reporting first-quarter earnings today, many investors are probably wondering if it’s a good buy despite what the coronavirus has done to the dining industry.

Chipotle’s (NYSE: CMG) earnings today are expected to be a little ugly with Wall Street expecting the fast-casual diner’s earnings per share to fall 25%, according to Zacks. But revenue is expected to rise by 7% to $1.39 billion and same-store sales are expected to jump 1.8%, according to Consensus Metrix.

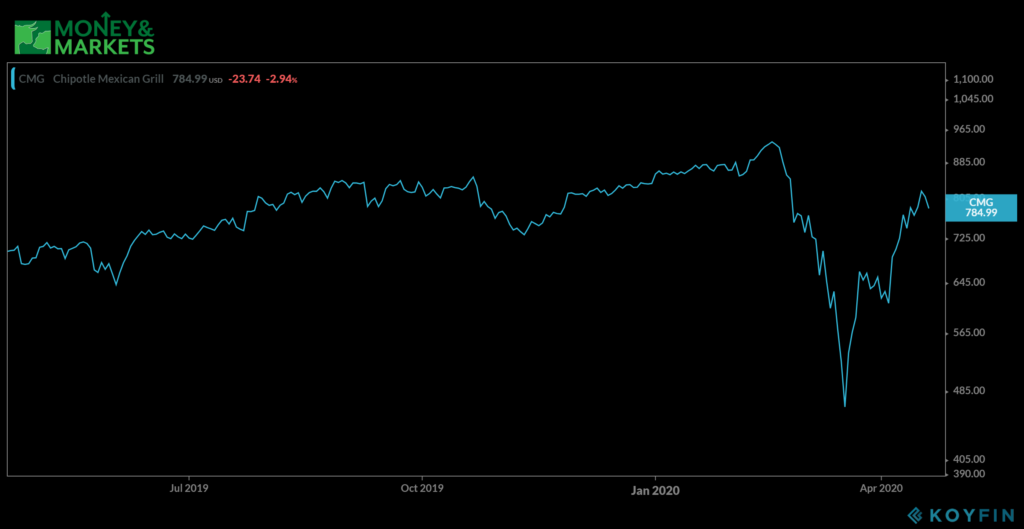

The stock was trading 2.4% lower at $789.09 around 1:45 p.m. EDT, after falling as much as 3.2% earlier in Tuesday’s session. Chipotle stock has made a strong recovery since the coronavirus crash started in mid-February.

Since hitting a low of $415 on March 18, Chipotle stock has surged back around 94% in just a month, fueled by the passing of the $2.2 trillion CARES Act and optimism for the development of its delivery service and digital platform.

Chipotle stock has only lost 3.4% of its value year to date, and it’s outperforming some of its biggest competition. During the same time frame, McDonald’s Corp. (NYSE: MCD) has fallen 8.1%, Starbucks Corp.(NASDAQ: SBUX) has dropped 14.3% and Shake Shack Inc. (NYSE: SHAK) lost 22.1%.

CNBC Mad Money host Jim Cramer is optimistic about Chipotle stock, calling it “impervious” and a buy under $800.

“I think Chipotle’s good if you can get it under $800,” Cramer said during his show Monday. “Remember: This is a stock that is kind of impervious. Why? Because it’s got a great balance sheet and that’s what we’re looking at is balance sheets.”

The consensus price target among top Wall Street analysts wass $822.38 Monday, and 51.5% of analysts recommend it as a “buy,” according to Market Realist. Another 45.5% ranked it a “hold,” while only 3% said it was a “sell.”

Chipotle stock should be one to keep an eye on going forward, and it could be a good buy. It may be best to wait until after the earnings call to see how management sees the future shaking out. Its quick recovery from the recent COVID-19 crash and outperformance against competition while holding a strong balance sheet are good signs as well.