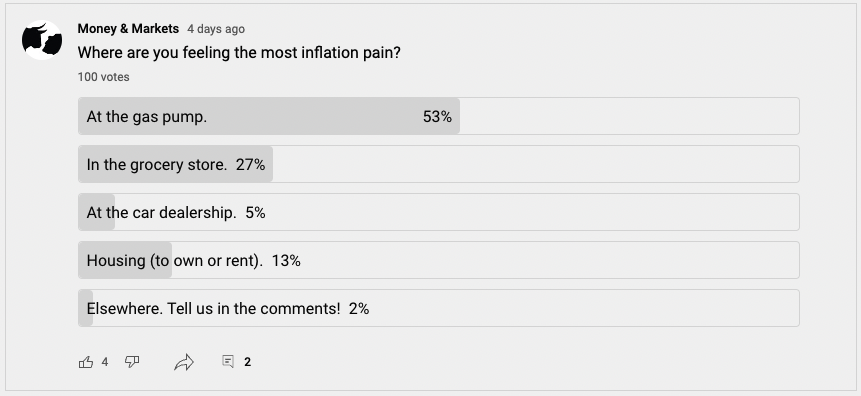

A few weeks ago, we asked our YouTube viewers where they were feeling the sting from inflation:

The fact is prices are up everywhere, and folks are looking for ways to stretch every dollar.

Enter: discount retail stores.

The chart above shows that annual sales for discount stores in the U.S. trended down from 2016 to 2020.

But in 2021, sales ramped up 12.3%.

This trend isn’t just a blip on the radar. I have high conviction discount retailers will keep growing, thanks in part to pervasive inflation.

Today’s Power Stock is the largest discount retailer in the U.S.: Dollar General Corp. (NYSE: DG).

DG operates 18,190 stores that sell discounted goods from cleaning products to packaged food.

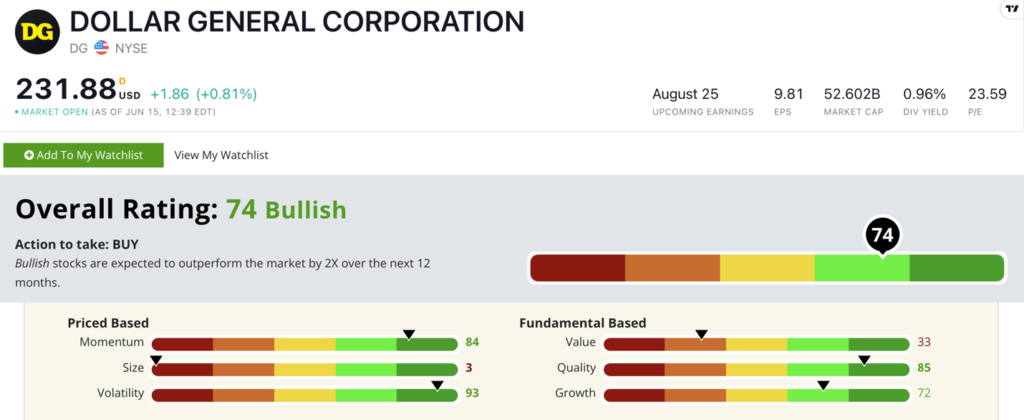

Dollar General stock scores a “Bullish” 74 on our Stock Power Ratings system, and we expect it to beat the broader market by at least 2X in the next 12 months.

DG Stock: High Quality + Momentum

DG had a solid first quarter.

High points include:

- Increasing net sales by 4.2% to $8.8 billion compared to the first quarter of 2021.

- Revised full-year guidance, increasing net sales growth to 10% to 10.5%.

Before I discuss DG’s excellent momentum, I want to dive into the stock’s quality.

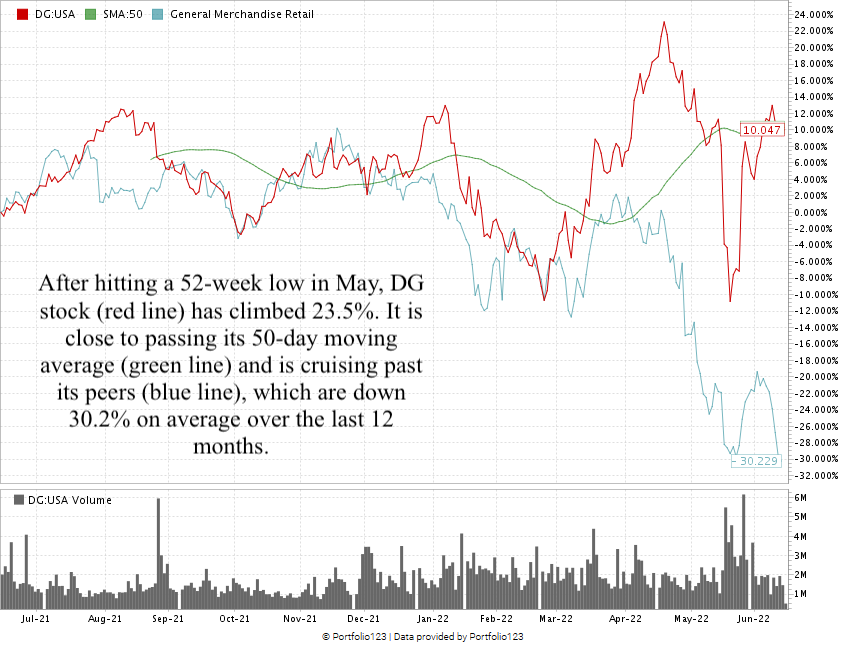

DG’s return on equity of 37.3% is double the average of its general merchandise retail peers.

That means DG shareholders are getting double the rate of return on their shares.

Its operating margin is 8.9%, while its peers average just 2.8%.

After reaching a 52-week high in April, DG stock fell — along with the rest of the market — 27.6%.

However, it’s rebounded to gain 23.5%. It’s now just 14% off the high it set in April.

Dollar General stock scores a 74 overall on our proprietary Stock Power Ratings system.

That means we’re “Bullish” and expect it to beat the broader market by at least two times in the next 12 months.

Discount retail sales were strong last year, even before high inflation.

As folks try to stretch every dollar, retailers like Dollar General are set for even higher growth. I think you can see why Dollar General stock is a strong candidate for your portfolio.

Bonus: DG’s 1% forward dividend yield means it pays shareholders $2.20 per share, per year just for owning the stock!

Stay Tuned: High-Growth Global Entertainment Co.

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on a “Strong Bullish” entertainment Power Stock to buy.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to Feedback@MoneyandMarkets.com — my team and I would love to hear from you!