Disagreement is the reason the stock market exists. In general terms, buyers and sellers disagree with each other.

If I want to buy shares of Tesla, for example, I must believe the stock is likely to go up. After all, I wouldn’t buy if I expected prices to fall since I could just wait and buy later.

But to buy, I need someone willing to sell those shares. Sellers are willing to sell because they believe there are better opportunities in other stocks.

Stocks trade only when buyers and sellers disagree about the prospects of the stock.

While the entire business of Wall Street depends on this disagreement, right now, there seems to be universal agreement on an important fact. Every analyst and investor seems to believe the stock market is overvalued.

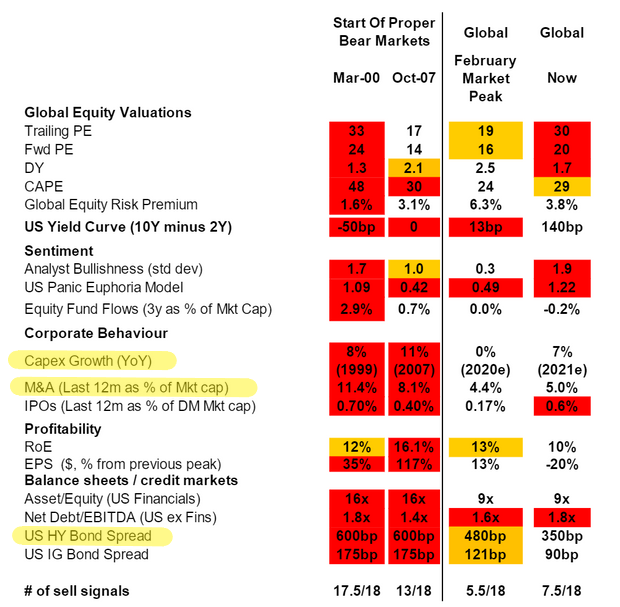

Analysts at Citi Research recently noted that stocks are overvalued but concluded that doesn’t matter. Their research included a collection of indicators that turned bearish before important market declines in the past.

Fundamental measures based on earnings or dividends are more overvalued now than they were before the bear markets in 2008 or 2020.

But other factors, more important ones, are bullish. The factors Citi identified as important are in the chart below.

Growth Is More Valuable Than Overvaluation

Source: MarketWatch.com.

Citi Says Overvaluation Doesn’t Matter

Capex growth is among the most important factors. This shows how much money companies are spending on capital expenditures. Excessive growth is a sign companies have too much cash. We are not at that level yet.

Mergers and acquisitions are also proceeding at a reasonable pace. This is another indicator that companies see opportunities but are not overly exuberant.

Bond spreads are also important. They show how worried the biggest investors are. These are investors controlling billions of dollars with sources of information inside companies. When they grow nervous, these measures increase. Low values indicate they don’t hear bad news.

While it does seem that everyone agrees overvaluation is present in the stock market, Citi’s research is one of the few pieces highlighting that this doesn’t matter.

There are reasons for concern, but as of today, they see no reason to expect a market crash.

I’ve told people anyone could do this and double their money in a year.

By the end of 2020, I proved it.

An equal weighted account using this strategy went up 132% last year.

Imagine turning every $2,000 into almost five grand.

Click here to see how I do it.

P.S. I wasn’t surprised considering my 12 year back test never had a losing year. But our live results are proving to be better. Click here to see how this could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.