Amid the stock market chaos, one sector is showing strength while other equities fall: information technology. In fact, the sector continues to outperform the S&P 500 and there are a number of cloud ETFs to buy that can help you beat the benchmark.

According to S&P Dow Jones Indices, the S&P 500 information technology sector is outperforming the benchmark by a wide margin.

The average one-year returns for the sector are 27.5%, compared to just 2.3% for the overall S&P 500.

And within that sector, one class has the potential to continue rising above all others.

With millions of Americans continuing to work remotely, the way companies conduct business is changing — forever in some cases.

Cloud technology companies have been able to capitalize on these headwinds by offering businesses easy, cost-effective ways to store, manage and share data.

One way investors can seek out big gains, despite the market downturn, is to look for exchange-traded funds that hold cloud companies.

Here are some cloud ETFs to buy that can provide those returns.

Cloud ETFs to Buy

1. Global X Cloud Computing ETF

Fund Family: Global X Management

Managed Assets: $553 million

Management Fee: 0.68%

Annual Dividend Yield: 0.04%

1-Year Return: 21.65%

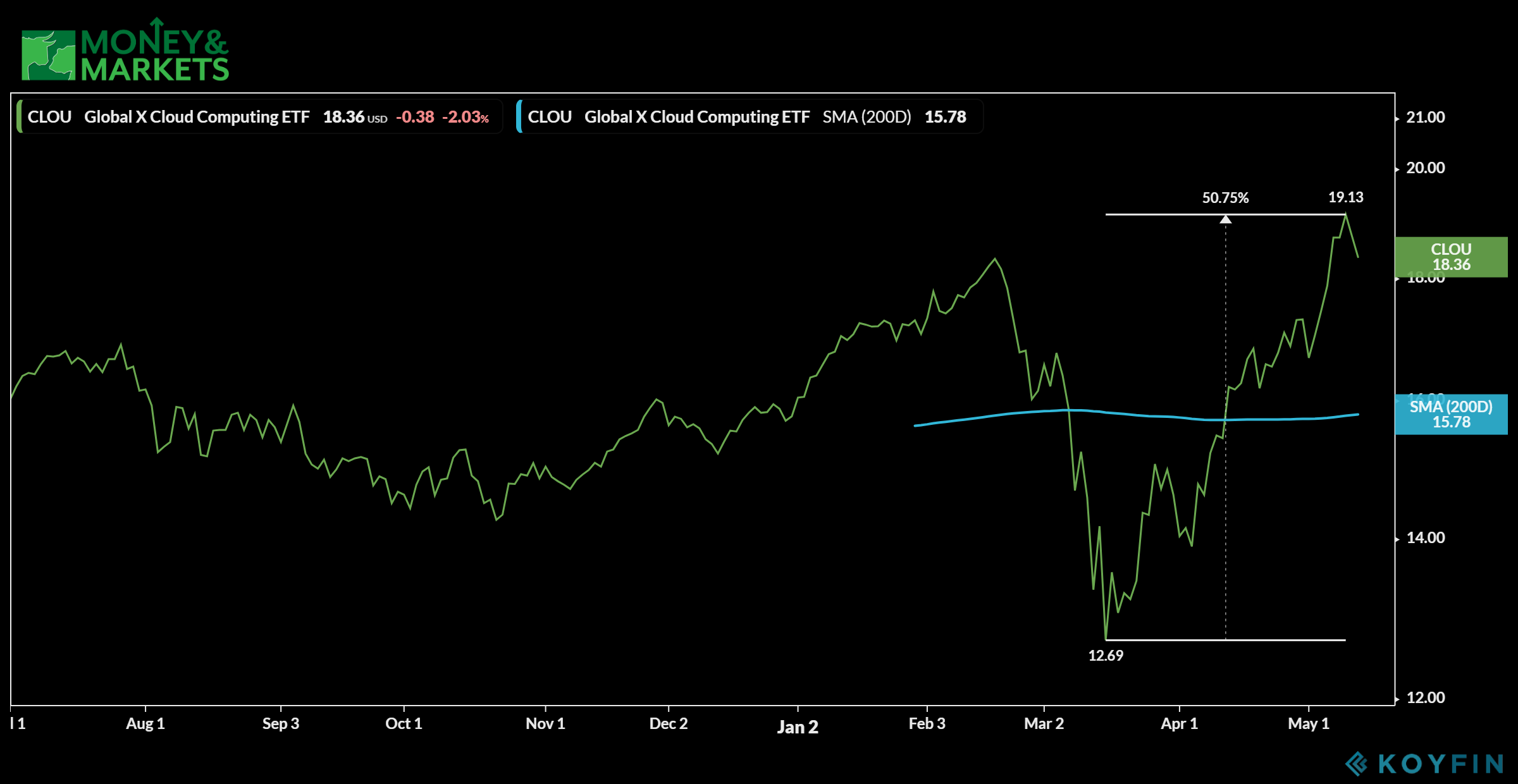

The Global X Cloud Computing ETF (Nasdaq: CLOU) is a relatively new ETF on the market, started just over a year ago.

But it has grown in a short time to hold more than $553 million in total assets.

After reaching a previous high in February 2020, CLOU retreated to a new 52-week low in relatively short order.

However, it’s made a massive recovery — to the tune of a 50.7% gain — to reach a new 52-week high of around $19 per share on May 11.

Some of its biggest holdings include Twilio Inc. (NYSE: TWLO), Everbridge Inc. (Nasdaq: EVBG) and Zoom Video Communications Inc. (Nasdaq: ZM).

Currently, CLOU is providing a one-year return of 21.65% and a one-month return of 18.1%.

As an ETF, it also pays shareholders a dividend. Being relatively new, the history of that dividend payment is small. Its last payment was just $0.01 per share.

CLOU also comes with a management fee of 0.68%.

Its solid growth coupled with a good track record for big returns makes Global X Cloud Computing one of the cloud ETFs to buy now.

2. First Trust Cloud Computing ETF

Fund Family: First Trust Portfolio

Managed Assets: $54.9 million

Management Fee: 0.6%

Annual Dividend Yield: 0.38%

1-Year Return: 12.05%

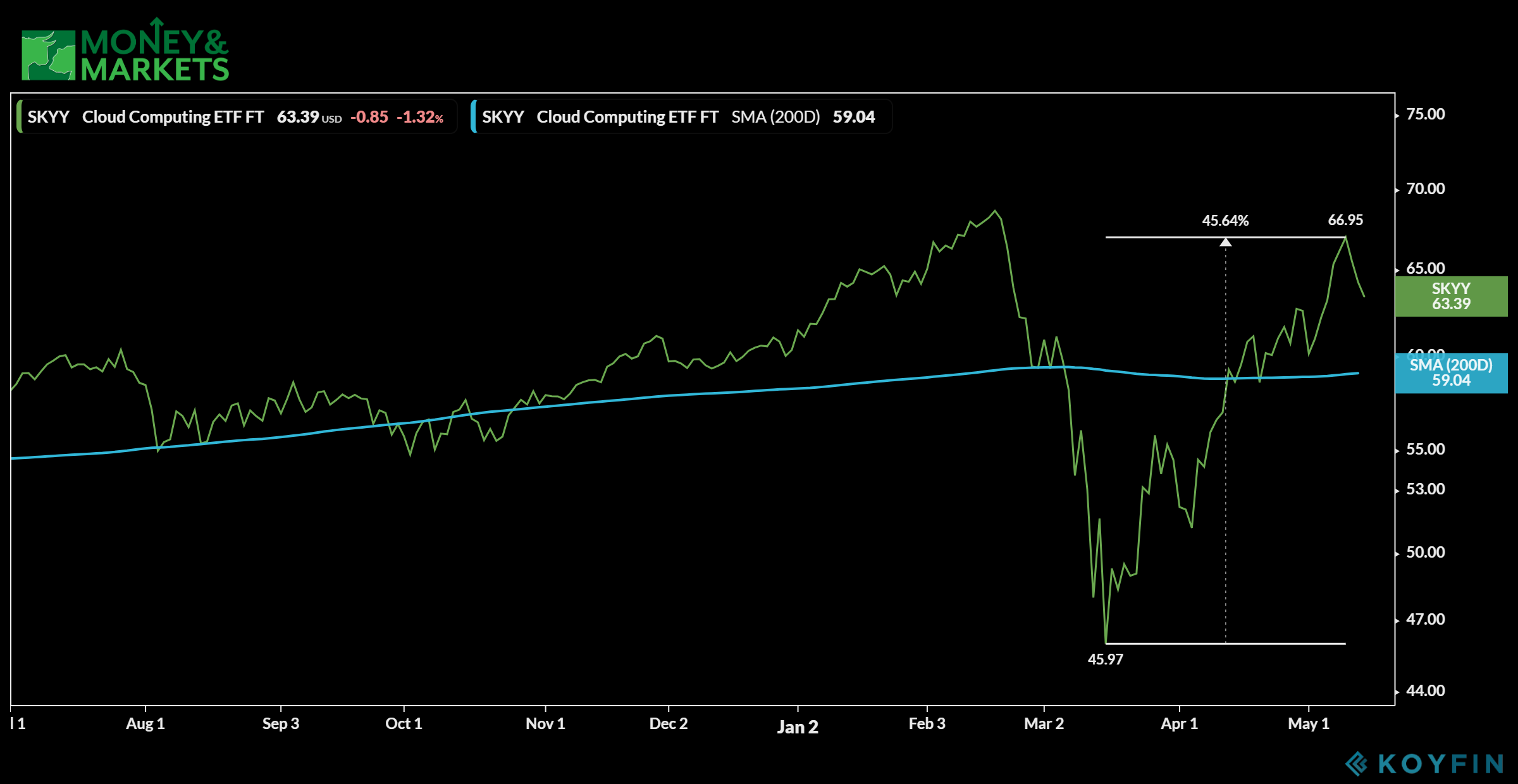

The next ETF on the list was started back in 2011, making it one of the first cloud computing ETFs on the market.

The First Trust Cloud Computing ETF (Nasdaq: SKYY) is managed by First Trust Portfolios, and it has managed assets totaling close to $55 million.

Like CLOU (and the broader market), this ETF suffered a big drop from its 52-week high set back in February 2020. However, also like CLOU, it has rebounded — jumping 45.6% from its March lows.

Historically, SKYY has been on an upward trajectory since its inception. It was hampered by the overall market downturn but seems to be back on track.

SKYY holds big companies like Amazon.com Inc. (Nasdaq: AMZN), Microsoft Corp. (Nasdaq: MSFT) and Google parent Alphabet Inc. (Nasdaq: GOOG). That means its portfolio is built for strong growth even when the stock market is down.

Its one-year return is more than 12%, but its five-year return is a staggering 107.5%.

The annual dividend yield for SKYY seems low at 0.38%, but its most recent payment was $0.03 per share. That’s down from previous quarters, but it has been as high as $0.27 per share.

It also comes with a slightly lower management fee than CLOU — 0.6%.

But SKYY has a strong and diverse portfolio of holdings, which makes it one of the cloud ETFs to buy now.

3. iShares North American Tech-Software ETF

Fund Family: BlackRock iShares

Managed Assets: $4 billion

Management Fee: 0.46%

Annual Dividend Yield: 0.49%

1-Year Return: 15.6%

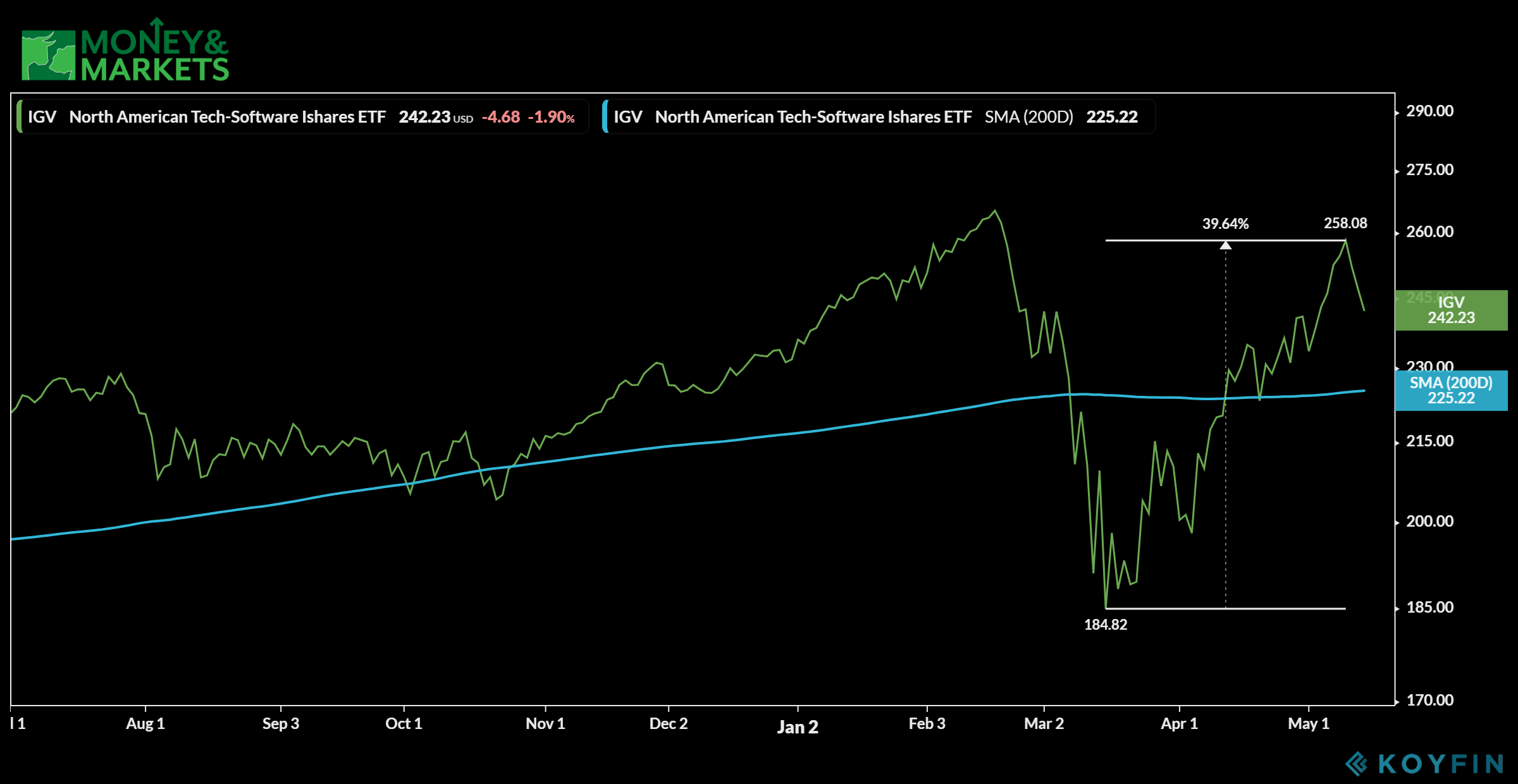

The iShares North American Tech-Software ETF (NYSEARCA: IGV) is the largest ETF on our list with managed assets of around $4 billion.

Managed by BlackRock Inc. (NYSE: BLK), this ETF is one to hold over time as opposed to buying and selling quickly.

As you can see, its performance is very similar to that of CLOU and SKYY — a big dip in February followed by a solid recovery.

Since reaching its 52-week low in March 2020, IGV has bounced up by around 40% in just over a month.

The ETF has holdings primarily in the information technology space, such as Salesforce.com Inc. (NYSE: CRM), Adobe Inc. (Nasdaq: ADBE) and Oracle Corp. (NYSE: ORCL).

Over the last year, its returns have been 15.6%. But here’s where the long-term play comes in: Over five years, IGV has a return of 140.7% — the largest on the list.

It is a bit more volatile than our previous two recommendations with a 60-month beta of 1.03.

But IGV does pay a bigger dividend than the others — $1.17 per share in March. However, that increase was due to it not making a dividend payment in the latter half of 2019. On average, IGV has a dividend of around $0.20 per share.

The management fee for IGV is the lowest on the list at 0.46%, but it is the most expensive with a price of around $243 per share in May 2020.

But an impressive long-term return is why the iShares North American Tech-Software ETF is one of the cloud ETFs to buy now.

4. Wisdom Tree Cloud Computing Fund

Fund Family: WisdomTree Investments

Managed Assets: $105 million

Management Fee: 0.45%

Annual Dividend Yield: 0.49%

1-Year Return: 15.6%

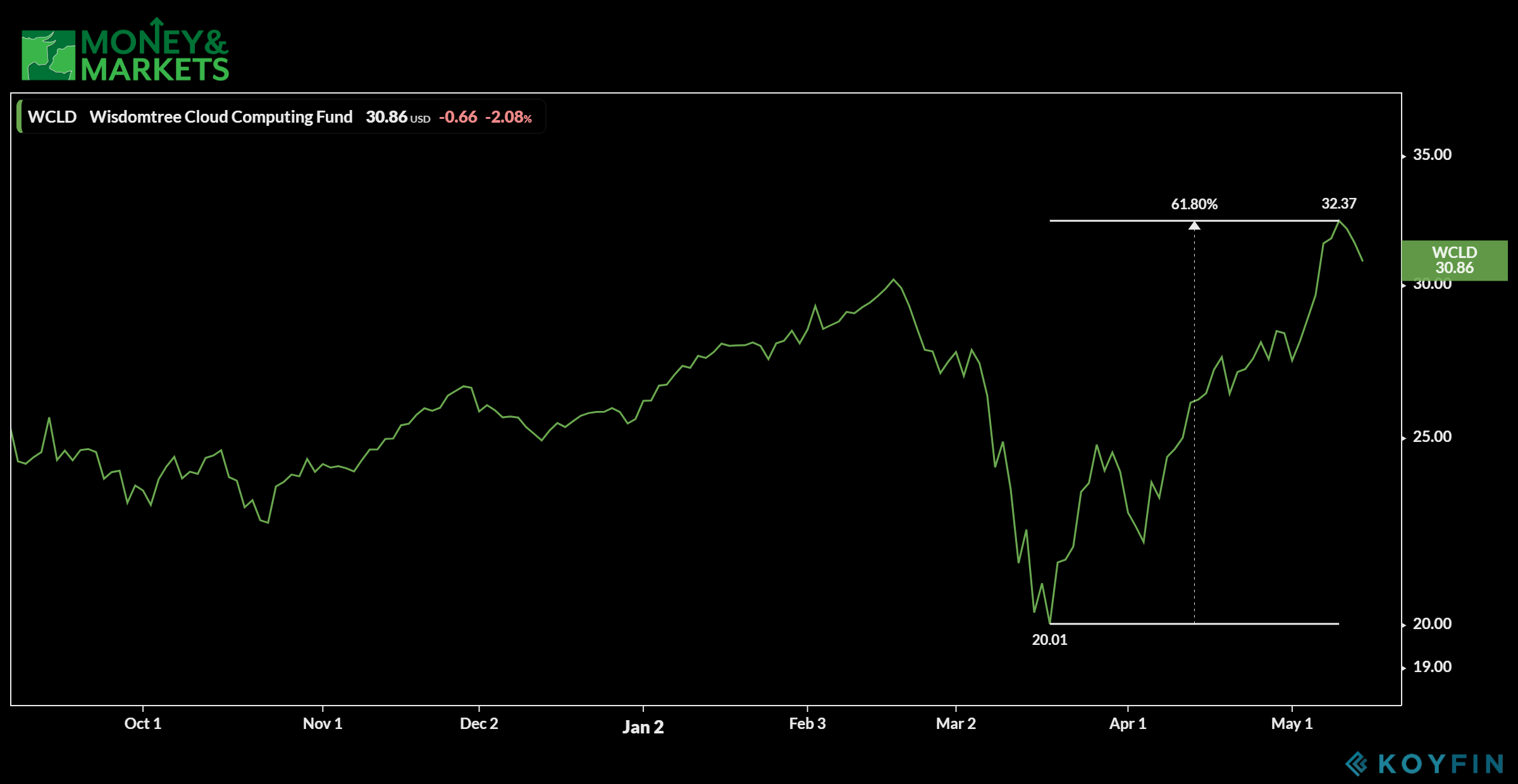

Our last cloud ETF to buy is a little bit different from the others.

The Wisdom Tree Cloud Computing Fund (Nasdaq: WCLD) is an equal-weighted ETF. That means every stock in the index has the same weight, regardless of the company size. Market weight ETFs, like the ones above, weigh holdings based on market capitalization.

WCLD was started in 2019 by WisdomTree Investments as a way to capitalize on the growing cloud computing market.

It suffered a big drop in the February 2020 crash, but has regained its losses and then some. Since reaching a low point in March 2020, WCLD has jumped 61% and recently hit a 52-week high of around $31 per share.

The ETF holds companies like PayPal Holdings Inc. (Nasdaq: PYPL), Dropbox Inc. (Nasdaq: DBX) and DocuSign Inc. (Nasdaq: DOCU).

Remember, we recommended DocuSign as one of our work from home stocks to buy and four stocks to buy and hold for 2020.

Its performance since inception indicates a one-year return of around 22.8%, and it comes with a slight management fee of 0.45%.

The ETF has not paid a dividend yet because it is still new on the market.

However, it does have a strong equal-weighted portfolio and has weathered the market crash well. That’s why the Wisdom Tree Cloud Computing Fund is one of the cloud ETFs to buy now.

Here you have four cloud ETFs to buy that all have strong portfolio holdings, and have the potential for returns of more than 20% in a year.

While some may be a little more expensive than others, all will provide solid exposure to the cloud computing sector, which continues to outperform the S&P 500.

That makes these are the cloud ETFs to buy now.