Oil is capturing headlines. And it should. After all, the price of oil fell below negative $37 in the futures market.

That negative price was an anomaly. It was because storage facilities were nearly full as a specific futures contract expired. Unless there are changes in the market, we could see oil turn negative again when June futures expire.

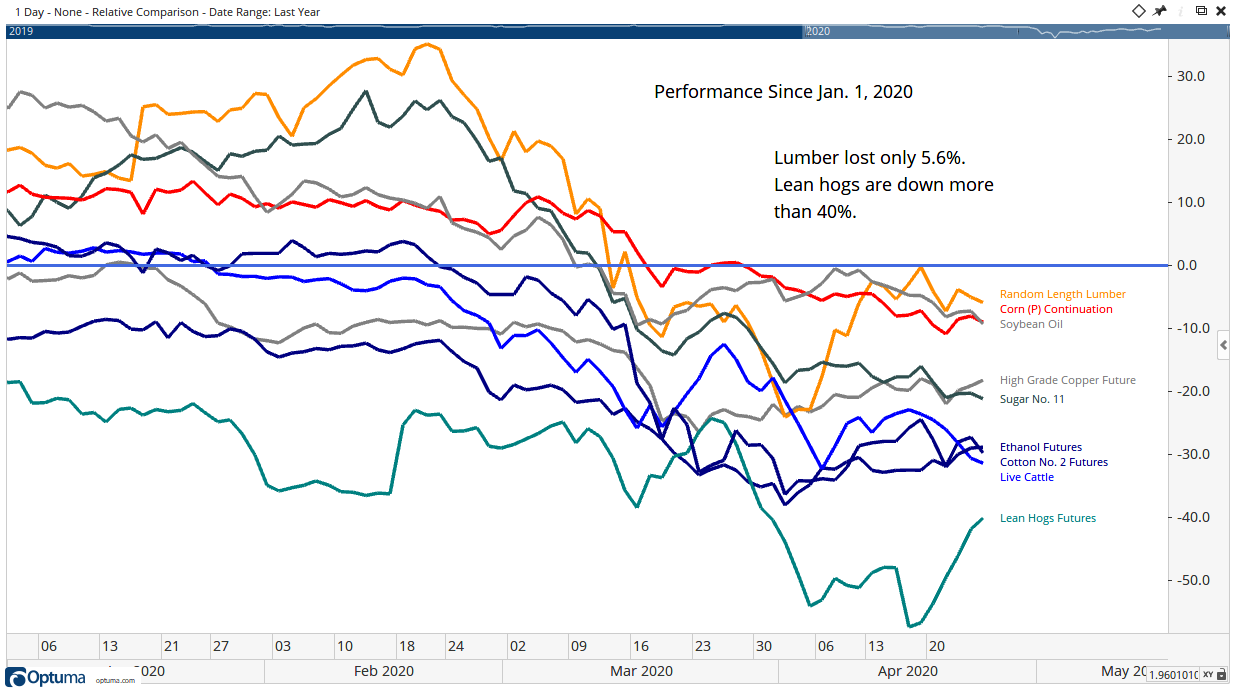

While oil captured headlines, other commodity prices also crashed on futures markets. The chart below shows a variety of futures contracts. All are down since the beginning of the year. Lumber is the best performer and shows a loss of 5.6%.

With most commodities down more than 20%, this chart shows producers in a variety of markets face problems.

Agricultural Market Commodity Prices Slammed

Hog producers, cattle ranchers and farmers see problems similar to oil producers. Demand is down with restaurants closed and large gatherings banned. But agricultural producers cannot quickly react to the changing market. That means supply continues to build and there are excesses in agricultural markets.

Unlike oil, physical products in agricultural markets become useless in time. Hogs and cattle cannot be stored indefinitely for a variety of reasons.

One farmer told a local news station, “The whole system is really built for on-time delivery of the animal to the plant, then to processing, and from processing to the grocery store. Any one piece gets out of wack and there can be real problems.”

As an example of how this works, “fatter pigs are sold at a severe discount because they don’t properly fit the machinery at processing facilities.

A pig that might be worth $125 at slaughter, if it gains just 15 pounds, could be worth only $40. In two weeks, pigs can gain 30 to 40 pounds.

“In less than three weeks I’ve got hogs from my nursery coming into my facility, and they have no place to go,” and farmers may be forced to euthanize their animals.

In other markets, closing factories reduced demand. That created downward pressure on prices for cotton, alcohol used as an industrial solvent and other products. Some businesses in these sectors will fail during this downturn.

Imploding commodity prices are a threat to the nation’s economy that many investors are ignoring. If factories aren’t reopened soon, these markets might never be the same.

Disruption to agricultural and industrial markets will delay the economic recovery. Commodity prices are another piece of evidence pointing to a long-term economic slowdown.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.