One well-respected economist is on a speaking tour explaining why he believes the U.S. is near a recession.

According to news reports:

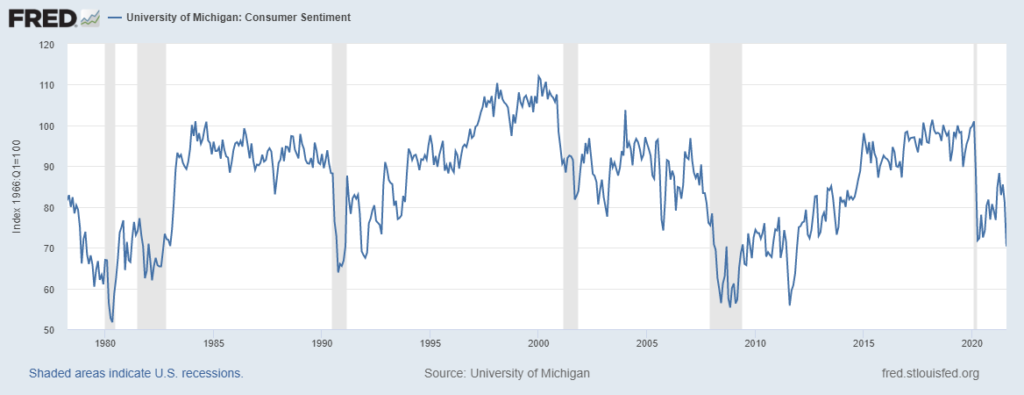

In a major speech at Queen Mary University of London, Professor Blanchflower predicted that a U.K. recession will follow hard on the heels of the one he’s forecasting for the U.S. at the end of the year. The very latest consumer confidence data in the U.S. is clear that worry and anxiety levels are increasing in people. Professor Blanchflower stressed that these indicators also have predictive power – with current wellbeing levels a huge cause for concern.

Specifically, he’s looking for a 10-point decline in consumer sentiment.

Consumer Sentiment Since the 1970s

Source: Federal Reserve.

Blanchflower added that:

This sort of data could predict all of the last six recessions in the United States that macroeconomists missed. People are hurting after the COVID shock. And they know when bad times are here and coming. And this sort of analysis gives us an edge over more traditional models — helping to predict downturns up to a year in advance.

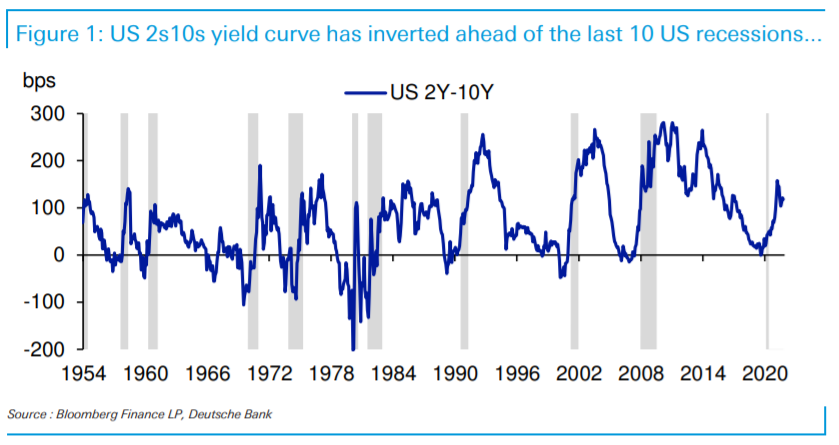

On the other hand, economists with Deutsche Bank note that none of the last 10 U.S. recessions has occurred without a yield curve inversion. They follow the relationship between yields on 2-year Treasury notes and 10-year Treasuries.

Yield Curve Doesn’t Suggest a Coming Recession

The difference between the yields is called the yield curve. Generally, yields are higher on 10-years than on 2-years. An inversion occurs when the yield on the 2-year note is higher, which tends to occur before recessions.

Source: Ritholtz.com.

As the above chart shows, the yield curve isn’t forecasting a recession. Clearly, one economist is right, and the other is wrong.

So, what should investors do?

Investors should follow the price action rather than economic forecasts. For now, the price action in the stock market is trending upward. Price models based on economic data are also bullish.

The time to sell will be when the trend reverses. This could happen soon, but preemptively selling based on what economists say could be a costly mistake.

P.S. Adam O’Dell is going LIVE on November 4 to reveal a once-in-a-lifetime opportunity accidentally created by the millions of new traders flooding the market. Why is now the best time in history to start trading? Find out all the details on November 4 by signing up for the event here.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.