Editor’s Note: LIVE on November 4, Adam O’Dell will prove that there’s no better time to start trading than right now, during a once-in-a-lifetime Perfect Trading Window. He’ll also reveal a simple strategy that’s ideally suited to exploit this market anomaly (It already crushes the market by six times, but things are about to go ballistic!) Click here to reserve a VIP spot to this game-changing live event.

It’s important to remain objective when analyzing financial markets. While it is challenging, seeing both sides of an issue offers important insights.

I have a strong opinion on inflation. I believe that high inflation hurts consumers and that even transitory inflation is harmful.

Federal Reserve officials, on the other hand, argue that transitory inflation is acceptable, since Fed policies can push inflation back down.

To see the Fed’s point, I suspended disbelief. I’ll assume that the same officials who failed to spot transitory inflation approaching can somehow manage to push prices down.

As I thought about an economy where the Fed is masterful, I came to the conclusion the Fed is still wrong. Even transitory inflation hurts consumers, both in the short term and in the long run.

In the short term, consumers struggle to pay higher prices. Income changes slowly, so when the price of gas jumps 55% in 12 months, they must cut spending elsewhere to afford gas.

Transitory Inflation Pushes Prices Higher in the Long Run

Consumer income generally comes from employment. Economists think of the wages we receive from work as the price of labor. They readily acknowledge that wages change slowly because they believe that prices are sticky. That means prices tend to change slowly.

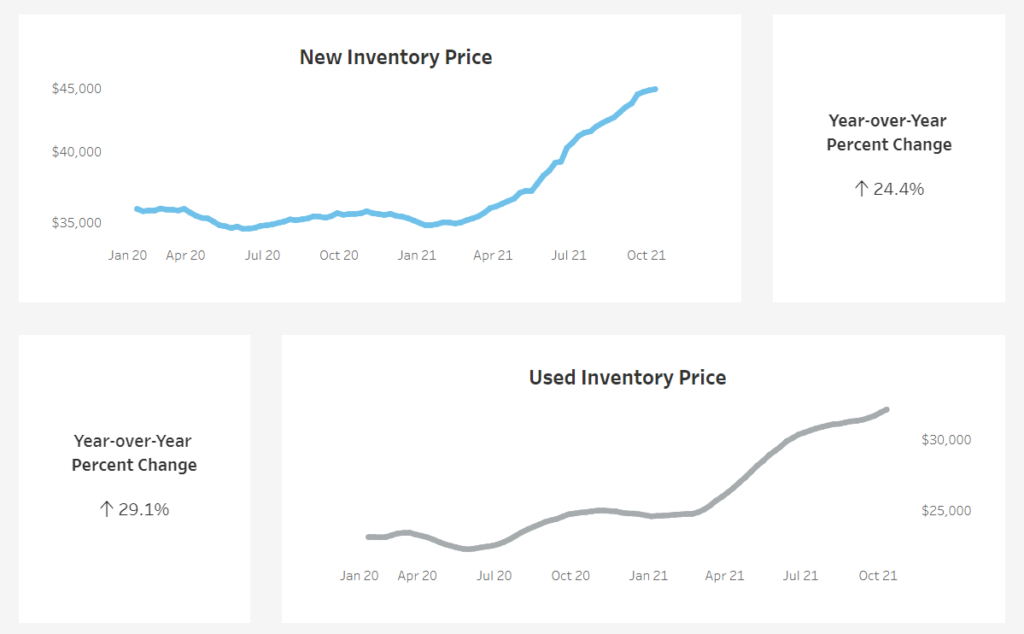

Of course, not all prices are sticky. Retail prices tend to go up quickly. They are sticky on the downside — and that’s the problem with transitory inflation in the long run. The chart of car prices shown below illustrates the problem.

Inflation Pushed Car Prices Higher in Short Term

Source: YAA.com.

Prices for both new and used cars have soared in the past year. The Fed tells us that this is a temporary problem caused by chip shortages and supply issues that won’t last long.

Assuming that’s true, it doesn’t matter. As consumers we know that new car prices aren’t returning to an average of $35,000. Used car prices are also at a permanently higher plateau.

That’s the problem with transitory inflation. Prices are sticky and aren’t coming back down. Consumers face challenges in the short term and in the long run. And even if inflation drops, higher prices are here to stay.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.