Consumer spending is a significant part of economic growth — it may be the most important component of the economy.

According to the White House, “Falling consumer spending has major effects on overall GDP growth, as it accounts for roughly 68% of GDP.”

This fact explains the goal of federal stimulus programs. Policymakers want to get money to consumers so they can keep the economy going.

Stimulus, at least the most recent program, is a response to the decline in consumer spending, a 1.7% drop according to the most recent data.

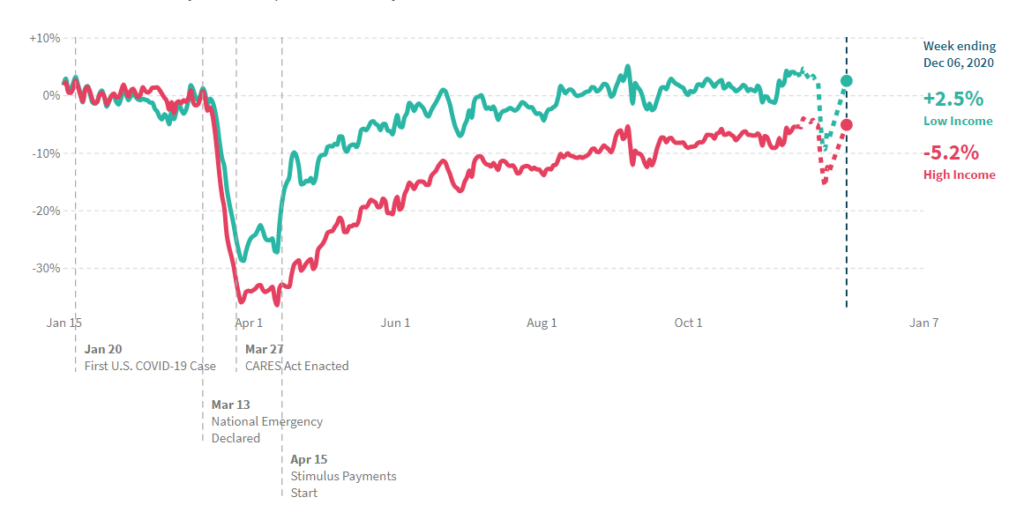

Under the headlines, as the chart below shows, an interesting pattern is developing, one that highlights a potential failure of the stimulus program.

Low- vs. High-Income Consumer Spending

Source: TrackTheRecovery.org.

A Vaccine Won’t Cure the Economy

A truism, high-income consumers have more money to spend than low-income consumers, but they are the ones who have pared down spending in the pandemic. Shutdowns may have altered their spending patterns permanently.

Simple examples like gym dues and restaurant spending show that spending in 2021 is not going to snap back to 2019 levels.

High-income consumers have been forced to forego some spending and may not return to old levels as they consider risk levels. Even after the pandemic ends, some consumers will continue to wear masks and avoid restaurants.

Increased spending by low-income earners shows targeted stimulus programs are important to recovery. As a group, low-income earners were able to keep up with inflation. But they won’t grow the economy.

High-wage earners hold the key to the economy. Jobs with high wages, defined as paying more than $60,000 a year, have increased 1.2% during the pandemic while there was a 5.2% loss in jobs paying less than $27,000 a year and a 4% drop in medium-wage jobs.

The drop in spending despite the increased employment for high-wage consumers shows a possible long-term shift in the economy, away from discretionary spending that supports so many low-wage jobs.

Such a shift is a problem that a vaccine won’t solve.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.