When money is tight at home, shopping for what you need becomes more important than shopping for what you want.

For millions of Americans suffering from coronavirus-related layoffs, this is most evident when shopping for groceries.

Shoppers are now buying consumer staples (toilet paper, laundry detergent and basic food items) and spending less on clothes and entertainment.

This increase in sales means consumer staples stocks — companies that manufacture and sell these necessary items — are going up fast.

We used Money & Markets Chief Investment Strategist Adam O’Dell’s Green Zone Ratings system and found one of the best stock performers in the S&P 500 Consumer Staples Index in July … one that could give you double-digit gains in short order.

More on that in a bit.

First, you need to know why the consumer staples sector continues to grow.

Recession Fuels Consumer Staples Stocks

The gross domestic product (GDP) in the U.S. fell at an annual rate of 32.9% in the second quarter of 2020, according to the Bureau of Economic Analysis.

GDP is the monetary value of all goods and services in a country. It’s used to estimate the size of the economy and growth rate. A decline in GDP can indicate lower values or a drop in production — both of which can illustrate a shrinking economy.

And unemployment is still above 10%.

All of that is reflected in what Americans are buying.

44% More Americans Are Stocking Up on Essentials

This means companies that provide essential products will grow even faster as the U.S. remains in a recession and millions are without jobs.

We found a consumer staples stock using Adam’s Green Zone Ratings system that we think will deliver double-digit gains as the sector continues to rise.

Using Adam’s stock rating system, we uncovered a high-quality consumer staples stock that is an industry leader.

Church & Dwight Co. Inc. (NYSE: CHD) manufactures and sells everyday household products in the U.S. and internationally.

Its most well-known brand is Arm & Hammer — which offers laundry detergents, baking soda and carpet deodorizers. It also makes cleaning solutions under its OxiClean brand.

In its latest quarterly earnings report, the company’s earnings per share (EPS) increased 37% year over year and beat Wall Street projections by nearly 10%.

That’s higher than most of its competitors.

What’s more, its earnings per share for the next 12 months are anticipated to grow by nearly 9% which better than competitors like The Clorox Co. (NYSE: CLX), Colgate-Palmolive Co (NYSE: CL) and Kimberly-Clark Corp. (NYSE: KMB) — all of which are forecast to have EPS growth of 6% or less.

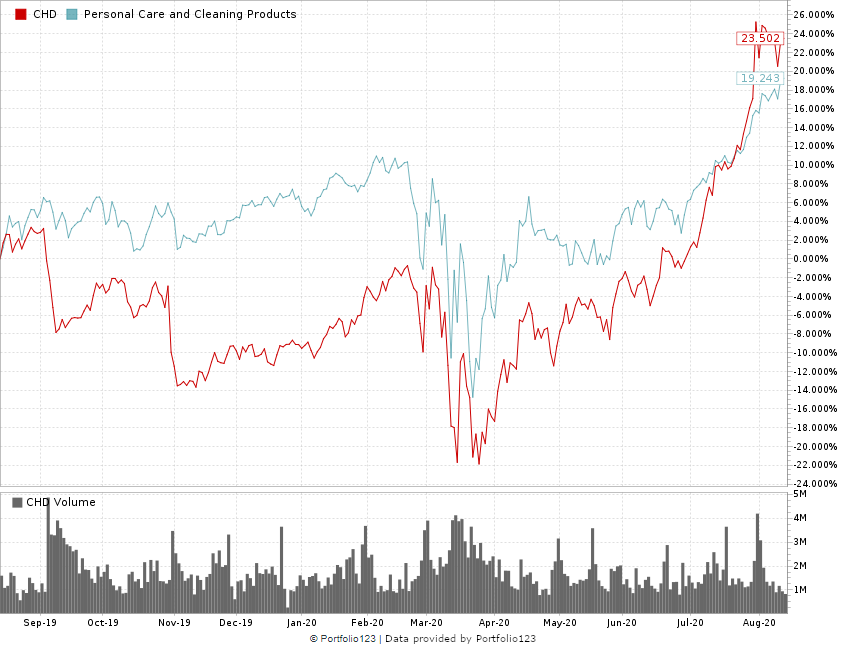

Church & Dwight Bounced 58% From March Lows

Church & Dwight earns a 79 overall ranking on Adam’s Green Zone Ratings system.

It rates highest in volatility, quality and growth.

Here’s a breakdown of the company:

- Volatility — The company ranks a 97 on volatility backed up with a beta of 0.63. A beta less than 1 means the stock is less volatile that the rest of the stock market.

- Quality — Church & Dwight stock ranks a 90 on quality. Its returns on assets, equity and investment are all far better than the personal care products industry. It also had a net margin of 15.7% compared to the industry average of minus-9.87%.

- Growth — With an annual sales growth of 8.4% and earnings-per-share growth of 19.8%, the company rates an 81 on growth — meaning only 19% of all other stocks rated are better.

What to Do With Church & Dwight Stock

With the economy in recession and millions of Americans still out of work, the way we shop will continue to transform from want to need.

That means a sharper focus on buying items we need. Church & Dwight’s products are a great example.

We will always need laundry detergent, toothbrushes and other daily essentials.

It spells continued growth for consumer staples stocks … and bigger profits.

Analysts have set a high price target of $105 per share for CHD — a 9% gain from its current price.

But I see it going even higher as its sales and earnings will continue to rise.

The bottom line: Church & Dwight is a traditional recession-proof stock. You should get in now to bank double-digit gains.