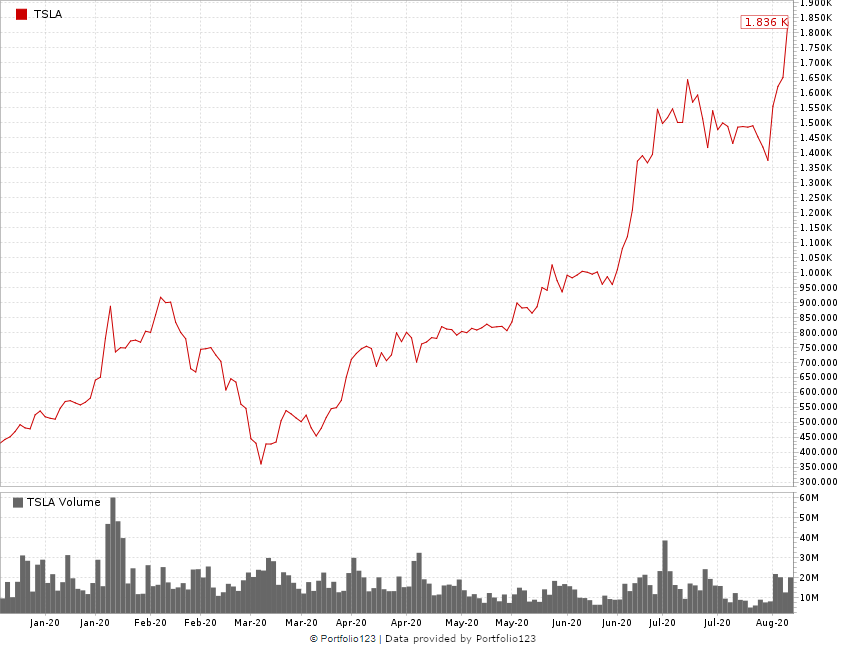

Even Tesla’s haters (and there are plenty of them) can’t deny the stock’s momentum.

As of this writing, investors are paying just shy of $1,900 per share for Tesla (Nasdaq: TSLA).

Momentum will carry Tesla stock price to $2,000 before the end of the week.

According to Chief Investment Strategist Adam O’Dell’s Green Zone Rating system, Tesla ranks a 94 in momentum. Only 6% of U.S. stocks rank better in this factor.

With this in mind, how high will it go?

I’m looking at a $2,200 price target by the end of next week, August 28. That’s an additional 17% from today’s levels. The stock is already up more than 36% from its recent low on August 11.

Sooner or later, it will crash. It fell 60% in a month during the coronavirus panic. Had the market not crashed, it would’ve kept going higher. It’s already double what it was during the market’s previous high in late February.

Tesla Stock: Duck and Cover

Tesla is showing a unique yet straightforward bullish pattern. It rises, stabilizes for a month or two, then takes off again, almost like clockwork.

Tesla’s Year-to-Date Stock Surge

As long as the market keeps going up, this momentum will continue. And a $2,500 price by year-end is not out of the question.

Consider that Tesla recently announced a 5-for-1 split of its stock. At today’s prices, a share of Tesla’s stock will cost about $400.

Younger, less-experienced investors will jump all over this because Tesla sounds “cheaper” at $400 a share than $2,000.

Tesla is already one of the most popular stocks on the free investing app Robinhood.

A lower threshold to entry will make it that much more attractive. (Sure, you can buy fractional shares at whatever amount you choose already, but the idea of owning a whole share for $400 versus one-fifth of a share will appeal to a lot of people.)

If retail investors flood the stock, it could go as high as $600. That would put it up around $3,000 based on today’s prices, a more than 50% rise.

Where TSLA Stock Could Go From Here

When the bubble pops (and Tesla stock is in a bubble), there will be tremendous opportunity to capture gains of 100%, 500%, even 1,000% or more on the downside with put options.

Keep a close eye on the stock after this week.

Usually, during these big jumps like we’ve seen this week, they’ll end with one final, tremendous move up, then quickly drop between 5% and 10% before settling down.

Don’t buy anything now.

Wait until next week, when and if we see one of those final, blowout moves higher.

If you’re an experienced options trader, you know what to look for.

If you’re a trading novice — or if you want expert advice — Mike Carr is an options master.

Mike has figured out a way to time the weekly highs and lows in the markets. While he doesn’t follow Tesla, he has found what he calls the perfect trade … a repeatable trade you can make week after week, targeting gains of 100% or more every time you trade it.

Now, Mike’s publisher closed the doors to this service yesterday. However, I managed to convince him to reopen it for Money & Markets readers just for today. Check out the discount code you can access here to get a full year for over 60% off.

Besides the weekly trade, Mike offers an overview of the market that can help inform your short-term trading. That alone is priceless.

Stay safe out there, and practice discretion.