Copper prices can help us see what’s coming in the markets.

As inflation rose last year, Federal Reserve officials and other policymakers told us not to worry.

They explained that inflationary pressures were transitory.

We had reason to worry when inflation topped 7%.

However, we see indications that inflation will ease — the price of copper in future markets, for example.

Investors follow copper as an economic indicator. According to NPR:

…when it comes to forecasting the macroeconomic future, copper has its own special reputation.

So much so that the slang term commodities traders use for the copper market is Dr. Copper. It’s thought to be so good at predicting the economy it has a Ph.D. in economics.

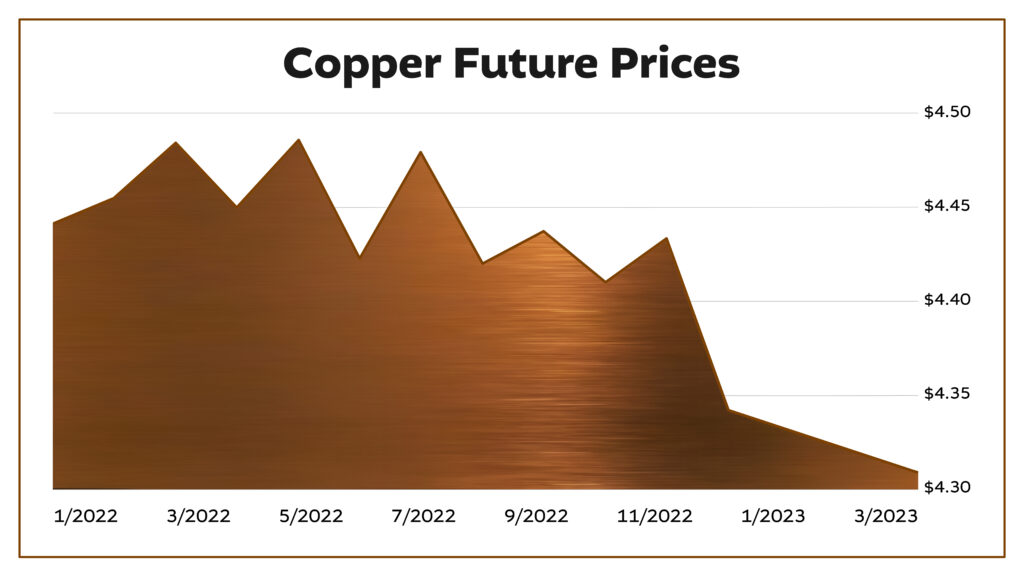

Copper trades on futures markets. This allows us to see the price traders are willing to pay for the metal at a given time in the future.

For example, a contract for delivery in February 2022 showed the price of copper is $4.44 per pound. Traders are paying $4.36 per pound for delivery in December 2022.

You can see the trend in copper prices in the chart below.

The trend is down. Under normal market conditions, it should be up.

If you buy copper today and hold it until next year, you will incur costs for storage and insurance. The price reflects these costs. The fact that prices are trending down shows that other factors are more important.

Expect Copper Supply and Demand to Remain Steady

The only other factors in futures prices are supply and demand.

If they remain steady, storage and insurance costs push the price up every month.

The downtrend in the chart shows that investors don’t expect supply and demand to remain steady.

We know that supply changes slowly in a labor-intensive activity like mining. That means demand is the main factor driving the price trend. Declining prices indicate demand should be easing over the next year.

Other commodities, including oil, show similar trends. Softening demand should ease inflationary pressures.

This doesn’t let the Fed off the hook. It should have acted earlier. But if the Fed does nothing now, inflation should ease over the next year.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters