We know the world changed in March when the global economy shut down. Now many political and business leaders are trying to convince us the changes are only temporary.

Some experts assure us that everything will be back to normal this summer. Others say normalcy will return later this year. A few believe it will be 2021 before we fully recover.

When thinking about this, we should remember that the experts predicting recovery failed to anticipate the shutdown. In all fairness, no one could have expected this. Of course, that means it’s likely that no one can expect to understand what society will look like when we do finally recover.

Instead of trying to understand the big picture, investors could just focus on individual sectors. At this level it is possible to make some informed forecasts.

Online Retail Sales Blast Off

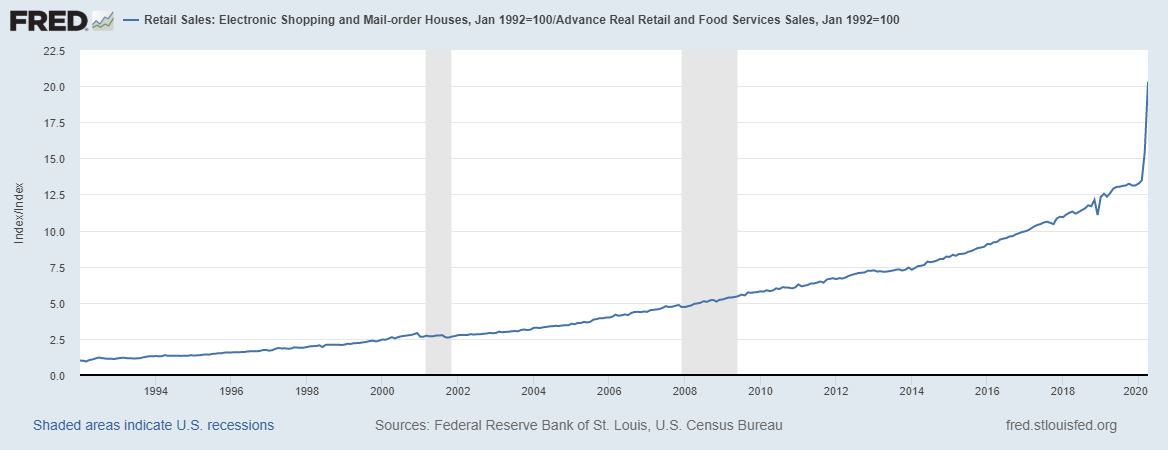

The chart below shows a trend that accelerated in the pandemic and will affect all investors in the future. It charts sales at mail-order houses and online retailers as a percentage of all retail sales.

Source: Federal Reserve

In 1992, about 1% of all retail sales were completed from home shopping shows, catalogs or ads in magazines. As internet shopping became safe in the 1990s, consumers increased their at-home shopping.

The ratio has been inching up about 1% a year over the past five years. At the end of 2019, online orders accounted for about 13.1% of retail sales.

In April, the percent of online retail sales jumped to 20.3%. This isn’t going to fall back to normal. Consumers have shifted online, and they are likely to stay there.

For investors, this jump highlights obvious winners including Amazon Inc. (Nasdaq: AMZN), Walmart Inc. (NYSE: WMT) and specialty retailers.

A small cap auto supplier, U.S. Auto Parts Network (Nasdaq: PRTS), which is up 283% year to date, could be a winner.

Obvious losers are department stores that have struggled for years, and mall-based retailers without a competitive advantage.

There will be other changes as the economy reopens but as investors, it is usually best to understand a small change instead of trying to see how the whole world will be different.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.