During a recent visit to my doctor, I noticed several big changes. (I admit, it had been too long since my last visit.)

The nurses and doctor had tablets instead of the old paper patient charts.

All the information they needed was digitized and linked.

I started to look into what goes into making patient records digital.

What I found was shocking:

This chart shows the market value of electronic health records from 2018 to 2026.

In the next five years, the market’s value will skyrocket 135.5% to $17.9 billion!

That’s massive market growth in a short time.

Today’s Power Stock provides health care information technology, such as electronic health records hardware and software: Computer Programs and Systems Inc. (Nasdaq: CPSI).

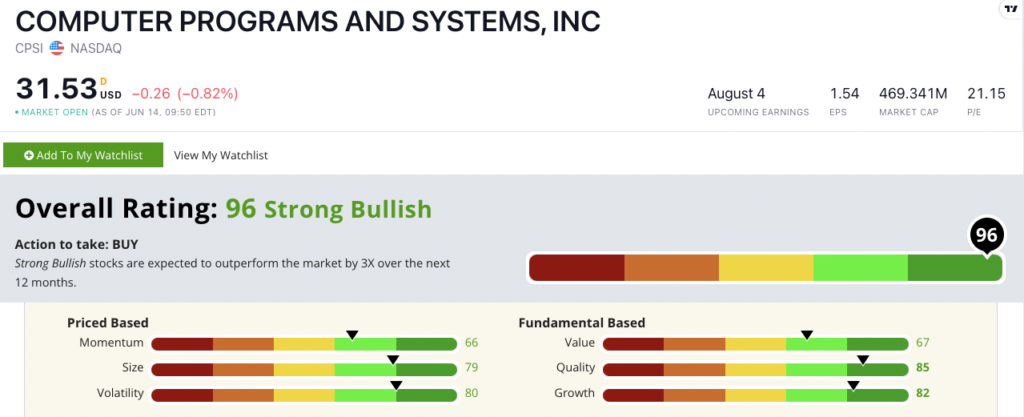

CPSI Stock Power Ratings in June 2022.

Computer Programs helps hospitals, clinics and assisted living facilities upgrade from old paper records to digital ones, using Internet of Things (IoT) technology.

The stock scores a “Strong Bullish” 96 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

CPSI Stock: Strong Quality and Growth

I looked closer at CPSI’s recent quarterly report.

Here’s what I found interesting:

- CPSI grew its quarterly revenue to $77.9 million in the first quarter of 2022 — a 14.5% increase over the same quarter a year ago.

- In May, the company announced it had acquired Healthcare Resource Group, which tracks revenue from patients.

CPSI stock rates in the green in all six factors in our Stock Power Rating system. It scores the highest on quality and growth.

Its return on equity of 10.1% trounces the heath care support services industry average of negative 10.4%. It also outpaces the industry in returns on assets and equity.

The company’s net margin is almost three times better than its peers!

CPSI’s earnings-per-share growth rate over the prior quarter is an excellent 94.4%, and its sales growth over the same time is 14.5%.

From its 52-week high in November 2021 to its low in January 2022, CPSI stock dropped 25.2%.

It made up a lot of that ground by bouncing 26.7% from that low into April. The stock is still 11.8% above its January low mark.

CPSI stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Hospitals and doctors’ offices continue to get “smarter” by using cutting-edge technology to trim costs and make life easier for patients.

I'm confident Computer Programs and Systems Inc. stock is worthy of a spot in your portfolio.

Stay Tuned: Top Franchise Business Resells Goods

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent American franchiser that buys and sells used goods.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to Feedback@MoneyandMarkets.com — my team and I would love to hear from you!