We’re facing a global oil and natural gas crisis.

European nations are moving away from Russian imports after its invasion of Ukraine.

U.S. gas prices average $5 per gallon as crude oil prices top $120 per barrel.

One nation is ramping up its natural gas production to meet global demand: Peru.

The chart above shows the production of natural gas in Peru over the last 30 years.

In that time, production grew 2,604.8%.

The country has plenty of excess to ship to countries in need … for instance, those in Europe.

Today’s Power Stock explores and develops natural gas and crude oil in Peru: PetroTal Corp. (OTC: PTALF).

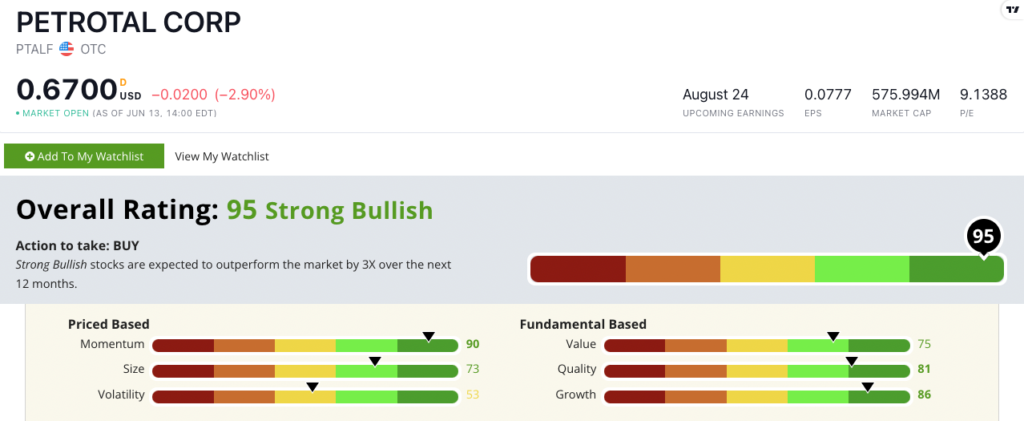

PTALF Stock Power Ratings in June 2022.

Houston-based PetroTal drills for crude oil and natural gas in northern Peru.

PetroTal stock scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

PTALF Stock: Growth + Quality + Momentum

I got my hands on a recent presentation to PTALF investors.

Here’s what I found interesting:

- The first quarter of 2022 was the sixth consecutive quarter of production increases for the company!

- It produced 11,746 barrels of oil per day in the first quarter of 2022 — a 60% increase from the same period a year ago.

Over the last 12 months, PTALF has notched an earnings-per-share growth rate of 999.9% and a sales growth rate of 155.2% — thanks to increased demand for its products in Europe.

PTALF scores a “Strong Bullish” 86 on our growth metric.

The company’s operating margin of 45.8% crushes its fossil fuel exploration peer average of just 10.3%.

Add in its double-digit returns on assets, equity and investment, and it’s clear why PetroTal earns an 81 on quality.

The oil and gas market has been strong since Russia invaded Ukraine.

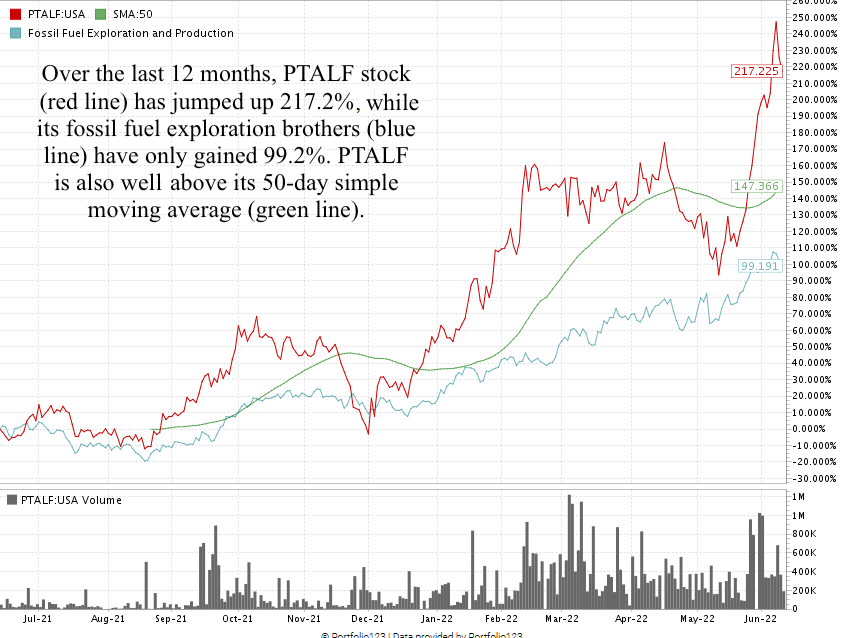

But few stocks in the sector are as strong at PTALF, as you can see in the chart above.

It cruised past its peers in the fossil fuels exploration industry (the light blue line).

PetroTal Corp. stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Europe is in dire need of oil and natural gas. It’s looking to Peru and other countries to fill the void from sanctions against Russia.

I’m confident you can see why PetroTal is an under-the-radar stock to invest in today.

Stay Tuned: Top-Notch Health Tech Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a solid electronic health technology stock.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.