Since I moved to South Florida five years ago, my body has changed.

I used to be able to endure freezing temperatures with no problem.

Now, I find anything below 60 degrees unbearable.

That’s because it’s much warmer here than just about anywhere else in the country.

Now I find myself running my air conditioning in the middle of February … something I never did living in Kansas.

And I’m not the only one…

Statista expects the global heating and cooling market will expand 22% to $288 billion between the end of last year and 2027.

Using Adam O’Dell’s proprietary Stock Power Ratings system, I’ve found a great stock to capitalize on this trend.

CSWI: An Industrial Products Giant

Today’s Power Stock is CSW Industrials Inc. (Nasdaq: CSWI).

The Dallas-based company produces heating and cooling products such as electrical systems, grilles, registers and diffusers.

Its products are used in all forms of construction, including residential and industrial.

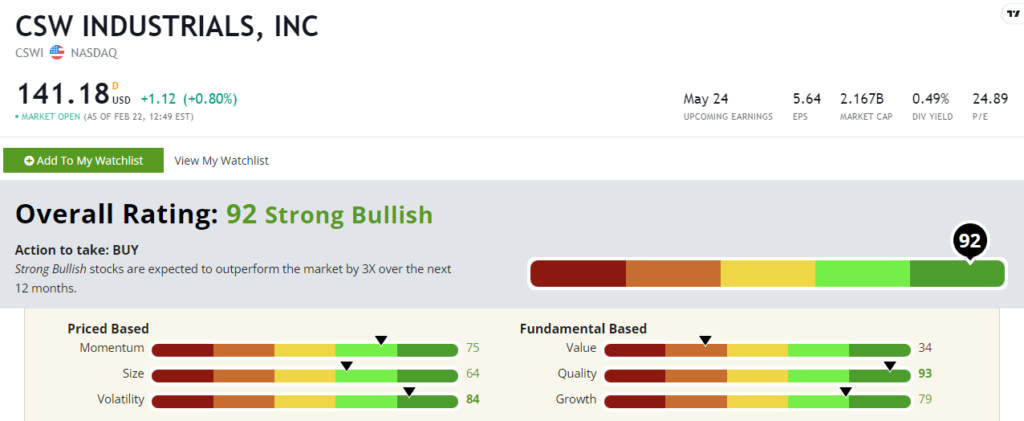

CSWI stock scores a “Strong Bullish” 92 out of 100 on our Stock Power Ratings system. We expect it to outperform the broader market by 3X over the next 12 months.

In addition to heating and cooling products, CSWI also produces fire protection systems and architectural metal products for construction.

And it’s raking in some nice profits along the way. Let’s dig into a few of its specific factor ratings.

CSW Industrials Stock: Fantastic Quality + Strong Growth

CSWI recently closed out a strong quarter.

Here are some of the highlights:

- Its total revenue was $171.1 million — a 26% increase over the same period a year ago.

- Net income for the company jumped an incredible 68% year over year to $15.6 million.

That shows why CSWI scores a 79 on growth.

The stock also outperforms on our quality factor … where it scores a “Strong Bullish” 93.

Its operating margin is 17.5% compared to the industry average of -2.3%.

The company’s return on equity is nearly nine times higher than its machinery manufacturing industry peers.

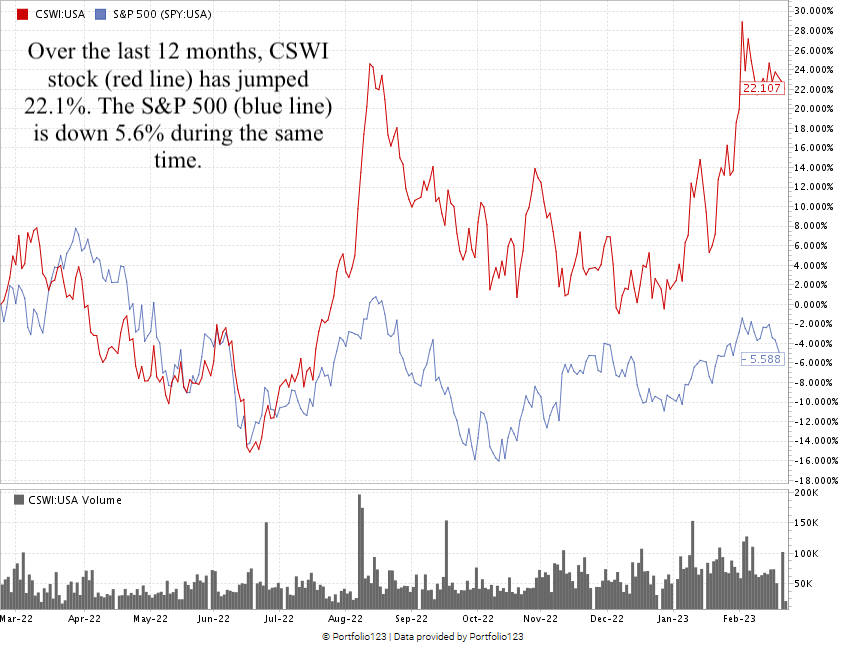

As you can see by the red line below, CSWI stock is up 22.1% over the last 12 months.

Created in February 2023.

The S&P 500 is down 5.6% during the same 12 months (as indicated by the blue line above).

CSW Industrials stock scores a 92 overall on our proprietary Stock Power Ratings system.

That means we are “Strong Bullish” on the stock and expect it to outperform the broader market.

No matter where new buildings are being constructed, the one thing they all need is efficient heating and cooling systems.

CSWI is a $2.1 billion giant in that space.

That’s what makes it a compelling stock for your portfolio.

Bonus: The company’s 0.48% forward dividend yield pays shareholders $0.68 per year for every share they own.

Stay Tuned: 98-Rated Co. Profits as Education Evolves

Tomorrow, I have another top-rated stock to share with you.

This company boomed as classrooms transitioned online amid the COVID pandemic — and it’s thriving even as students return to campus.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets