The landscape of southeast Kansas — where I worked as a newspaper editor for 10 years — is dotted with strip mines.

These old mines used to produce 50% of all zinc and 10% of all lead mined in the U.S.

The landscape also includes tiny communities that used to be mining camps: 50 Camp, Foxtown, Little Italy, Pumpkin Center and Red Onion.

The camps were like communities, complete with schools, churches and cabins where miners and their families lived.

Those camps are long gone, but mining communities — part of the accommodation industry —are still prominent in the U.S. and Canada:

This chart shows the annual revenue from the accommodation industry in the U.S.

From 2020 to 2025, the industry’s revenue will increase 59.7%.

Today’s Power Stock specializes in accommodations for the natural resource industry: Civeo Corp. (NYSE: CVEO).

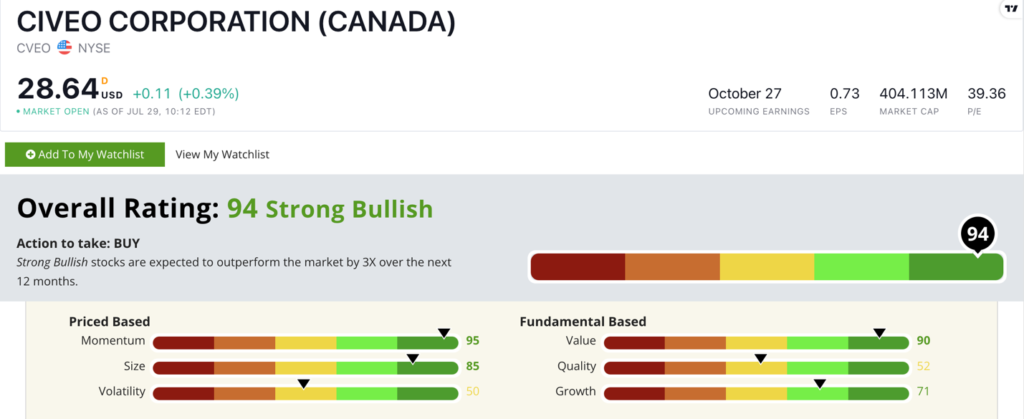

CVEO Stock Power Ratings in August 2022.

Now, Civeo doesn’t build or manage hotels. It develops lodges, villages and mobile accommodations for miners in the U.S., Canada and Australia.

Civeo stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

CVEO Stock: Excellent Momentum + Value

Civeo Corp. had an outstanding first quarter.

High points include:

- Reported sales of $166 million — a 32.8% increase over the same quarter a year ago.

- The fifth consecutive quarter of sales growth for the company.

As you can see, Houston-based CVEO is a top-notch value stock — scoring a 90 on that metric on our Stock Power Ratings system.

CVEO trades with a price-to-sales ratio of 0.6 — that’s more than three times lower than the hospitality services industry average. This tells us the stock is inexpensive relative to its peers.

Its price-to-cash flow and price-to-book value ratios also reflect the stock’s value: Both are more than half its peers’ averages.

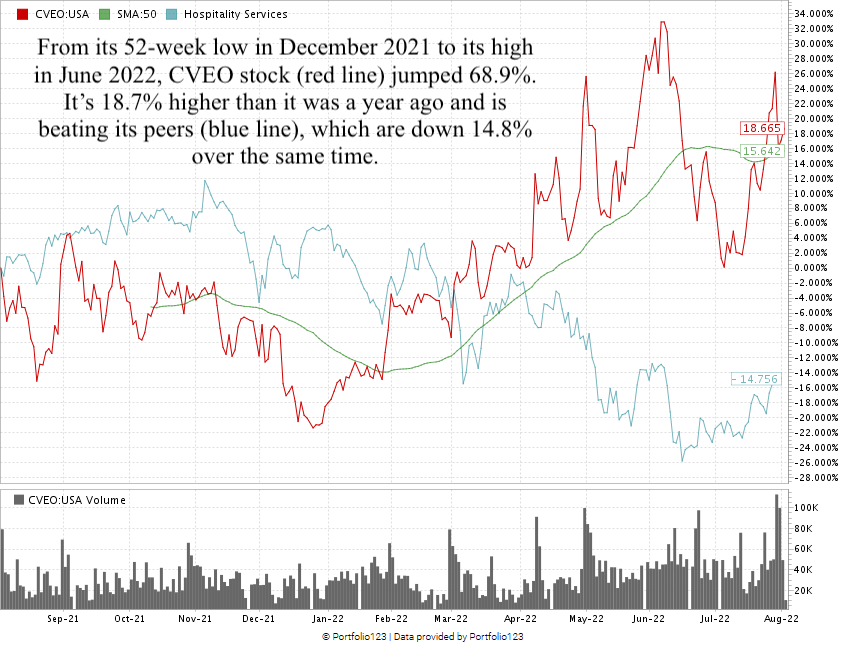

Over the last 12 months, CVEO stock is up 18.7%. Its hospitality services industry peers are averaging negative 14.8% over the same time.

From its 52-week low in December 2021 to its high in June 2022, the stock ran up 68.9%.

I have high conviction it’s setting the table for another run at its 52-week high.

Civeo Corp. stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

CVEO’s business model provides accommodations for miners across oil, gas and mineral sectors.

Natural resources continue to see high demand. The need for CVEO’s accommodations will increase from here.

That makes it a strong contender for your portfolio.

Stay Tuned: Debt Finance Company

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on an excellent debt-solution provider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to my team and me at Feedback@MoneyandMarkets.com.