Last year, my friend Jonathan started a new business.

Things are going well for him. His products are in demand, and he’s generating revenue.

Jonathan left a lucrative career in the tech industry to pursue his dream.

And he’s not alone:

The Bureau of Labor Statistics’ quarterly business starts since 2011 are in the chart above.

The number of new businesses created each quarter has increased more than 84% since 2011!

New businesses don’t start with a ton of money … they take time to build up capital and expand. And they need a little help at times.

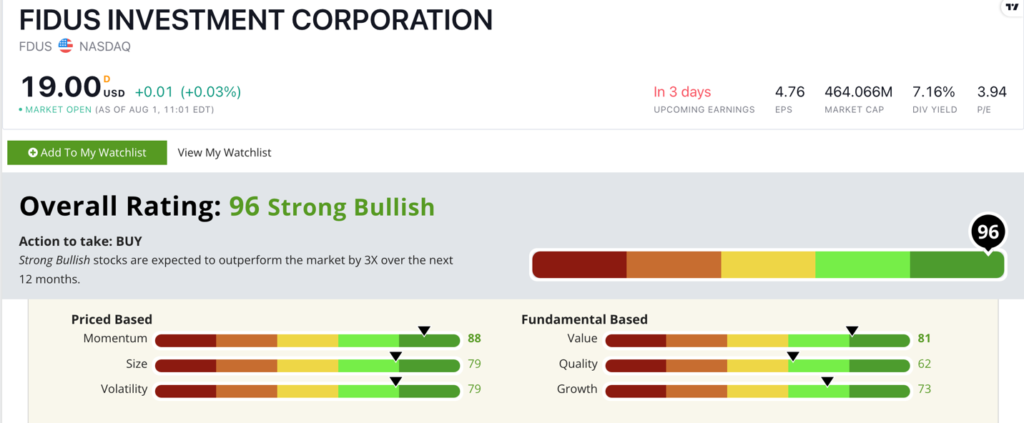

That brings me to today’s Power Stock, a business development company that helps startups secure capital: Fidus Investment Corp. (Nasdaq: FDUS).

FDUS Stock Power Ratings in August 2022.

FDUS focuses its investments in:

- Aerospace and defense.

- Business services (software services, training and marketing)

- And retail companies.

Fidus stock scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

FDUS Stock: Strong Value + Momentum

I did a deeper dive into FDUS.

Here’s what I uncovered:

- In 2021, the company generated $146 million in total revenue — a 73% increase over 2020.

- It invested almost $91 million in seven small- to medium-sized companies in the first quarter of this year.

FDUS rates in the green on all six Stock Power Ratings factors.

It’s a strong value stock.

Fidus’ price-tos (earnings, sales, cash flow and book value) are astonishing … especially compared to its peers.

FDUS’ price-to-earnings ratio is a reasonable 4.0 — almost 10 times lower than the investment service sector’s bloated average.

Its price-to-cash flow is the same … telling us Fidus stock is undervalued.

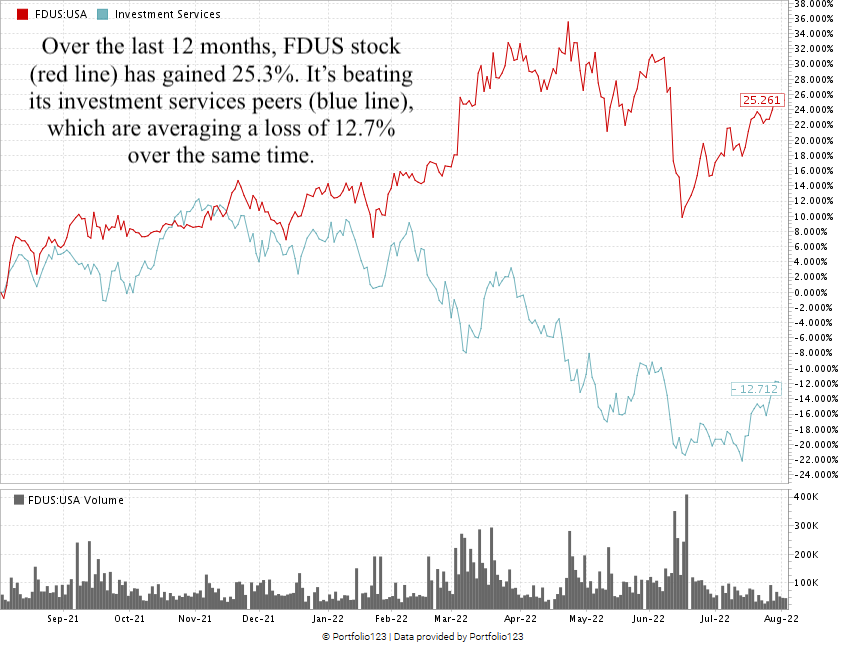

After broader market headwinds sent the stock lower in June, FDUS has climbed back up 14%.

It’s about 25% higher than it was a year ago and is outpacing its industry peers — which are down 12.7% over the same time.

Fidus Investment Corp. stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

More Americans are rolling up their sleeves and going into business for themselves.

But every business needs help from time to time, and Fidus Investment Corp. is there to lend a helping hand.

FDUS is a strong candidate for your portfolio.

Bonus: Fidus’ forward dividend yield is an excellent 9.3%. It pays its shareholders $1.77 per share, per year.

Stay Tuned: Top Bank Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a bank stock that’s crushing the market right now.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.