The global population has risen by 57.3 million people this year.

This puts added pressure on the world’s freshwater supply.

In response, governments and utilities are taking salt water from oceans and turning it into drinkable water.

The process of turning salt water into freshwater is called desalination.

The chart above shows the growth of the water desalination equipment market from 2021 to 2026.

By 2026, Markets & Markets expects it to reach $11.2 billion — a 57.5% increase over five years!

Today’s Power Stock turns seawater into freshwater: Consolidated Water Co. Ltd. (Nasdaq: CWCO).

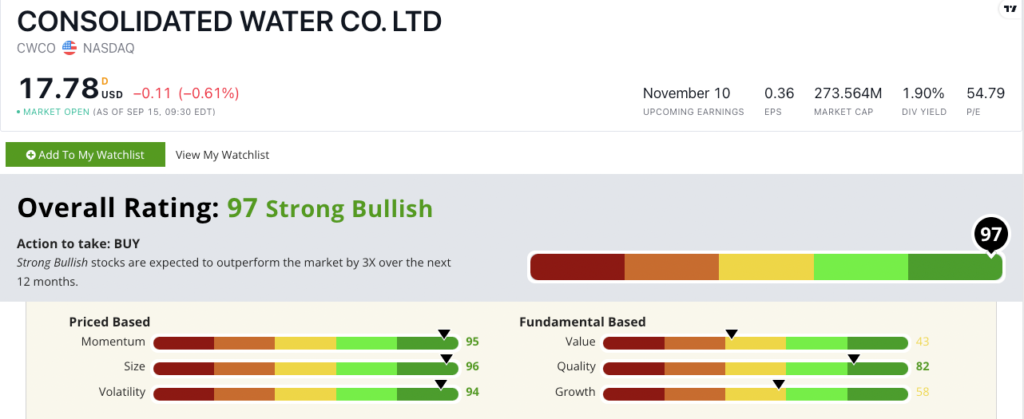

CWCO Stock Power Ratings in September 2022.

CWCO operates desalination plants in the Cayman Islands and Bahamas.

It also designs and builds desalination plants for other companies and governments.

Consolidated Water stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

CWCO Stock: Strong Momentum + Low Volatility

CWCO's second quarter of 2022 was strong:

- It reported quarterly revenue of $21.1 million — a 26% year-over-year increase!

- CWCO also won a contract to design and operate a desalination plant in the Cayman Islands worth $20 million.

CWCO had a strong quarter, but its strong quality is the factor that anchors its rating. Its return on assets is more than 100 basis points higher than the water utility industry average.

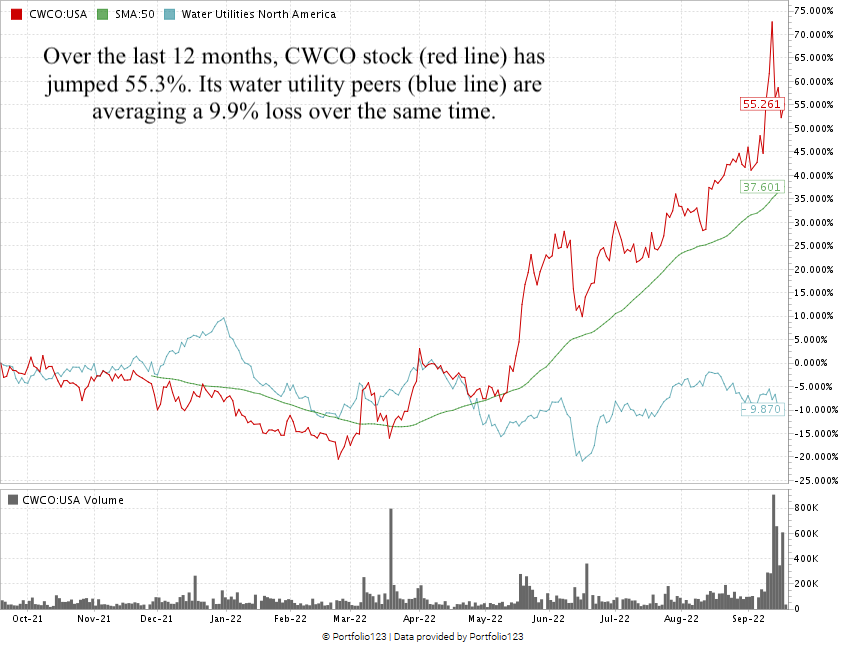

Another reason CWCO shines is its low-volatility momentum:

Over the last 12 months, CWCO is up 55.3% and beating the water utilities sector, which is down 9.9% over the same time.

CWCO stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The global population growth is putting a strain on our freshwater supply.

Consolidated Water's proven desalination method helps countries and utilities meet the increasing demand for water. All this makes CWCO a powerful portfolio contender.

Bonus: The company’s forward dividend yield of 1.9% means it will pay you $0.34 per share, per year.

Stay Tuned: Top Pawnshop Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a Texas-based pawnshop operator.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.