Last week, I watched an episode of Pawn Stars, a TV series about a Las Vegas pawnshop where people try to sell everything from family heirlooms to collectibles.

With rising interest rates and inflation, I think about the future of pawnshops as people try to make ends meet.

The Board of Governors of the Federal Reserve System reports 22% of Americans either have no bank account (unbanked) or rely on alternative financial services (underbanked).

The oldest source of credit in the world is pawnbroking — lending money on items of value.

High inflation spells tough economic times ahead, and pawnshops will see more activity as people look for cash to pay bills and buy essentials.

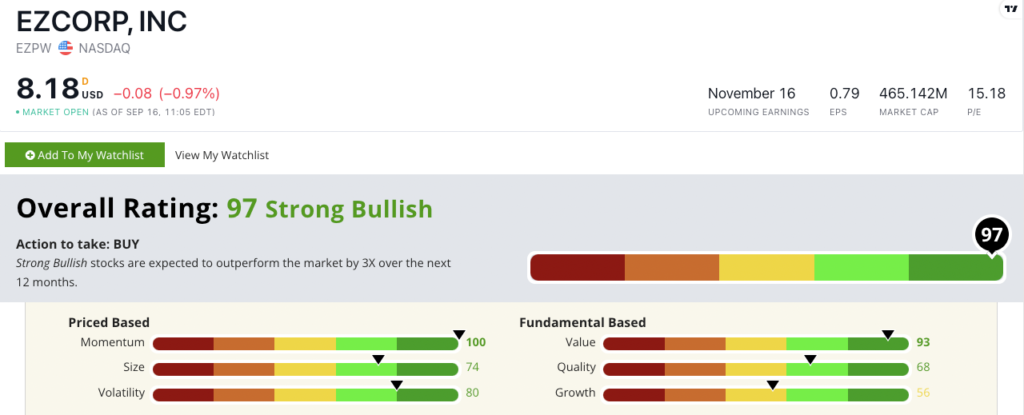

Pawn-loan provider EZCORP Inc. (Nasdaq: EZPW) is today’s Power Stock.

EZPW Stock Power Ratings in September 2022.

EZPW operates pawnshops across the U.S, Mexico, Guatemala, El Salvador and Honduras.

EZCORP Inc. stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

EZPW Stock: Excellent Value + Solid Momentum

EZCORP stock is on track for a strong 2022.

Highlights include:

- Revenue in the first three quarters surpassed annual revenue from all of 2021!

- Earnings-per-share growth rate of 421.7% from its last quarter to its most recent one.

While its sales and earnings numbers show fantastic growth, EZPW shines on our value metric — where it scores a 93.

Its price-to-sales ratio tells us it’s a bargain: It’s nearly three times lower than the specialty finance industry average.

Its price-to-book ratio is a similar story: EZPW’s is 0.9. The industry average, on the other hand, is an inflated 1.8.

Another bright spot for EZPW is its momentum:

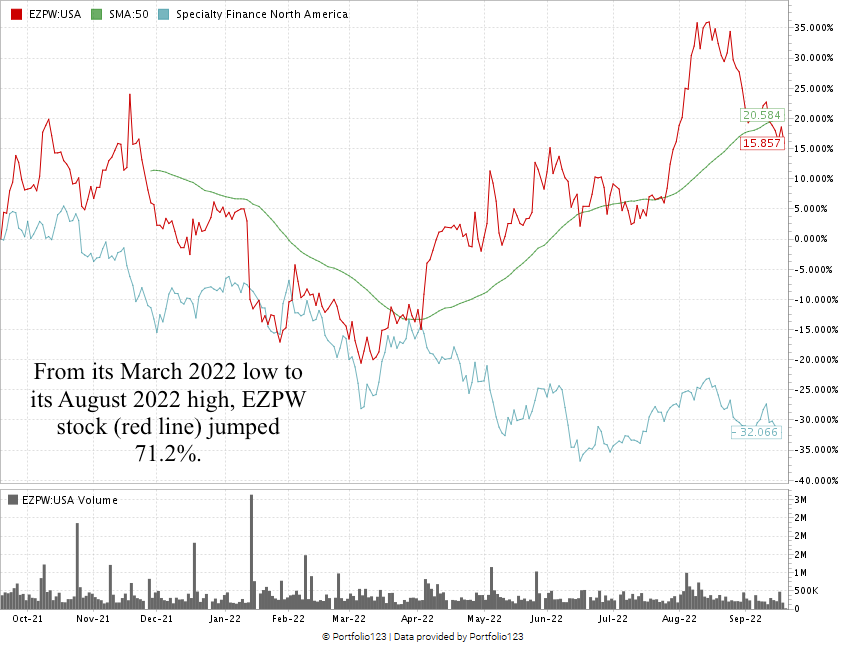

After hitting a 52-week low in March 2022, EZPW shot up 71.2% to reach a high in August.

Over the last 12 months, the stock is up 15.8%. Meanwhile, its peers are averaging a 32.1% decline over the same time.

EZPW scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

More than 63 million Americans either have no bank account or rely on alternative financing — like pawnshops — for emergency cash.

A leader in the pawnshop market in the U.S. and Latin America, EZPW is a strong addition to your portfolio.

Stay Tuned: High-Quality, High-Momentum Oil Logistics Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a logistics company specializing in the storage and transportation of crude oil.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.